8:00 - 17:00

Opening Hour: Mon - Fri

| Oklahoma Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 112,637 Vehicle Miles Driven: 47,699 Million |

| Driving Deaths | Speeding: 143 Drunk Driving: 683 |

| Vehicles | Registered: 3,388,401 Total Stolen: 10,583 |

| Most Popular Vehicle | F150 |

| Average Premiums (Annual) | Liability: $461.01 Collision: $318.47 Comprehensive: $225.84 Combined Premium: $1,005,32 |

| Percentage of Motorists Uninsured | 10.50 Percent State Rank: 31st |

| Cheapest Provider | State Farm Mutual Auto |

With a population of 3,943,079, Oklahoma has a lot of drivers on its roads. With millions of drivers, it’s also natural that there are numerous auto insurance companies offering a dizzying array of coverage and rate options.

Looking at so many Oklahoma auto insurance providers is daunting and raises numerous questions. Who are the best providers in Oklahoma? What are Oklahoma’s driving laws, and how do the laws impact rates if broken?

Even if you already have a provider, when an unexpected accident throws a dent in your plans (and your car), it is necessary to know what coverage you have.

Luckily, we cover all this and much more, because we know how important it is to find the right rates and coverage. Finding the right provider can save you money (and headaches) over time. Start comparing rates today by entering your ZIP code above in our FREE online tool!

Keep reading to learn everything you need to know about Oklahoma’s insurance providers, driving regulations, and so much more.

Table of Contents

If you are moving to or live in Oklahoma, also known as the “Sooner State,” you will have endless attractions to visit. There are beautiful parks featuring waterfalls and natural rock caves scattered throughout the state. There are also cities like Oklahoma City, which ranked on US News top 100 places to live in 2018. If you chose to live in this beautiful state, though, you have to know what it costs to operate a vehicle in Oklahoma.

You might be wondering where to start, and we will break down the auto insurance coverage types in Oklahoma for you in order to make the process as easy as possible.

Below, we have provided information and help so you can get the best coverage options for your needs.

| Insurance Required | Minimum Limits – 25/50/25 |

|---|---|

| Body Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

Oklahoma is an “at fault” accident state, meaning if you are the driver at fault you are liable for personal injury or property claims.

Oklahoma state law requires drivers to have the following minimum liability insurance in case of an accident:

Bear in mind, though, that minimum liability insurance only covers the minimum amount required by the state of Oklahoma. In the event of an accident, you may find that the minimum liability amount quickly runs out. To avoid this, it’s important to consider additional coverage options.

Oklahoma law requires every driver and every owner of a vehicle to have proof of financial responsibility (liability coverage) at all times.

Here are 3 acceptable forms of proof of financial responsibility:

Drivers in Oklahoma are required to have at least one form of proof of financial security on their person when operating a vehicle. If you don’t have financial security, you may face fines or jail time.

Driving without insurance can result in the following:

Don’t risk it! Driving without insurance does have consequences.

In a 2018 study by the NAIC, the annual per capita disposable income in Oklahoma was $39,740.

Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after his or her taxes have been paid. This means Oklahomans have only $3,311 to spend per month on groceries, rent, and other household budgets.

On average, residents in Oklahoma pay $986 annually for comprehensive auto insurance.

That’s $82 a month going to auto insurance, and this amount could be much higher if purchasing more than minimum auto insurance.

American Consumer Credit Counseling suggests saving 20 percent of every paycheck. With Oklahoma’s DPI, that’s $662 each month. To make sure you’re getting the best deal on auto insurance, keep reading to learn about the different coverage and provider options.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $461.01 |

| Collision | $318.47 |

| Comprehensive | $225.84 |

| Combined | $1,005.32 |

The above table illustrates the most recent data provided by the leading source on the matter, the National Association of Insurance Commissioners. Expect auto insurance rates in Oklahoma to be significantly higher from 2018 on.

Don’t forget — Oklahoma has minimum requirements for liability coverage, but experts suggest drivers purchase more than what state law requires, especially when the state is an “at-fault” state like Oklahoma.

You never know when an accident will happen, so it is smart to add extra coverage to your plan. Below, we have covered some of the most popular coverage options to add to a basic auto insurance policy.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 63% | 66% | 66% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 65% | 63% | 63% |

Here’s the deal. MedPay, Uninsured, and Underinsured Motorist coverages are optional in Oklahoma, but you should still have them. They are important coverages in case of an accident.

Why? Because in 2015, 10.5 percent of motorists in Oklahoma were uninsured. These uninsured drivers will likely go bankrupt before being able to pay off the costs of medical bills and property damage in an accident for which they are at fault.

Did you know? Oklahoma ranks 31st in the nation for its number of uninsured motorists.

Oklahoma’s loss ratios are on the low side, especially when compared to 2015 top insurance companies in the U.S., who had loss ratios that ranged from 94 to 112 percent. From the above table, you can see that Oklahoma’s MedPay loss ratio has increased over the last years, but Underinsured and Uninsured loss ratios have decreased.

So what does this mean for you?

Companies with high loss ratios mean they are paying out a high amount in claims — but don’t get too excited. Insurers with high loss ratios (over 100 percent) are losing money and run the risk of going bankrupt.

Companies with low loss ratios mean they are not paying claims out.

Bottom line? Avoid companies with very low or very high claims. In the case of loss ratios, a middle number is best.

Oklahoma has a zero deductible full glass coverage law.

Let’s look closer at what extra coverages you can add to your policy. We know that you want to get the complete coverage you need for an affordable price.

Fortunately, there are effective and affordable extras you can add to your policy.

Here’s a list of useful coverage available to you in Oklahoma:

In Oklahoma, average rates from insurance companies show that males are paying more than females for auto insurance.

Data from our researchers, though, shows that male and female insurance costs are leveling out to an almost equal basis as both genders age in Oklahoma.

Hopefully, insurance rates on the basis of gender will continue to be eliminated.

Bear in mind, your driving record and coverage plan will play a large part in determining your costs — more so than your gender.

| Most Expensive ZIP Codes in Oklahoma | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 74110 | TULSA | $5,150.50 | Liberty Mutual | $8,036.87 | Progressive | $6,463.20 | USAA | $3,803.59 | State Farm | $3,821.57 |

| 74115 | TULSA | $5,130.85 | Liberty Mutual | $8,170.58 | Progressive | $6,486.61 | State Farm | $3,613.95 | USAA | $3,798.77 |

| 74106 | TULSA | $5,113.35 | Liberty Mutual | $8,036.87 | Progressive | $6,415.81 | State Farm | $3,612.06 | USAA | $3,803.59 |

| 74103 | TULSA | $5,031.82 | Liberty Mutual | $7,967.96 | Progressive | $7,174.36 | State Farm | $3,491.00 | USAA | $3,601.75 |

| 74146 | TULSA | $4,996.54 | Liberty Mutual | $8,064.64 | Progressive | $6,253.73 | State Farm | $3,482.71 | USAA | $3,720.71 |

| 74120 | TULSA | $4,955.86 | Liberty Mutual | $8,133.55 | Progressive | $6,436.54 | State Farm | $3,416.00 | USAA | $3,467.63 |

| 74128 | TULSA | $4,946.22 | Liberty Mutual | $8,033.79 | Progressive | $6,046.90 | State Farm | $3,286.17 | USAA | $3,720.71 |

| 74119 | TULSA | $4,938.25 | Liberty Mutual | $8,138.50 | Progressive | $6,332.46 | State Farm | $3,333.26 | USAA | $3,601.75 |

| 74129 | TULSA | $4,932.56 | Liberty Mutual | $8,064.64 | Progressive | $5,904.00 | State Farm | $3,425.78 | USAA | $3,720.71 |

| 74126 | TULSA | $4,924.71 | Liberty Mutual | $8,036.87 | Progressive | $5,752.62 | State Farm | $3,524.07 | USAA | $3,803.59 |

| 74134 | TULSA | $4,923.31 | Liberty Mutual | $8,064.64 | Progressive | $5,740.74 | State Farm | $3,493.32 | USAA | $3,718.14 |

| 74116 | TULSA | $4,912.91 | Liberty Mutual | $7,777.09 | Progressive | $6,252.36 | State Farm | $3,399.50 | USAA | $3,718.14 |

| 74104 | TULSA | $4,906.22 | Liberty Mutual | $8,124.78 | Progressive | $6,026.21 | USAA | $3,467.63 | State Farm | $3,475.89 |

| 74112 | TULSA | $4,905.35 | Liberty Mutual | $8,033.79 | Progressive | $5,767.37 | State Farm | $3,443.96 | USAA | $3,798.77 |

| 73119 | OKLAHOMA CITY | $4,901.45 | Liberty Mutual | $8,234.24 | Progressive | $6,328.07 | State Farm | $3,524.17 | USAA | $3,548.39 |

| 74172 | TULSA | $4,895.93 | Liberty Mutual | $7,967.96 | Progressive | $7,267.59 | State Farm | $2,739.02 | USAA | $3,495.20 |

| 73106 | OKLAHOMA CITY | $4,893.95 | Liberty Mutual | $8,278.13 | Progressive | $6,024.45 | State Farm | $3,243.59 | USAA | $3,548.39 |

| 74130 | TULSA | $4,887.69 | Liberty Mutual | $7,561.76 | Progressive | $5,897.39 | State Farm | $3,492.86 | USAA | $3,803.59 |

| 74135 | TULSA | $4,883.58 | Liberty Mutual | $8,129.71 | Progressive | $6,101.54 | State Farm | $3,348.99 | USAA | $3,425.64 |

| 73102 | OKLAHOMA CITY | $4,879.88 | Liberty Mutual | $8,056.71 | Progressive | $6,611.05 | USAA | $3,376.34 | State Farm | $3,427.03 |

| 73108 | OKLAHOMA CITY | $4,873.82 | Liberty Mutual | $8,278.13 | Progressive | $6,090.43 | State Farm | $3,320.26 | USAA | $3,548.39 |

| 73103 | OKLAHOMA CITY | $4,872.88 | Liberty Mutual | $7,986.52 | Progressive | $6,412.37 | State Farm | $3,332.42 | USAA | $3,376.34 |

| 74127 | TULSA | $4,870.80 | Liberty Mutual | $7,900.10 | Progressive | $5,994.04 | State Farm | $3,249.42 | USAA | $3,601.75 |

| 74105 | TULSA | $4,869.18 | Liberty Mutual | $8,129.71 | Progressive | $5,745.38 | State Farm | $3,378.65 | USAA | $3,409.32 |

| 73109 | OKLAHOMA CITY | $4,867.95 | Liberty Mutual | $8,234.24 | Progressive | $6,211.04 | State Farm | $3,379.66 | USAA | $3,544.14 |

According to our researcher’s data, ZIP codes in Tulsa seem to be the most expensive places to purchase auto insurance, with Oklahoma City as a close second.

| Cheapest ZIP Codes in Oklahoma | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Annual Expensive Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 73555 | MANITOU | $3,646.98 | Liberty Mutual | $6,048.86 | Progressive | $4,036.19 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| 73542 | FREDERICK | $3,650.18 | Liberty Mutual | $6,134.72 | Progressive | $4,036.19 | State Farm | $2,369.85 | GEICO | $2,743.46 |

| 73521 | ALTUS | $3,682.05 | Liberty Mutual | $6,059.14 | Progressive | $4,247.18 | State Farm | $2,536.43 | GEICO | $2,743.46 |

| 73539 | ELMER | $3,692.21 | Liberty Mutual | $6,048.86 | Progressive | $4,038.41 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| 73570 | TIPTON | $3,692.55 | Liberty Mutual | $6,119.06 | Progressive | $4,162.66 | State Farm | $2,484.29 | GEICO | $2,743.46 |

| 73537 | ELDORADO | $3,694.92 | Liberty Mutual | $6,119.06 | Progressive | $4,089.93 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| 73939 | GOODWELL | $3,704.39 | Liberty Mutual | $5,974.78 | Farmers | $3,871.33 | State Farm | $2,566.00 | USAA | $3,063.11 |

| 73946 | KENTON | $3,715.81 | Liberty Mutual | $5,930.51 | Farmers | $3,973.18 | State Farm | $2,591.02 | USAA | $3,063.11 |

| 73549 | HEADRICK | $3,722.42 | Liberty Mutual | $6,119.06 | Progressive | $4,071.71 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| 73523 | ALTUS AFB | $3,724.33 | Liberty Mutual | $6,059.14 | Progressive | $4,398.59 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| 73945 | HOOKER | $3,725.51 | Liberty Mutual | $6,107.55 | Progressive | $3,978.70 | State Farm | $2,413.73 | USAA | $3,063.11 |

| 73937 | FELT | $3,725.60 | Liberty Mutual | $5,930.51 | Farmers | $3,987.50 | State Farm | $2,591.02 | USAA | $3,063.11 |

| 73951 | TYRONE | $3,725.68 | Liberty Mutual | $5,930.51 | Progressive | $4,076.36 | State Farm | $2,427.10 | USAA | $3,063.11 |

| 73944 | HARDESTY | $3,726.17 | Liberty Mutual | $5,930.51 | Progressive | $3,963.30 | State Farm | $2,591.02 | USAA | $3,063.11 |

| 73552 | INDIAHOMA | $3,727.43 | Liberty Mutual | $6,170.47 | Progressive | $3,974.04 | State Farm | $2,650.11 | GEICO | $2,929.45 |

| 73703 | ENID | $3,729.94 | Liberty Mutual | $6,062.18 | Progressive | $4,317.07 | State Farm | $2,605.49 | USAA | $2,775.83 |

| 73938 | FORGAN | $3,732.65 | Liberty Mutual | $5,930.51 | Farmers | $3,924.56 | State Farm | $2,644.59 | USAA | $3,063.11 |

| 73950 | TURPIN | $3,734.52 | Liberty Mutual | $5,930.51 | Farmers | $4,077.42 | State Farm | $2,530.49 | USAA | $3,063.11 |

| 73942 | GUYMON | $3,735.69 | Liberty Mutual | $6,107.55 | Progressive | $3,975.41 | State Farm | $2,539.69 | USAA | $3,063.11 |

| 73949 | TEXHOMA | $3,737.64 | Liberty Mutual | $5,930.51 | Progressive | $4,086.86 | State Farm | $2,602.61 | USAA | $3,063.11 |

| 73931 | BALKO | $3,743.28 | Liberty Mutual | $5,930.51 | Progressive | $3,991.29 | State Farm | $2,652.36 | USAA | $3,063.11 |

| 73526 | BLAIR | $3,745.24 | Liberty Mutual | $6,048.86 | Progressive | $4,149.82 | State Farm | $2,594.10 | GEICO | $2,743.46 |

| 73932 | BEAVER | $3,746.46 | Liberty Mutual | $5,973.04 | Farmers | $3,992.83 | State Farm | $2,625.34 | USAA | $3,063.11 |

| 73538 | ELGIN | $3,753.25 | Liberty Mutual | $6,417.53 | Progressive | $3,935.21 | State Farm | $2,680.52 | GEICO | $2,929.45 |

| 73933 | BOISE CITY | $3,754.57 | Liberty Mutual | $5,930.51 | Progressive | $3,920.57 | State Farm | $2,828.97 | USAA | $3,063.11 |

These rate differences are why it is so important to compare auto insurance costs, as the area could be a potential cost factor when moving.

We have also listed the most and least expensive cities for auto insurance in Oklahoma.

| Most Expensive Cities in Oklahoma | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Tulsa | $4,903.84 | Liberty Mutual | $7,969.89 | Progressive | $6,156.47 | State Farm | $3,378.92 | USAA | $3,592.35 |

| Nichols Hills | $4,794.06 | Liberty Mutual | $7,672.10 | Progressive | $5,997.68 | State Farm | $3,290.75 | USAA | $3,414.20 |

| Oakhurst | $4,745.40 | Liberty Mutual | $7,718.08 | Progressive | $5,756.48 | State Farm | $3,222.50 | USAA | $3,601.75 |

| Forest Park | $4,715.69 | Liberty Mutual | $7,387.73 | Progressive | $5,906.39 | State Farm | $3,118.89 | USAA | $3,557.24 |

| Oklahoma City | $4,713.34 | Liberty Mutual | $7,827.17 | Progressive | $5,859.47 | State Farm | $3,212.84 | USAA | $3,454.53 |

| Del City | $4,680.38 | Liberty Mutual | $7,707.40 | Progressive | $5,958.85 | State Farm | $3,177.55 | USAA | $3,387.22 |

| Midwest City | $4,663.70 | Liberty Mutual | $7,591.38 | Progressive | $5,929.75 | State Farm | $3,159.62 | USAA | $3,425.67 |

| Glenpool | $4,659.69 | Liberty Mutual | $7,369.86 | Progressive | $6,301.87 | State Farm | $3,125.00 | GEICO | $3,255.36 |

| Bixby | $4,644.01 | Liberty Mutual | $7,495.04 | Progressive | $5,758.16 | State Farm | $3,292.25 | USAA | $3,374.02 |

| Catoosa | $4,634.41 | Liberty Mutual | $7,524.38 | Progressive | $5,939.26 | State Farm | $3,091.73 | USAA | $3,491.27 |

| Broken Arrow | $4,615.49 | Liberty Mutual | $7,610.60 | Progressive | $5,711.59 | State Farm | $3,195.70 | USAA | $3,492.20 |

| Bethany | $4,603.06 | Liberty Mutual | $7,482.10 | Progressive | $5,617.79 | State Farm | $3,180.39 | USAA | $3,480.61 |

| Wheatland | $4,559.24 | Liberty Mutual | $7,721.70 | Progressive | $5,641.86 | State Farm | $2,955.50 | USAA | $3,480.61 |

| Sperry | $4,535.05 | Liberty Mutual | $7,492.84 | Progressive | $5,560.96 | GEICO | $3,255.36 | State Farm | $3,456.65 |

| Jenks | $4,533.23 | Liberty Mutual | $7,532.72 | Progressive | $5,444.49 | State Farm | $3,118.62 | GEICO | $3,255.36 |

| Moore | $4,532.19 | Liberty Mutual | $7,741.34 | Progressive | $5,535.16 | State Farm | $3,114.17 | USAA | $3,364.53 |

| Kiefer | $4,520.92 | Liberty Mutual | $7,067.04 | Progressive | $6,401.55 | State Farm | $2,955.11 | GEICO | $3,255.36 |

| Jones | $4,511.62 | Liberty Mutual | $7,461.14 | Progressive | $5,372.22 | State Farm | $3,184.63 | USAA | $3,404.21 |

| Newalla | $4,500.55 | Liberty Mutual | $7,532.89 | Progressive | $5,423.01 | State Farm | $2,991.37 | USAA | $3,392.86 |

| Choctaw | $4,493.07 | Liberty Mutual | $7,532.89 | Progressive | $5,582.56 | State Farm | $2,726.56 | USAA | $3,236.09 |

| Macomb | $4,485.54 | Liberty Mutual | $6,808.25 | Progressive | $6,124.88 | State Farm | $2,904.89 | USAA | $3,326.43 |

| Sapulpa | $4,461.79 | Liberty Mutual | $7,103.45 | Progressive | $6,186.67 | State Farm | $2,692.50 | GEICO | $3,255.36 |

| Arcadia | $4,434.77 | Liberty Mutual | $7,288.95 | Progressive | $5,351.58 | State Farm | $2,888.22 | USAA | $3,284.58 |

| Luther | $4,421.24 | Liberty Mutual | $7,234.87 | Progressive | $5,061.66 | State Farm | $2,977.73 | USAA | $3,404.21 |

| Harrah | $4,395.57 | Liberty Mutual | $7,585.54 | Progressive | $4,971.03 | State Farm | $2,938.60 | USAA | $3,377.30 |

Auto insurance in Tulsa costs about $1,250 more than auto insurance in Manitou.

| Cheapest Cities in Oklahoma | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Manitou | $3,646.98 | Liberty Mutual | $6,048.86 | Progressive | $4,036.19 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| Frederick | $3,650.18 | Liberty Mutual | $6,134.72 | Progressive | $4,036.19 | State Farm | $2,369.85 | GEICO | $2,743.46 |

| Altus | $3,682.05 | Liberty Mutual | $6,059.14 | Progressive | $4,247.18 | State Farm | $2,536.43 | GEICO | $2,743.46 |

| Elmer | $3,692.21 | Liberty Mutual | $6,048.86 | Progressive | $4,038.41 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| Tipton | $3,692.55 | Liberty Mutual | $6,119.06 | Progressive | $4,162.66 | State Farm | $2,484.29 | GEICO | $2,743.46 |

| Eldorado | $3,694.92 | Liberty Mutual | $6,119.06 | Progressive | $4,089.93 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| Goodwell | $3,704.39 | Liberty Mutual | $5,974.78 | Farmers | $3,871.33 | State Farm | $2,566.00 | USAA | $3,063.11 |

| Kenton | $3,715.81 | Liberty Mutual | $5,930.51 | Farmers | $3,973.18 | State Farm | $2,591.02 | USAA | $3,063.11 |

| Headrick | $3,722.42 | Liberty Mutual | $6,119.06 | Progressive | $4,071.71 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| Altus Afb | $3,724.33 | Liberty Mutual | $6,059.14 | Progressive | $4,398.59 | State Farm | $2,591.02 | GEICO | $2,743.46 |

| Hooker | $3,725.51 | Liberty Mutual | $6,107.55 | Progressive | $3,978.70 | State Farm | $2,413.73 | USAA | $3,063.11 |

| Felt | $3,725.60 | Liberty Mutual | $5,930.51 | Farmers | $3,987.50 | State Farm | $2,591.02 | USAA | $3,063.11 |

| Tyrone | $3,725.68 | Liberty Mutual | $5,930.51 | Progressive | $4,076.36 | State Farm | $2,427.10 | USAA | $3,063.11 |

| Hardesty | $3,726.17 | Liberty Mutual | $5,930.51 | Progressive | $3,963.30 | State Farm | $2,591.02 | USAA | $3,063.11 |

| Indiahoma | $3,727.43 | Liberty Mutual | $6,170.47 | Progressive | $3,974.04 | State Farm | $2,650.11 | GEICO | $2,929.45 |

| Forgan | $3,732.65 | Liberty Mutual | $5,930.51 | Farmers | $3,924.56 | State Farm | $2,644.59 | USAA | $3,063.11 |

| Turpin | $3,734.52 | Liberty Mutual | $5,930.51 | Farmers | $4,077.42 | State Farm | $2,530.49 | USAA | $3,063.11 |

| Guymon | $3,735.69 | Liberty Mutual | $6,107.55 | Progressive | $3,975.41 | State Farm | $2,539.69 | USAA | $3,063.11 |

| Texhoma | $3,737.64 | Liberty Mutual | $5,930.51 | Progressive | $4,086.86 | State Farm | $2,602.61 | USAA | $3,063.11 |

| Balko | $3,743.28 | Liberty Mutual | $5,930.51 | Progressive | $3,991.29 | State Farm | $2,652.36 | USAA | $3,063.11 |

| Blair | $3,745.24 | Liberty Mutual | $6,048.86 | Progressive | $4,149.82 | State Farm | $2,594.10 | GEICO | $2,743.46 |

| Beaver | $3,746.46 | Liberty Mutual | $5,973.04 | Farmers | $3,992.83 | State Farm | $2,625.34 | USAA | $3,063.11 |

| Elgin | $3,753.25 | Liberty Mutual | $6,417.53 | Progressive | $3,935.21 | State Farm | $2,680.52 | GEICO | $2,929.45 |

| Boise City | $3,754.57 | Liberty Mutual | $5,930.51 | Progressive | $3,920.57 | State Farm | $2,828.97 | USAA | $3,063.11 |

| Snyder | $3,765.73 | Liberty Mutual | $6,134.72 | Progressive | $4,100.83 | State Farm | $2,511.91 | USAA | $3,019.27 |

Now that we’ve covered rates based on area, let’s look at some of the best and worst insurance companies in Oklahoma.

There are hundreds of providers in the state of Oklahoma. How do you know which one to choose? Finding the right auto insurance company is hard. No-one wants to spend hours looking at rates and policies to find the best deal.

That’s why we’ve done the work for you. We’ve researched companies in Oklahoma so that you can choose what is best for you. We’ve broken down companies’ financial ratings, AM best ratings, and who has the most complaints.

Keep scrolling to learn about Oklahoma’s auto insurance providers.

| Providers | AM Best Rating | Direct Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| Allstate Insurance Group | A+ | $186,448 | 7.00% | 48.05% |

| CSAA Insurance Group | A | $103,378 | 3.88% | 50.54% |

| Farmer's Insurance Group | NR | $303,207 | 11.38% | 51.38% |

| Geico | A++ | $184,196 | 6.91% | 66.79% |

| Liberty Mutual Group | A | $174,654 | 6.55% | 57.68% |

| Oklahoma Farm Bureau Group | B+ | $105,712 | 3.97% | 55.16% |

| Progressive Group | A+ | $238,951 | 8.96% | 55.51% |

| Shelter Insurance Group | A | $92,167 | 3.46% | 61.81% |

| State Farm Group | A | $677,192 | 25.41% | 57.03% |

| USAA Group | NR | $172,914 | 6.49% | 69.06% |

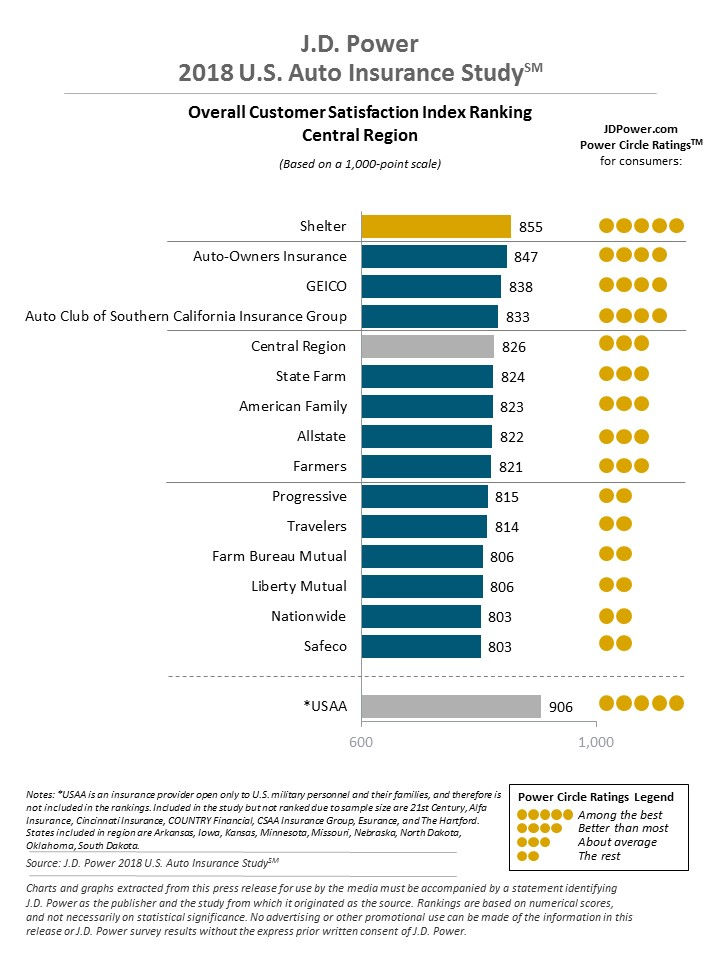

We all want to have excellent service, and companies that strive to provide excellent customer service naturally rank higher.

As you can see from the graph above, some of the largest providers in Oklahoma are also great at customer satisfaction. Farmers Insurance and Geico both rank at the top of the list.

J.D. Power Business Consultant says, “Cost is not the sole indicator of customer satisfaction in the auto insurance industry. Low prices may attract new customers, but it’s service that keeps them.”

| Top Providers of Car Insurance in Oklahoma | Company Complaint Ratio 2017 | Total Complaints 2017 |

|---|---|---|

| Allstate Insurance Group | 0.5 | 163 |

| CSAA Insurance Group | 3.97 | 6 |

| Farmers Insurance Group | 0 | 0 |

| Geico | .007 | 6 |

| Liberty Mutual Group | .007 | 6 |

| Oklahoma Farm Bureau Group | 0.21 | 2 |

| Progressive Group | 0.75 | 120 |

| Shelter Insurance Group | 0.61 | 47 |

| State Farm Group | 0.44 | 1,482 |

| USSA Group | 0 | 2 |

Above, you will see the number of complaints listed for the biggest insurance providers in Oklahoma. Bear in mind that complaints don’t necessarily mean you should avoid a company. How the company resolves complaints and overall customer satisfaction also plays a role in the quality of a company.

| Company | Company Annual Average | Percentage Compared to State Annual Average |

|---|---|---|

| Allstate F&C | $3,718.62 | -11.39% |

| Farmers Insurance Co | $4,142.40 | 0.0% |

| Geico | $3,437.33 | -20.51% |

| Progressive Northern | $4,832.35 | 14.28% |

| SAFECO Insurance Co of America | $6,874.62 | 39.74% |

| State Farm Mutual Auto | $2,816.80 | -47.06% |

| USAA | $3,174.15 | -30.50% |

In the chart below, we will compare how rates from the top insurers in Oklahoma compare to the state average.

State Farm Mutual and Geico’s rates are lower than the National Average. On the other hand, SAFECO Insurance Co of America and Progressive Northern are significantly higher than the national average. This could be a contributing factor to why they are not on the list of most popular insurance companies in Oklahoma.

Below are the average annual rates by carrier and driving record in Oklahoma.

| Company | Commute and Annual Mileage | Average Annual Rate |

|---|---|---|

| Allstate | 10-mile commute. 6000 annual mileage. | $3,718.62 |

| Allstate | 25-mile commute. 12000 annual mileage. | $3,718.62 |

| Farmers | 10-mile commute. 6000 annual mileage. | $4,142.40 |

| Farmers | 25-mile commute. 12000 annual mileage. | $4,142.40 |

| Geico | 10-mile commute. 6000 annual mileage. | $3,371.88 |

| Geico | 25-mile commute. 12000 annual mileage. | $3,502.79 |

| Liberty Mutual | 10-mile commute. 6000 annual mileage. | $6,874.62 |

| Liberty Mutual | 25-mile commute. 6000 annual mileage. | $6,874.62 |

| Progressive | 10-mile commute. 6000 annual mileage. | $4,832.35 |

| Progressive | 25-mile commute. 12000 annual mileage. | $4,832.35 |

| State Farm | 10-mile commute. 6000 annual mileage. | $2,768.69 |

| State Farm | 25-mile commute. 12000 annual mileage. | $2,864.91 |

| USAA | 10-mile commute. 6000 annual mileage. | $3,135.87 |

| USAA | 25-mile commute. 12000 annual mileage. | $3,212.43 |

Most of the companies’ rates don’t vary based on mileage and commute distance. But Geico, USAA, and State Farm all have a hundred dollar difference between a 25-mile commute and a 10-mile commute.

Commute times don’t have as much of an effect on your rates as things like a DUI.

Next, we will look at the coverage level rates for Oklahoma and break them down.

You might be wondering how rates vary based on coverage level. Remember, while it’s tempting to go with the lowest coverage, it is always better to have more complete coverage in case of an accident.

Below, we have listed carriers’ coverage costs in Oklahoma.

| Group | Coverage Type | Average Annual Rate |

|---|---|---|

| Allstate | High | $3,958.78 |

| Allstate | Medium | $3,703.87 |

| Allstate | Low | $3,493.21 |

| Farmers | High | $4,369.10 |

| Farmers | Medium | $4,095.52 |

| Farmers | Low | $3,962.59 |

| Geico | High | $3,670.99 |

| Geico | Medium | $3,442.87 |

| Geico | Low | $3,198.14 |

| Liberty Mutual | High | $7,253.93 |

| Liberty Mutual | Medium | $6,849.85 |

| Liberty Mutual | Low | $6,520.08 |

| Progressive | High | $5,214.67 |

| Progressive | Medium | $4,801.19 |

| Progressive | Low | $4,481.18 |

| State Farm | High | $3,007.85 |

| State Farm | Medium | $2,796.58 |

| State Farm | Low | $2,645.97 |

| USAA | High | $3,308.89 |

| USAA | Medium | $3,165.21 |

| USAA | Low | $3,048.34 |

Many auto insurance companies determine rates by looking at your credit score. What does this mean for you? At most insurance companies, the better your credit score is, the better rates you will receive.

In the state of Oklahoma, the average credit score is 656. This number places Oklahoma in the list of the top 10 states with the lowest credit scores.

At top companies like Liberty Mutual, a good credit score will give you an average annual rate of $4,724. But if you have poor credit, Liberty Mutual’s average annual rate jumps to $9,874! That’s a $5,150 difference!

As you can see, your credit history plays a large role in determining your rates. Keep reading to learn how your driving record can also impact your rates.

| Company | Driving Record | Average Annual Rate |

|---|---|---|

| Allstate | With one DUI | $4,329.11 |

| Allstate | With one accident | $3,749.51 |

| Allstate | With one speeding violation | $3,597.46 |

| Allstate | Clean record | $3,198.39 |

| Farmers | With one accident | $4,490.66 |

| Farmers | With one DUI | $4,381.87 |

| Farmers | With one speeding violation | $4,199.60 |

| Farmers | Clean record | $3,497.47 |

| Geico | With one DUI | $4,256.03 |

| Geico | With one accident | $3,835.75 |

| Geico | With one speeding violation | $3,153.48 |

| Geico | Clean record | $2,504.07 |

| Liberty Mutual | With one DUI | $8,761.12 |

| Liberty Mutual | With one accident | $7,744.42 |

| Liberty Mutual | With one speeding violation | $6,369.71 |

| Liberty Mutual | Clean record | $4,623.23 |

| Progressive | With one accident | $6,992.38 |

| Progressive | With one speeding violation | $4,419.80 |

| Progressive | With one DUI | $4,154.13 |

| Progressive | Clean record | $3,763.08 |

| State Farm | With one accident | $3,017.59 |

| State Farm | With one DUI | $2,816.80 |

| State Farm | With one speeding violation | $2,816.80 |

| State Farm | Clean record | $2,616.01 |

| USAA | With one DUI | $4,112.53 |

| USAA | With one accident | $3,362.41 |

| USAA | With one speeding violation | $2,880.43 |

| USAA | Clean record | $2,341.22 |

With a clean driving record, your annual rates will be significantly less. As you can see, only one DUI adds $1,752 to Geico’s annual rate! That’s an extra $146 a month to pay!

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 31 | 873 | 904 |

Knowing your state’s laws is important. State laws can often be confusing, though, especially if you are a new resident or passing through Oklahoma. Every state has different laws on seatbelt requirements, speed limits, and drunk driving.

The last thing anyone wants is a fine for breaking a law. Especially if you didn’t know that law existed in the first place.

In order for you to avoid a fine and keep your rates low, scroll down to read our summary of Oklahoma’s state laws.

Auto insurance is legally required in the state of Oklahoma. As stated before, motorists in Oklahoma must have the required amount of minimum auto insurance and proof of financial responsibility.

While Oklahoma state law requires all vehicles to have auto insurance, auto insurance companies can refuse to give coverage to high-risk drivers.

The DMV tells high-risk drivers to turn to Oklahoma’s Automobile Insurance Plan if they are unable to find providers willing to insure them.

Bottom line? Follow state laws and keep yourself off the blacklist of high-risk drivers.

Sometimes, despite our best efforts, accidents happen and affect our driving records. In the state of Oklahoma, the comprehensive auto insurance for high-risk drivers requests to fill out an SR-22 form for high-risk insurance.

Here are some of the reasons drivers in Oklahoma may need to fill out an SR-22 form:

Oklahoma does not have a government-sponsored auto insurance program for low-income families. Only a few states have this program, but don’t be discouraged that Oklahoma isn’t one of them! By shopping around for low rates in your area, you can still save money on auto insurance.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

A cracked or broken windshield will likely happen sometime in your driving career. Through no fault of your own, stray stones, branches, and cold can all contribute to a cracked windshield. In Oklahoma, though, insurers are not required to replace your cracked or broken windshield.

Even though Oklahoma law doesn’t require replacement, an insurer may offer replacement with a comprehensive coverage plan.

Insurers who offer windshield repair or replacement with comprehensive coverage may require you to take the vehicle to a specific auto repair shop.

In Oklahoma, insurance companies can also offer to repair your windshield with aftermarket and used parts under a comprehensive coverage plan. If you decline, you will have to pay the cost of repairs to your windshield yourself.

In the state of Oklahoma, automobile insurance fraud is classified as a crime. Breaking this law may result in fines and/or jail time.

IIHS defines fraud as the following:

Hard fraud occurs when someone deliberately fabricates claims or fakes an accident. Soft insurance fraud, also known as opportunistic fraud, occurs when people pad legitimate claims.

The IIHS also reports that property and casualty fraud, in the five year period between 2013-2017, racked up an amount of $30 billion each year!

In 2018, Oklahoma’s Department of Insurance reported receiving 1,286 complaints of fraud. Authorities recovered $345,924 from auto insurance fraud and submitted $152,456 for criminal prosecution.

Bottom line — don’t fake a claim or add false extras onto a claim. It’s simply not worth it.

If you are injured or your vehicle is damaged, you only have a certain amount of time to file a claim to receive the money you are owed. Below is the amount of time you have to file claims in Oklahoma.

| Oklahoma Statutes of Limitations | Range |

|---|---|

| Personal Injury | Two years |

| Property Damage | Two years |

Oklahoma has an Unfair Claims Settlement Practices Act. Oklahoma law requires insurers to disclose to their clients exactly what their policy covers. The Unfair Claims Settlement Practices Act helps prevent insurers from “overlooking” benefits on your coverage policy when you file a claim. Imagine paying your hard-earned money each month on coverage, and the benefits are conveniently forgotten when you need them most.

While this act helps prevent you from being unfairly treated, the best way to avoid being cheated is to know EXACTLY what your policy covers.

Next, we will look at what you need to know about licensing a vehicle in Oklahoma.

We get it. Paying for insurance is expensive. But the penalties for driving without insurance are steeper. Your first offense could get you the following:

Acceptable proof of insurance forms include the following:

Oklahoma enforces checking for insurance by requiring proof of insurance when registering a vehicle. The state of Oklahoma also has an electronic insurance verification system in place to keep track of Oklahoma resident’s insurance.

Anytime you are pulled over, you also must provide proof of vehicle insurance to the officer.

Oklahoma can also suspend your vehicle registration if you violate insurance laws. These include:

You will be sent a letter if your vehicle registration has been suspended. At this point, it is up to you to provide valid auto insurance to reinstate your vehicle registration.

In Oklahoma, young drivers can’t get a learner’s permit until they are at least 15 1/2 years old. They must then have the learner’s permit for at least 6 months and fulfill the other requirements listed below before they can apply to have a license.

| Requirements for Getting a License in Oklahoma | Details |

|---|---|

| Mandatory holding period | Six months |

| Minimum supervised driving time | 50 hours (10 of which must be at night) |

| Minimum age | 16 years old |

These rules are not the only ones that must be followed. There are also restrictions in place for young drivers during the period of their learner’s permit or intermediate license, including:

The above restrictions may be lifted after six months with driver education OR 12 months without driver education or at age 18 (minimum age: 16 1/2).

Take note — If a young driver takes driver education classes, it shaves the waiting period for restrictions in half!

Going to the DMV is a necessity for all age groups. Older residents in Oklahoma must renew their licenses every four years, the same as the general population. As well, regardless of age, Oklahoma residents are NOT allowed to renew driver licenses by mail or online. While the trip every four years comes around sooner than one thinks, there is one perk to living in Oklahoma:

Unlike other states, Oklahoma doesn’t require older drivers and the general population to pass vision tests before renewing their licenses.

So while you still have to visit the DMV in person, you can (though probably shouldn’t) scratch an eye-doctor visit off your to-do list.

If you are moving to Oklahoma, updating your auto insurance is a necessary item on your to-do list. Make sure to inform your current provider of your new address so you can get updated proof of insurance cards. You also need to make sure you have the minimum auto insurance coverage required by the state of Oklahoma.

| Insurance Required | Minimum Limits – 25/50/25 |

|---|---|

| Body Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

After you’ve registered at your local DMV, some insurers (like Geico) will require you to take your vehicle to the Oklahoma Department of Public Safety (DPS) or Oklahoma Tax Commission (OTC). Once there, a tag agent will inspect the vehicle to confirm your vehicle identification number.

The last thing you want is to rack up points on your driving record because you don’t know the rules of the road. To help you avoid breaking the law, we’ve listed some of the main rules you need to know when driving in Oklahoma.

If you don’t know these laws, it is inevitable that authorities will eventually pull you over!

Oklahoma is an at-fault state. But what does this mean?

When a vehicle accident occurs in Oklahoma, police and auto insurance companies determine faut. The result is that the at-fault driver has to pay for medical expenses, damages, and all other costs caused by the accident.

If you don’t have insurance or the right coverage, your resources will quickly be drained if you are found to be at-fault in the state of Oklahoma.

If you are driving slower than the speed limit, you are NOT allowed to drive in the left lane. The general rule of thumb is that if you are slower than general traffic, keep to the right side of the road.

Passing on the right is allowed under CERTAIN circumstances.

If you do pass on the right, JUSTIA US law says, “Every driver who intends to pass another vehicle proceeding in the same direction, which requires moving his vehicle from one lane of traffic to another, shall first see that such movement can be made with safety and shall proceed to pass only after giving a proper signal by hand or mechanical device.”

To help you avoid a ticket, here are the speed limits across the state of Oklahoma.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 70 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

Everyone knows wearing a seatbelt is important. But do you know the specific laws in the state of Oklahoma? Don’t fear, we have listed them for you! Keep reading to learn about Oklahoma’s seat belt laws.

| Safety Belt Laws in Oklahoma | Details |

|---|---|

| Age/Seats Applicable | 9+ years old in front seats |

| First Offense Fine | $20 plus fees |

| Effective Since | February 1, 1987 |

| Primary Enforcement | Yes; effective since November 1, 1971 |

Most importantly, we want to keep our children safe. There are child safety seat laws in Oklahoma to insure our children’s safety in the state of Oklahoma. Below are the main car seat laws you need to know.

| Type of Car Seat Required | Age |

|---|---|

| Rear-facing Child Safety Seat | Younger than 2 years (or until a child outgrows the manufacturer's top height or weight recommendations) |

| Child Restraint System | Younger than 4 years old |

| Child Restraint or Booster Seat | 4 to 7 years old (can't be taller than 4'9") |

| Adult Belt Permissible | Over 8 years old (or taller than 4'9") |

The first time you break car seat laws, you face a fine of $50 plus fees.

There is no Oklahoma state law restricting riding in cargo areas. It is still best to use caution when riding in cargo areas, though, and make sure to exercise your best judgment to insure everyone’s safety.

Two of the biggest rideshare companies in the U.S. are Uber and Lyft. If you want to insure your vehicle to rideshare, you must choose from one of the following insurers in Oklahoma.

Each insurer has different coverages and requirements, so make sure you choose one that best fits your needs. Most ridesharing companies will also have you complete vehicle safety checks in addition to purchasing ridesharing insurance.

26.4 percent of all traffic-related deaths in Oklahoma are alcohol-related. In 2017, there were 165 fatalities caused by alcohol-related accidents. Drunk driving often comes with terrible costs, which is why Oklahoma has strict laws in place to control drunk driving-related incidents.

| DUI Law in Oklahoma | Details |

|---|---|

| Name for Offense | Driving while intoxicated (DWI) |

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | First – misdemeanor, Second or more in 10 years – felony |

| Look Back Period | 10 years |

As you can see, the first Driving While Impaired (DWI) offense is a misdemeanor, whereas the second offense is a felony. Below, you can see the penalties in Oklahoma for first-time and consecutive offenses.

| DUI – First Offense | Details |

|---|---|

| License Revoked | One to six months |

| Jail Time | Five days to one year |

| Fine | No minimum but up to $1,000 |

| Other | IID (ignition interlock) required for 18 months if BAC is 0.15+ |

| DUI – Second Offense | Details |

|---|---|

| License Revoked | Six months minimum |

| Jail Time | One to five years |

| Fine | No minimum but up to $2,500 |

| Other | IID (ignition interlock) required for five years |

| DUI – Third Offense | Details |

|---|---|

| License Revoked | One to three years |

| Jail Time | One to 10 years |

| Fine | No minimum but up to $5,000 |

| Other | IID (ignition interlock) required for five years |

Clearly, it does not pay to drive drunk. The same goes for marijuana-impaired driving in Oklahoma. The state of Oklahoma has a zero-tolerance law for the use of THC and metabolites.

Best policy? Avoid driving drunk or impaired. Having just one too many can result in an injury or a tragic accident.

Do you know what is just as deadly as driving impaired? Driving distracted. Below are Oklahoma’s laws about cellphone use while driving.

| Laws on Cellphones while Driving in Oklahoma | Details |

|---|---|

| Hand-held ban | Learner's permit and intermediate license holders |

| Text ban | All drivers |

| Enforcement | Primary |

What does this information mean? Basically, young drivers with learner’s permits or intermediate licenses are prohibited from using cell phones while driving. As well, drivers of all ages are prohibited from texting while driving. So save the texts until you get home.

Wherever you live, it is important to know the risks you face when you are out on the road. We know you want to be as safe as possible when driving. One of the ways to accomplish this is by knowing what to keep an eye out for in Oklahoma.

We have collected all the facts you need to know about owning and operating a vehicle in Oklahoma so that you can feel confident about what is going on in your hometown.

From theft to fatality rates, we have covered it all for you here.

| Car Model and Make | Year of Vehicle | Total Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1994 | 1143 |

| Ford Pickup (Full Size) | 2004 | 780 |

| Dodge Pickup (Full Size) | 2001 | 419 |

| GMC Pickup (Full Size) | 1994 | 304 |

| Honda Civic | 1998 | 292 |

| Honda Accord | 1996 | 269 |

| Chevrolet Impala | 2005 | 181 |

| Chevrolet Pickup (Small Size) | 1998 | 127 |

| Ford Explorer | 2002 | 123 |

| Chevrolet Malibu | 2009 | 119 |

Full-sized pickups are definitely on the hit list in Oklahoma. If you own one of these cars, you may want to keep a closer eye on it. Next, the worst cities for vehicle theft in Oklahoma according to a 2013 report by the FBI.

| City | Total Thefts |

|---|---|

| Broken Arrow | 135 |

| Del City | 81 |

| Endid | 90 |

| Lawton | 229 |

| Midwest City | 261 |

| Moore | 133 |

| Norman | 168 |

| Oklahoma City | 4,076 |

| Shawnee | 129 |

| Tulsa | 2,389 |

Let’s jump into the sobering fatalities in Oklahoma and the main causes.

Two of Oklahoma’s cities made it onto NHTSA’s list of fatal crashes.

| City | Total Killed in 2016 | Fatality Rate per 100,000 Population |

|---|---|---|

| Oklahoma City | 87 | 13.6 |

| Tulsa City | 52 | 12.9 |

Next, let’s look at traffic fatalities in rural versus urban environments.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 523 | 498 | 465 | 497 | 468 | 499 | 468 | 391 | 426 | 417 |

| Urban | 226 | 239 | 203 | 199 | 241 | 229 | 201 | 254 | 260 | 238 |

| Total | 750 | 737 | 668 | 696 | 709 | 678 | 669 | 645 | 687 | 655 |

Clearly, rural roads are more dangerous than urban. This may be unexpected to you because urban roads are more congested. If you consider factors like increased speed on rural roads, though, the higher fatality rate starts to make sense.

Get this — person type also shows trends in fatalities. By person type, we mean pedestrian versus occupant of the vehicle and the vehicle type. Let’s dig a little deeper into Oklahoma’s fatality rates.

| Oklahoma Traffic Deaths by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 230 | 226 | 222 | 207 | 198 |

| Light Pickup Truck Occupants | 130 | 174 | 121 | 144 | 123 |

| Light Utility Truck Occupants | 92 | 82 | 78 | 88 | 86 |

| Van Occupants | 22 | 18 | 21 | 31 | 27 |

| Large Truck Occupants | 29 | 41 | 27 | 27 | 28 |

| Other/Unknown Occupants | 9 | 11 | 9 | 6 | 11 |

| Bus Occupants | 0 | 4 | 0 | 0 | 0 |

| Motorcyclists | 92 | 57 | 89 | 88 | 93 |

| Pedestrians | 58 | 50 | 70 | 88 | 78 |

| Bicyclists and Other Cyclists | 13 | 4 | 6 | 5 | 6 |

| Other/Unknown Non-occupants | 3 | 2 | 2 | 3 | 5 |

| State Total | 678 | 669 | 645 | 687 | 655 |

Passenger cars and pickups are involved in the most fatalities in Oklahoma. But beware, because non-occupants are also fatalities of accidents. When you are walking or bicycling near a roadway, make sure you keep an eye on the road for vehicle traffic.

Let’s now jump into crash type fatalities in Oklahoma.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Involving a Roadway Departure | 385 | 402 | 359 | 386 | 370 |

| Single Vehicle | 351 | 335 | 351 | 376 | 357 |

| Involving a Rollover | 232 | 246 | 217 | 223 | 210 |

| Involving Speeding | 174 | 152 | 171 | 185 | 143 |

| Involving a Large Truck | 112 | 134 | 106 | 126 | 133 |

| Involving an Intersection (or Intersection Related) | 134 | 146 | 116 | 139 | 126 |

| Total Fatalities (All Crashes) | 678 | 669 | 645 | 687 | 655 |

Now that we know the where, who, and why of fatalities happening in Oklahoma, let’s dig a little deeper and look at the five-year fatality trend for counties in Oklahoma.

| 10 Counties in Oklahoma with the Most Traffic Fatalities | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Oklahoma | 75 | 73 | 85 | 88 | 90 |

| Tulsa | 71 | 61 | 72 | 67 | 70 |

| Cleveland | 21 | 16 | 28 | 14 | 25 |

| Canadian | 12 | 14 | 12 | 17 | 24 |

| Comanche | 15 | 15 | 12 | 15 | 16 |

| Le Flore | 7 | 10 | 14 | 18 | 16 |

| Grady | 19 | 17 | 17 | 16 | 14 |

| McClain | 9 | 7 | 7 | 16 | 14 |

| Mayes | 12 | 15 | 7 | 21 | 14 |

| Ottawa | 8 | 4 | 11 | 7 | 14 |

| Top 10 County Total | 298 | 265 | 303 | 300 | 297 |

| State Total (Includes All Counties) | 678 | 669 | 645 | 687 | 655 |

Bear in mind that Oklahoma’s fatality numbers are actually low compared to other states.

In comparison, California’s state fatalities totals were over 3,000.

However, you can clearly see that speeding is a problem in Oklahoma. Especially when you consider that fatalities due to rollover were likely caused by speeding. Still not convinced? Let’s examine the 25 counties with the most fatalities involving speeding in 2017 and see how they compare to 2015 and 2016.

| County Name | 2015 | 2016 | 2017 |

|---|---|---|---|

| Oklahoma | 36 | 30 | 21 |

| Tulsa | 22 | 24 | 20 |

| Le Flore | 6 | 5 | 8 |

| Cherokee | 1 | 3 | 7 |

| Canadian | 1 | 2 | 6 |

| Cleveland | 8 | 3 | 6 |

| Delaware | 2 | 3 | 5 |

| Atoka | 0 | 1 | 4 |

| Caddo | 2 | 4 | 4 |

| Creek | 0 | 3 | 4 |

| Mayes | 1 | 5 | 4 |

| McCurtain | 2 | 2 | 4 |

| Rogers | 2 | 6 | 4 |

| Adair | 2 | 1 | 3 |

| Pittsburg | 7 | 3 | 3 |

| Texas | 1 | 1 | 3 |

| Woodward | 3 | 4 | 3 |

| Bryan | 2 | 7 | 2 |

| Choctaw | 0 | 2 | 2 |

| Comanche | 2 | 3 | 2 |

| Custer | 1 | 3 | 2 |

| McClain | 2 | 3 | 2 |

| Muskogee | 3 | 1 | 2 |

| Payne | 1 | 4 | 2 |

| Pontotoc | 1 | 1 | 2 |

Tulsa ranks highest on the list in the number of speeding deaths. Next, let’s look at the other major claimer of lives.

Drunk driving is a prevalent problem across America, and Oklahoma is no exception. Below are the top 10 counties in Oklahoma with the highest DWI fatalities.

| County Name | 2015 | 2016 | 2017 |

|---|---|---|---|

| Carter | 3 | 6 | 4 |

| Cimarron | 7 | 3 | 5 |

| Comanche | 7 | 5 | 5 |

| Dewey | 5 | 5 | 3 |

| Grant | 3 | 3 | 8 |

| Jackson | 7 | 7 | 3 |

| Johnston | 26 | 26 | 32 |

| Kay | 18 | 25 | 25 |

| Logan | 10 | 4 | 7 |

| Marshall | 7 | 4 | 1 |

Unfortunately, drunk driving is also prevalent among young drivers. Alcohol and inexperience often make for a deadly combination in teen drivers, although drunk driving is dangerous at any age. That extra drink is simply not worth it!

| Number of Under 18 DWI Arrests | Total per One Million People (DWI Under 18 Arrests) | Rank |

|---|---|---|

| 107 | 111.27 | 18 |

In the U.S., the average amount of underage, alcohol-impaired deaths per 100,000 people is 1.2 fatalities.

Oklahoma’s underage fatalities due to alcohol impairment are 1.3 fatalities, which is slightly above the national average.

With the number of accidents caused by alcohol impairment and other factors, the next question is naturally how long does it take for help to arrive? If you are in an accident, you want help to arrive as fast as possible. That’s why we are going to show you Oklahoma’s EMS Response Time, so you can feel secure that help will arrive shortly.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 9.44 min | 16.21 min | 49.34 min | 66.75 min | 383 |

| Urban | 4.18 min | 7.33 min | 30.04 min | 37.81 min | 244 |

Oklahoma’s response time is pretty good, as it only takes four to nine minutes for help to arrive and under an hour to be taken to the hospital from the time of the crash.

If you live in an urban area in Oklahoma, help will come faster than in a rural area.

How many cars do you own? In Oklahoma, the average number of cars owned as of 2016 is two. Three-car households are the second most common, followed by those who own one car.

Nobody wants to spend a huge chunk of their day commuting. Luckily for residents in Oklahoma, the average commute is 20 minutes or less, which is lower than the national average of 25 minutes. And fewer than two percent of commuters drive 90 minutes or more each day.

Curious how people are commuting to Oklahoma? At over 80 percent of commuters, the most common method is driving alone and about 10 percent carpool. Approximately five percent of work from home.

Traffic is the worst. Miles of cars slowly rolling forward, impatient honking, and a lot of teeth-gritting. Here are the worst cities in Oklahoma for traffic congestion. While there isn’t information on the percentage of time spent in congestion during peak time, it is clear that Tulsa and Oklahoma City residents spend quite a bit of time in traffic.

| City | Hours Spent in Traffic |

|---|---|

| Tulsa | 33 |

| Oklahoma City | 51 |

Oklahoma City ranks 46th in the U.S. for the most congested cities. Tulsa ranks 61st.

While it is discouraging that Oklahoma City and Tulsa are on the list, the rest of Oklahoma’s cities are not! So rest assured that Oklahoma is not a state where you will spend hours sitting in congestion.

We hope this comprehensive guide on Oklahoma has proved useful to you. Start comparing auto insurance rates today by entering your ZIP code below in our FREE online tool!

Auto Insurance Tips