8:00 - 17:00

Opening Hour: Mon - Fri

| Florida Statistics Summary | Details |

|---|---|

| Road Miles | Total Miles in State: 122,391 Vehicle Miles Driven: 201.04 Billion |

| Driving Deaths | Speeding: 299 Drunk-Driving: 839 |

| Vehicles | Registered: 14,946,691 Stolen: 42,579 |

| Most Popular Vehicle | Toyota Corolla |

| Average Premiums | Liability: $857.64 Collision: $282.96 Comprehensive: $116.53 Combined Premiums: $1,257.13 |

| Percent of Motorists Uninsured | 26.70% State Rank: 1 (Most Uninsured) |

If you have a Florida driver’s license, you’re one of 14,675,160 licensed drivers in your state (as of 2016). Although we hope these millions of drivers feel confident in their auto insurance coverage, that’s likely not the case.

The problem? Many people don’t totally understand what they’re paying for — let alone when their auto insurance coverage will even come in handy. In fact, there are too many auto insurance myths floating around that only make matters worse. (e.g., Car color impacts insurance rates.)

That’s why it’s important to stay informed with the right sources. (Hint: That includes us!) Before you spend a lot of money on Florida auto insurance, it’s a good idea to understand more about what you need to pay for and why.

While searching for the right insurance company for you, you can compare auto insurance quotes right here.

Table of Contents

Are you tired of spending too much money on auto insurance in the Sunshine State? Are you fed up with hours upon hours of researching insurance information to find out what is the average auto insurance monthly cost? Comparing various resources can get overwhelming, confusing, and flat-out tiring. So that’s why we’re here to help! We aren’t here to sell you anything.

We’re just auto insurance experts here to help YOU! This guide will break down Florida policy options, explain why certain types of coverage are important, how Florida’s rates compare from state to state and translate the jargon that makes your head spin. We want you to get the proper auto insurance coverage for the appropriate amount of money, so let’s get started.

| Florida Insurance Requirments | Minimum Limits |

|---|---|

| Personal Injury Protection (PIP) | $10,000 per accident |

| Property Damage Liability (PDL) | $10,000 per accident |

Florida is a state with no-fault auto insurance coverage, which means that after a car accident, your insurance pays your (and anyone under your policy) medical expenses and monetary losses, no matter who technically caused the collision.

This type of coverage is called personal injury protection (PIP) and also includes rehabilitation, loss of earnings, and funeral expenses. In some states PIP includes essential services such as child care. PIP claims are limited, though any damage that can’t be financially quantified won’t apply.

So, unlike most other states, Florida does not require you to carry bodily injury liability auto insurance coverage, which would cover someone else who got hurt in an accident that you (or anyone under policy) caused. Instead, you must have liability coverage for accident-related property damage — a.k.a. property damage liability (PDL). However, it would be wise to add to bodily injury liability coverage, too. You don’t want to cause an accident, injure someone, and get sued if their medical bills and injuries reach beyond a certain threshold of cost and severity.

If you purchase bodily injury liability coverage (which your insurance company will probably urge you to do), the minimum coverage is: “$10,000 of bodily injury to, or death of, one person in any one crash, $20,000 of bodily injury to, or death of, two or more persons in any one crash” as stated on the Florida Department of Highway Safety and Motor Vehicles website.

Since, of course, Florida requires you to have auto insurance, you may need to prove you have it from time to time. If you get into a car accident or get pulled over by a police officer for any reason, you’ll need to reveal your self-insurance certificate that was issued by the Florida Department of Highway Safety and Motor Vehicles.

If your insurance company alerts the Florida Department of Highway Safety and Motor Vehicles that you’ve canceled your only active insurance policy (or policies), you can count on getting a letter in the mail from the department asking for your insurance information. If this is the case, make sure you get a new insurance policy as soon as possible.

If you no longer own your car, return your Florida tags and registration immediately after you cancel your Florida insurance coverage.

When signing up with the Florida DMV or DOT, make sure that you choose to opt out of sharing your information with third parties, as Florida is one of the worst states for DMV and DOT data breaches.

In 2014, the annual per capita disposable personal income in Florida was $38,350. The annual full coverage average of auto insurance premiums for this same year was $1,208.77. So, on average, Florida auto insurance payments require about 3.15 percent of your income. Thankfully, you’re in the right place when it comes to learning more about where to find the best auto insurance rates in Florida.

But more on that later…

It’s time to learn about the cost of core auto insurance coverage first. When comparing Florida to the national annual auto insurance average, Florida costs are higher. The national average is $1,311, while Florida’s average is $1,742 — the fifth-highest average out of all 50 states!

| Coverage Type | Average Annual Costs (2015) |

|---|---|

| Liability | $857.64 |

| Collision | $282.96 |

| Comprehensive | $116.53 |

| Combined | $1,257.13 |

We’ve collected the average premium costs for each core coverage type from 2015. If you’re in Florida, there’s a good chance these costs have already increased by now. The data in this table comes from the National Association of Insurance Commissioners.

In 2015, 26.7 percent of motorists in Florida didn’t have auto insurance. In fact, this statistic puts Florida at the top of the list for the highest percentage of uninsured drivers in the United States! Medical Pay, Personal Injury Protection, and Uninsured/Underinsured Motorist Coverage are all optional coverage options in Florida, but it’s still advisable to get them on your policy so you don’t find yourself in a car accident or car theft situation without enough protection.

Loss ratios gauge the financial health of an insurance company. To put it simply, a loss ratio is the money a company pays for claims…to the money they take in for premiums. So, if they pay $50 in claims out of $100 taken in on premiums, their loss ratio would be 50:100, or 50 percent. The other 50 percent goes to paying overhead.

A company that pays more in claims than it takes in for premiums has a high loss ratio and isn’t in good shape, so you don’t want to pay premiums to a company with this issue.

The table below shows loss ratios for the aforementioned liability insurance categories in Florida:

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 75% | 62% | 76% |

| Medical Payments (MedPay) | 74% | 72.5% | 81% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 73% | 80% | 86% |

We know your goal is to get the complete coverage you need at affordable auto insurance rates. Learn more here: where can I compare several affordable auto insurance rates.

Good news: There are several powerful but cheap extras you can add to your policy, also called “riders.”

Here’s a list of useful coverage available to you in Florida:

The common thought is that men pay more for auto insurance.

In most states that isn’t always true, and Florida is a state where it is.

Rates can also change by where you live. Let’s take a look at the most expensive Florida ZIP codes.

| 25 Most Expensive Zip Codes in Florida | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 33142 | MIAMI | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33147 | MIAMI | $7,626.18 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | GEICO | $4,603.44 |

| 33125 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33135 | MIAMI | $7,606.64 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33130 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33136 | MIAMI | $7,592.83 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33127 | MIAMI | $7,517.24 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33010 | HIALEAH | $7,448.04 | Allstate | $12,185.02 | Progressive | $8,805.26 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33150 | MIAMI | $7,428.69 | Allstate | $12,124.19 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | GEICO | $4,603.44 |

| 33128 | MIAMI | $7,404.00 | Allstate | $12,185.02 | Progressive | $8,497.04 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33012 | HIALEAH | $7,304.68 | Allstate | $11,716.92 | Progressive | $8,805.26 | USAA | $4,202.34 | GEICO | $4,603.44 |

| 33126 | MIAMI | $7,297.22 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33013 | HIALEAH | $7,275.81 | Allstate | $11,715.10 | Progressive | $8,604.99 | USAA | $4,202.34 | GEICO | $4,603.44 |

| 33168 | MIAMI | $7,240.81 | Allstate | $11,827.36 | Progressive | $8,466.37 | USAA | $4,505.83 | GEICO | $4,603.44 |

| 33167 | MIAMI | $7,216.08 | Allstate | $11,654.27 | Progressive | $8,466.37 | USAA | $4,505.83 | GEICO | $4,603.44 |

| 33145 | MIAMI | $7,199.47 | Allstate | $10,732.87 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33144 | MIAMI | $7,197.53 | Allstate | $12,367.26 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33174 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | GEICO | $4,603.44 |

| 33199 | MIAMI | $7,178.70 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | GEICO | $4,603.44 |

| 33122 | MIAMI | $7,163.83 | Allstate | $11,836.51 | Liberty Mutual | $8,135.30 | USAA | $4,036.96 | GEICO | $4,603.44 |

| 33054 | OPA LOCKA | $7,162.08 | Allstate | $11,656.10 | Progressive | $8,533.79 | USAA | $4,505.83 | GEICO | $4,603.44 |

| 33184 | MIAMI | $7,153.94 | Allstate | $12,193.91 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | GEICO | $4,603.44 |

| 33016 | HIALEAH | $7,146.88 | Allstate | $11,656.10 | Progressive | $8,805.26 | USAA | $4,505.83 | GEICO | $4,603.44 |

| 33175 | MIAMI | $7,127.61 | Allstate | $12,009.61 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | GEICO | $4,603.44 |

| 33162 | MIAMI | $7,110.30 | Allstate | $11,684.61 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | GEICO | $4,603.44 |

Miami’s ZIP codes appear multiple times, making Miami one of the most expensive places to live in Florida.

| 25 Least Expensive Zip Codes in Florida | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 32694 | WALDO | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32643 | HIGH SPRINGS | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32618 | ARCHER | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32667 | MICANOPY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32669 | NEWBERRY | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32601 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32609 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32641 | GAINESVILLE | $3,489.42 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32615 | ALACHUA | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32658 | LA CROSSE | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32612 | GAINESVILLE | $3,492.52 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32603 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32605 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32606 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32607 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32608 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32611 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32653 | GAINESVILLE | $3,494.66 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32610 | GAINESVILLE | $3,504.58 | Allstate | $5,675.46 | Progressive | $3,951.64 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32631 | EARLETON | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32550 | MIRAMAR BEACH | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

| 32664 | MC INTOSH | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32681 | ORANGE LAKE | $3,610.75 | Allstate | $5,675.46 | Liberty Mutual | $3,954.28 | USAA | $2,456.82 | State Farm | $2,656.82 |

| 32633 | EVINSTON | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

| 32640 | HAWTHORNE | $3,646.11 | Allstate | $5,638.78 | Progressive | $5,035.52 | USAA | $2,129.02 | State Farm | $2,685.17 |

One of Waldo’s ZIP codes is the cheapest ZIP code in Florida.

Now that we’ve looked at ZIP codes, let’s see which cities are the most expensive.

| 10 Most Expensive Cities in Florida | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Brownsville | $7,631.16 | Allstate | $12,185.02 | Liberty Mutual | $9,457.09 | USAA | $4,036.96 | GEICO | $4,603.44 |

| Gladeview | $7,527.43 | Allstate | $12,154.60 | Liberty Mutual | $9,457.09 | USAA | $4,202.34 | GEICO | $4,603.44 |

| Fountainebleau | $7,237.96 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,037.71 | GEICO | $4,603.44 |

| Hialeah | $7,178.98 | Allstate | $11,504.33 | Progressive | $8,630.10 | USAA | $4,248.38 | GEICO | $4,603.44 |

| Golden Glades | $7,161.53 | Allstate | $11,695.48 | Liberty Mutual | $8,135.30 | USAA | $4,505.83 | GEICO | $4,603.44 |

| Coral Terrace | $7,081.53 | Allstate | $12,367.26 | Liberty Mutual | $8,191.19 | USAA | $4,045.62 | GEICO | $4,603.44 |

| Olympia Heights | $7,078.68 | Allstate | $12,367.26 | Liberty Mutual | $8,247.08 | USAA | $4,038.46 | GEICO | $4,603.44 |

| Miami | $7,078.48 | Allstate | $11,539.59 | Liberty Mutual | $8,684.52 | USAA | $4,077.32 | GEICO | $4,603.44 |

| Biscayne Park | $6,983.18 | Allstate | $11,896.30 | Progressive | $8,392.79 | USAA | $4,505.83 | GEICO | $4,603.44 |

| Miami Gardens | $6,972.48 | Allstate | $10,667.38 | Liberty Mutual | $8,209.82 | USAA | $4,505.83 | GEICO | $4,603.44 |

While Miami has some of the most expensive ZIP codes, it is not the most expensive city overall.

| 10 Least Expensive Cities in Florida | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Waldo | $3,481.35 | Allstate | $5,638.78 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| High Springs | $3,486.23 | Allstate | $5,672.94 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Archer | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Micanopy | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Newberry | $3,486.59 | Allstate | $5,675.46 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Alachua | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| La Crosse | $3,490.52 | Allstate | $5,703.00 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Gainesville | $3,494.00 | Allstate | $5,666.29 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Earleton | $3,523.03 | Allstate | $5,930.57 | Liberty Mutual | $3,903.07 | USAA | $2,129.02 | State Farm | $2,685.17 |

| Miramar Beach | $3,597.34 | Allstate | $5,996.61 | Progressive | $4,267.71 | USAA | $1,983.74 | State Farm | $2,555.76 |

Waldo had the cheapest ZIP code, and it is also the cheapest city in Florida.

This table shows the top five counties with the highest rates and the top five counties with the lowest rates. If you find yourself in one of the high-rate Florida counties, know you’re not the only one paying a lot for auto insurance!

| Top 5 Counties with the Highest Average Rates | Rates | Top 5 Counties with the Lowest Average Rates | Rates |

|---|---|---|---|

| Miami-Dade | $6,855 | Jefferson | $3,597 |

| Palm Beach | $6,268 | Gilchrist | $3,597 |

| Broward | $5,919 | Gadsden | $3,591 |

| Hillsborough | $5,858 | Levy | $3,581 |

| Pinellas | $5,269 | Franklin | $3,569 |

It’s also helpful to know that rates aren’t just based on where you live. Demographics also factor into the type of coverage you have. Do you live in Florida and fit into any of the following descriptions?

Now that you have an idea of how auto insurance rates compare between some Florida counties and demographics, let’s take a look at the insurance companies licensed in your state to help you find the right company for your coverage needs.

With the hundreds of auto insurance providers out there today, it’s nearly impossible to know who you can trust. You might be wondering, “Is it safe to switch to a new, smaller company that offers lower rates?” Let us help you decide!

Keep reading to discover what is the best auto insurance company across the Sunshine State.

Let’s dive right into their financial strength.

| Providers (by Size – Largest at Top) | A.M. Best Rating |

|---|---|

| Allstate Insurance | A+ |

| AmTrust | A- |

| Berkshire Hathaway | A++ |

| Infinity Insurance | A |

| Liberty Mutual | A |

| Progressive | A+ |

| State Farm | B++ |

| Travelers | A++ |

| USAA | A++ |

| Windhaven | Not Rated |

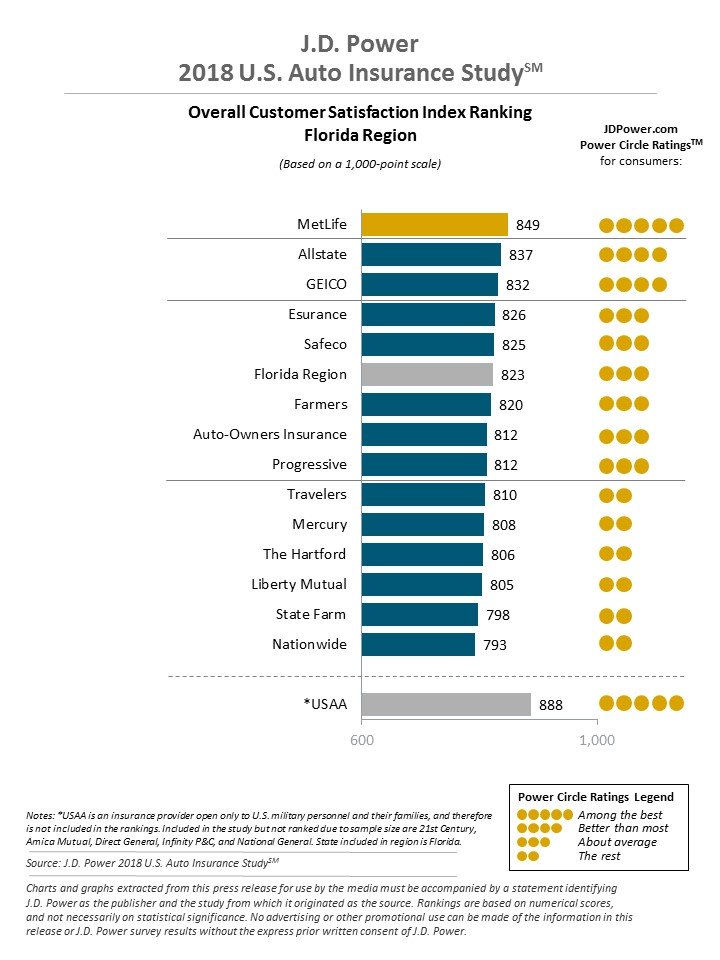

MetLife is number one with the best customer ratings out of all auto insurance companies in Florida. It wins an 849 out of a 1,000-point scale according to J.D. Power. You’ll also notice several other top companies in the 800s, some who fall below average.

When it comes to looking for the right auto insurance company for you, it’s imperative to keep a company’s customer-satisfaction ranking in mind. After all, you could be their customer, too!

Since State Farm ranks “below average” in the J.D. Power graphic, it’s no surprise that they racked up a grand total of 1,094 customer complaints over three years’ time. However, Windhaven beats them with 1571. That’s a lot of complaints!

As a Floridian, it’s a wise idea to keep these numbers in mind. You can find more customer complaint stats at the Florida Office of Insurance Regulation — where they show numbers for other types of insurance companies, too…not just auto insurance.

| Number of Customer Complaints | 2017 | 2016 | 2015 | Total |

|---|---|---|---|---|

| Allstate | 46 | 49 | 57 | 152 |

| Geico | 75 | 72 | 52 | 199 |

| Infinity | 137 | 141 | 179 | 457 |

| Liberty Mutual | 25 | 15 | 23 | 63 |

| Progressive | 140 | 153 | 149 | 442 |

| State Farm | 351 | 349 | 394 | 1,094 |

| Travelers | 2 | 1 | 1 | 4 |

| USAA | 53 | 33 | 21 | 107 |

| Windhaven | 544 | 629 | 398 | 1571 |

So that you don’t have to sift through tons of auto insurance company websites to find the best rates, we’ve compiled a list of the top five cheapest companies that serve Florida — along with the top five most expensive (so you know who to avoid).

| Top 5 Most Expensive Auto Insurance Providers (Average Rates) | Annual Rate | Top 5 Cheapest Auto Insurance Providers (Average Rates) | Annual Rate |

|---|---|---|---|

| Infinity Indemnity Insurance | $13,777 | USAA General Indemnity | $2,643 |

| Infinity Auto Insurance | $10,139 | USAA Casualty Insurance | $2,545 |

| Ocean Harbor Casualty Insurance | $6,715 | USAA | $2,281 |

| United Automobile Insurance | $5,683 | Florida Farm Bureau | $2,148 |

| Allstate Property & Casualty Insurance | $5,370 | Geico General Insurance/Government Employees Insurance | $2,021 |

Get Your Rates Quote Now |

|||

What’s more, we can literally help you find the cheapest rates around.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

We’ve already shared Florida’s 10 largest auto insurance companies with you, along with their financial ratings. But to give you a more precise scope of what exactly makes these companies large, check out their market shares and number of administered premiums:

| Insurance Company | Premiums Written | Market Share |

|---|---|---|

| Allstate Insurance | $1,842,800 | 9.63% |

| AmTrust | $413,351 | 2.16% |

| Berkshire Hathaway | $4,678,326 | 24.44% |

| Infinity Insurance | $357,011 | 1.86% |

| Liberty Mutual | $617,089 | 3.22% |

| Progressive | $3,031,444 | 15.84% |

| State Farm | $3,042,871 | 15.89% |

| Travelers | $444,623 | 2.32% |

| USAA | $1,357,367 | 7.09% |

| Windhaven | $385,885 | 2.02% |

For your information, here are the numbers of domestic and foreign property and casualty insurance companies in Florida:

| Property and Casualty Insurance | Number |

|---|---|

| Domestic | 114 |

| Foreign | 953 |

| Total | 1067 |

Following your state auto insurance laws is important, so you can be safe and do what you’re supposed to do. But to follow the law, you have to know the law, and that can be confusing to interpret. But not to worry — that’s just another reason why we’re here!

To get you in “the know,” we’ll give you the scoop on some of the most important auto insurance laws in the Sunshine State. It’s not all sunshine and butterflies, but we can at least shine a light to help point you in the right direction.

Ever wonder how insurance rates and laws get approved? Fortunately, auto insurance companies don’t get to create and automatically issue whatever rates and rules they want. There’s a regulated process.

All auto insurance rates and forms must be filed and approved by Florida’s Office of Insurance Regulation (FOIR) 30 days before they can go into effect. The Commissioner sometimes gives a 15-day extension with notice and also determines whether proposed insurance rates and laws are excessive.

If you get caught driving without insurance or driving under the influence of drugs or alcohol, you may be required to get either an SR22 or FR44 certification before your license can be reinstated. Either of these forms will be your proof of insurance.

Check also The penalties for a DUI conviction in Florida.

What’s the difference between the two?

You would file for an SR22 if you’re a high-risk driver because you didn’t drive with insurance, have too many points on your license or have had it suspended/revoked, and have been in a car accident that caused an injury or property damage. If caught driving without insurance, you may have to carry an SR22 for up to two years; three years for the other high-risk reasons.

An FR44, on the other hand, would be needed after a DUI or DWI conviction without enough insurance coverage, thus making you a higher-risk driver. You must have your FR44 for at least three years from conviction.

Other than filing for an SR22 (or an FR44 if also found under the influence at the wheel), there are other penalties you can expect if caught driving without insurance:

| First Offense | Second Offense | Third Offense (and Beyond) |

|---|---|---|

| Suspension of license and registration until reinstatement fee ($150) is paid and non-cancelable coverage is secured | Suspension of license and registration until reinstatement fee ($250) is paid and non-cancelable coverage is secured | Suspension of license and registration until reinstatement fee ($500) is paid and non-cancelable coverage is secured |

If you have a damaged/broken windshield and have comprehensive insurance coverage, you don’t have to pay for a windshield replacement; your deductible is waived. Your insurance company will just have to replace it with a windshield of the same quality, fit, and performance. According to Florida full glass coverage law, these are the only specifications when it comes to windshield repair/replacement.

The entire insurance industry (not just automobile insurance) estimates that fraud accounts for 10 percent of their losses. If companies weren’t losing that money, you’d be paying lower premiums on auto insurance. Based on a study conducted in 2008, Florida had the highest rates of auto insurance fraud (out of the 12 no-fault states) in both bodily injury and personal injury protection.

Fraud is pretty common in no-fault states because, as the Insurance Information Institute puts it, “medical providers, attorneys, and other entities perpetuate fraud by padding costs associated with a legitimate claim, for example by billing an insurer for a medical procedure that was not performed.” Talk about a mess! Thus, in 2012, Florida implemented a no-fault auto insurance bill that has since reduced fraud and lowered rates.

Insurance fraud is a crime, and crimes reap consequences. If a Floridian commits insurance fraud, they will get a civil penalty. Here’s the low-down:

If a person knowingly participates in an intentional car crash or falsifies car crash documentation, their punishment compounds with a minimum two-year prison sentence, plus a civil penalty fine of $15,000–$50,000.

The bottom line? Don’t commit insurance fraud of any kind!

Injured? Vehicle damaged? The statute of limitations is four years for both personal injury and property damage claims, which means…that’s how long you’ll have to file a claim and fight for the money owed to you.

Whether you’re an older driver, have a teen driver in your family, or are a new resident, it’s important to know the licensing laws that apply to your age and situation. Every state does things a little differently, so let’s dive into Florida’s licensing specifications.

Have a teenager approaching driving age? Let’s walk you through the requirements and restrictions of the different licensing stages for teens in Florida.

| Type of License | Age Requirements | Pre-Requisites | Passenger Restrictions | Driving Restrictions |

|---|---|---|---|---|

| Learners Permit | Minimum 15 | Complete the DATA course (can take it at age 14) Take the DMV test (can take it at age 14.5 At age 15, take a vision test at DMV | Must be a licensed driver of 21 or older in the front passenger seat | Can't drive after sunset for the first three months and then can't drive after 10 p.m. |

| Restricted License | Minimum 16 | 12-month holding period Minimum supervised 50 hours of driving (10 must be at night) | None | No driving from 11 p.m.-6 a.m. for 16-year-olds; No driving from 1 a.m.-5 a.m. for 17-year-olds |

| Unrestricted License | Minimum 18 | Must satisfy all previous requirements | None | None |

In Florida, drivers under 80 years old must renew their license every eight years, and they only need a vision assessment when renewing their license in person. However, drivers over 80 must renew it every six years and prove they have adequate vision during every renewal.

Mail and online renewal options are available to all drivers, including this older population, which means that older drivers don’t have to get their vision checked at a Florida Department of Highway Safety and Motor Vehicles ((DHSMV) location. Their doctor can do it instead, as long as the driver and doctor fill out and send in this form within one year of a license renewal request.

The DHSMV does allow family members and others to conduct unsafe driver investigations on drivers of any age. The DHSMV has the right to place restrictions on older drivers, such as “no driving at night” or “wear hearing aids on the road.” They also offer driver improvement courses for senior drivers specifically.

If you’ve just moved to Florida from another state with an already valid driver’s license, you can exchange your out-of-state license for a Florida version. You won’t need to take a driving knowledge exam, but you will need a vision exam.

To drive safely, you need to drive well, and to drive well, you need to know Florida’s rules of the road. If every driver follows their own set of rules, chaos ensues. Cue in laws to help the system run smoothly and prevent congestion and collisions.

If you’re a slower driver being overtaken by traffic on a Florida highway, move out of the left lane so that you don’t continue to block traffic. Remember it like this: Slower cars should keep right. Speaking of slower cars, it’s important to follow speed limits.

The table below shows the max speed limits of different types of roads in Florida. It is important to note that this table does not include slower-speed residential areas and school zones with various max speeds of 20–30 mph.

| Types of Road | Maximum Speed Limit (MPH) |

|---|---|

| Urban interstates | 65 |

| Other roads | 65 |

| Rural interstates | 70 |

| Other limited access roads | 70 |

In Florida, seat belts are enforced. Ages six years and older must wear a seat belt, and children six years and older are allowed in the front passenger seat. $30 (not including any possible additional fees) is the maximum base fine for a first offense when breaking a seat belt law.

Car seat laws look different. Kids five years and under must be in a car seat; no adult seat belts are permitted unless a four- or five-year-old child is transported during an emergency by non-immediate family, or has a documented medical condition that a car seat would worsen. $60 (not including any possible additional fees) is the maximum base fine for a first offense when breaking a car seat law, though Florida may also choose to add points to the caregiver’s driving record.

There are six insurance companies that offer coverage for ridesharing services:

Insurance requirements for rideshare drivers and companies:

You can’t be a rideshare driver if:

Automated driving, not just testing, is legal in Florida. Naturally, the vehicle operator must be licensed, but he or she does not have to be in the car. Also, no liability insurance is needed. You can find more about automated driving on the Florida Department of Transportation website.

Apart from following the basic rules of the road, wearing your seat belt, buckling your young child into a safety seat, and being a qualified rideshare driver, there are other safety laws in place that deal with driving impaired or distracted. We have already mentioned DUI/DWI before, but let’s sink deeper into those laws first.

If you’re caught driving impaired with a blood alcohol content (BAC) of 0.08 percent or more, you’ll be charged with driving under the influence (DUI). To classify a DUI as a felony, Florida has a look-back period of 10 years for a third offense and a lifetime look-back period for the fourth offense and any that follow.

| Penalty Type | First Offense | Second Offense | Third Offense | Fourth (or Subsequent) Offense |

|---|---|---|---|---|

| License Suspension or Revocation | 180 days to one year | Second in five years = min five-year revocation Second in six or more years = 180 days to one year revocation | Third in 10 years of second conviction = min 10-year revocation, may be eligible for hardship Reinstatement after two years | Mandatory permanent revocation with no hardship reinstatement allowed |

| Imprisonment | Eight hours to six months High BAC (.15) or minor in car = nine months or less For a first conviction, total period of probation and incarceration may not exceed one year | Nine months or less High BAC or minor in car = 12 months or less Second in five years = mandatory imprisonment at least 10 days with 48 hours consecutive confinement | If third in 10 years, mandatory 30 days with 48 consecutive hours If third in over 10 years, imprisonment no more than 12 months | Five years or less |

| Fine | $500–$1000 High BAC or minor in car = $1000–$2000 | $1000–$2000 High BAC or minor in car= $2000–$4000 | More than 10 years from 2nd conviction = $2000–$5000 High BAC or minor in car = $4000 min | $2000 min |

| Other | Car impounded for 10 days unless family has no other transportation Mandatory 50 hours community service (CS) or additional fine of $10 for each hour of CS required | Second in five years = car impounded for 30 days unless family has no other transportation | Third in 10 years = car impounded for 90 days unless family has no other transportation |

In Florida, there is no law specific to driving while under the influence of marijuana.

In Florida, distracted driving laws — particularly those concerning cell phone use — fall under “secondary enforcement,” which means that a police officer must have another reason to stop a driver before writing a citation for cell phone usage.

Fact: There is no ban for handheld cell phone usage while driving in Florida.

However, effective October 1, 2019, the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) says that cellphones have to be used hands-free when driving in school or work zones.

Texting while driving is banned for everyone. No matter where you live, Florida, or otherwise, don’t text and drive! Florida has recently passed a law (effective July 1, 2019) that made texting while driving a primary offense.

If you text and drive in Florida, you’ll receive the following tickets:

The only time you can text while driving is if you are fully stopped. Be careful while driving and talking on the phone. Stay aware of your surroundings, and keep your eyes on the road.

Let’s run through other important facts and stats in your state. If you’re curious, we have the data you want to know right here in one place.

To start, find out the hottest vehicles for thieves to snatch.

The table below ranks the top 10 auto thefts by make and model.

| RANK | MAKE and MODEL | YEAR | THEFTS |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2006 | 2211 |

| 2 | Nissan Altima | 2015 | 1275 |

| 3 | Toyota Camry | 2016 | 1248 |

| 4 | Honda Civic | 2000 | 1109 |

| 5 | Honda Accord | 2016 | 1106 |

| 6 | Toyota Corolla | 2015 | 1075 |

| 7 | Chevrolet Pickup (Full Size) | 2005 | 810 |

| 8 | Hyundai Sonata | 2016 | 679 |

| 9 | Dodge Pickup (Full Size) | 2005 | 530 |

| 10 | Chevrolet Impala | 2016 | 484 |

These cities have the highest car theft rates in Florida:

| RANK | FLORIDA CITY | THEFTS |

|---|---|---|

| 1 | Jacksonville | 3027 |

| 2 | Miami | 1996 |

| 3 | Orlando | 1240 |

| 4 | Tallahassee | 1099 |

| 5 | St. Petersburg | 1095 |

| 6 | Fort Lauderdale | 918 |

| 7 | Hialeah | 629 |

| 8 | Tampa | 628 |

| 9 | Miami Beach | 565 |

| 10 | Pompano Beach | 564 |

If you’re curious about fatality rates in Florida, we have the data right here for you in various categories from demographics…to crashes with alcohol-impaired drivers…and more. The NHTSA is the source for all of the following fatality data.

| Florida Traffic Fatalities | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Urban | 1,809 | 1,498 | 1,482 | 1,420 | 1,555 | 1,434 | 1,860 | 1,972 | 2,275 | 1,731 |

| Rural | 1,161 | 1,035 | 946 | 968 | 873 | 969 | 634 | 859 | 870 | 674 |

| Unknown | 10 | 27 | 16 | 12 | 3 | 0 | 0 | 107 | 31 | 707 |

| Total | 2,980 | 2,560 | 2,444 | 2,400 | 2,431 | 2,403 | 2,494 | 2,938 | 3,176 | 3,112 |

| Vehicle Type | Number (2015) | % | Number (2016) | % | Number (2017) | % |

|---|---|---|---|---|---|---|

| Passenger Car | 903 | 31% | 1,048 | 33% | 1,001 | 32% |

| Light Truck – Pickup | 213 | 7% | 289 | 9% | 256 | 8% |

| Light Truck – Utility | 271 | 9% | 262 | 8% | 306 | 10% |

| Light Truck – Van | 73 | 2% | 94 | 3% | 77 | 2% |

| Light Truck – Other | 2 | 0% | 8 | 0% | 2 | 0% |

| Large Truck | 31 | 1% | 30 | 1% | 45 | 1% |

| Other/Unknown Occupants | 25 | 1% | 34 | 1% | 30 | 1% |

| Total Occupants | 1,518 | 52% | 1,771 | 56% | 1,717 | 55% |

| Bus | 0 | 0% | 6 | 0% | 0 | 0% |

| Total Motorcyclists | 615 | 21% | 586 | 18% | 590 | 19% |

| Pedestrian | 629 | 21% | 653 | 21% | 654 | 21% |

| Bicyclist and Other Cyclist | 150 | 5% | 138 | 4% | 125 | 4% |

| Other/Unknown Nonoccupants | 26 | 1% | 28 | 1% | 26 | 1% |

| Total Nonoccupants | 805 | 27% | 819 | 26% | 805 | 26% |

| Total | 2,938 | 100% | 3,176 | 100% | 3,112 | 100% |

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Involving a Large Truck | 197 | 190 | 225 | 293 | 292 |

| Involving Speeding | 346 | 245 | 320 | 310 | 299 |

| Involving a Rollover | 431 | 371 | 481 | 573 | 538 |

| Involving an Intersection | 764 | 803 | 1,009 | 1,043 | 1,134 |

| Involving a Roadway Departure | 957 | 940 | 1,071 | 1,203 | 1,122 |

| Single Vehicle | 1,376 | 1,395 | 1,600 | 1,696 | 1,622 |

| Total Fatalities (All Crashes) | 2,403 | 2,494 | 2,938 | 3,176 | 3,112 |

| Ranking | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Miami-Dade County | 225 | 280 | 339 | 294 | 285 |

| 2 | Broward County | 180 | 173 | 224 | 245 | 225 |

| 3 | Hillsborough County | 171 | 158 | 190 | 228 | 190 |

| 4 | Orange County | 124 | 143 | 142 | 171 | 189 |

| 5 | Palm Beach County | 137 | 130 | 187 | 181 | 162 |

| 6 | Duval County | 133 | 120 | 133 | 156 | 151 |

| 7 | Volusia County | 90 | 86 | 87 | 122 | 130 |

| 8 | Pinellas County | 83 | 116 | 103 | 128 | 118 |

| 9 | Lee County | 92 | 81 | 95 | 105 | 113 |

| 10 | Polk County | 94 | 113 | 112 | 137 | 111 |

| Sub-Total 1 | Top Ten Counties | 1,329 | 1,400 | 1,612 | 1,767 | 1,674 |

| Sub-Total 2 | All Other Counties | 1,074 | 1,094 | 1,326 | 1,409 | 1,438 |

| Total | All Counties | 2,403 | 2,494 | 2,938 | 3,176 | 3,112 |

| County Name | Speeding Fatalities 2015 | Speeding Fatalities 2016 | Speeding Fatalities 2017 | Fatalities Per 100K Population 2015 | Fatalities Per 100K Population 2016 | Fatalities Per 100K Population 2017 |

|---|---|---|---|---|---|---|

| Alachua County | 5 | 6 | 8 | 1.93 | 2.27 | 3 |

| Baker County | 0 | 1 | 1 | 0 | 3.58 | 3.54 |

| Bay County | 2 | 7 | 5 | 1.1 | 3.83 | 2.72 |

| Bradford County | 0 | 1 | 0 | 0 | 3.74 | 0 |

| Brevard County | 8 | 9 | 15 | 1.41 | 1.56 | 2.55 |

| Broward County | 30 | 28 | 22 | 1.59 | 1.46 | 1.14 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 | 0 |

| Charlotte County | 3 | 5 | 2 | 1.74 | 2.81 | 1.1 |

| Citrus County | 2 | 2 | 2 | 1.42 | 1.4 | 1.37 |

| Clay County | 1 | 3 | 2 | 0.49 | 1.45 | 0.94 |

| Collier County | 1 | 1 | 2 | 0.28 | 0.27 | 0.54 |

| Columbia County | 2 | 2 | 3 | 2.93 | 2.89 | 4.31 |

| Desoto County | 6 | 3 | 0 | 16.91 | 8.35 | 0 |

| Dixie County | 0 | 0 | 0 | 0 | 0 | 0 |

| Duval County | 4 | 9 | 11 | 0.44 | 0.97 | 1.17 |

| Escambia County | 2 | 3 | 8 | 0.65 | 0.96 | 2.55 |

| Flagler County | 1 | 1 | 2 | 0.95 | 0.93 | 1.81 |

| Franklin County | 0 | 0 | 0 | 0 | 0 | 0 |

| Gadsden County | 1 | 6 | 4 | 2.17 | 13 | 8.68 |

| Gilchrist County | 1 | 0 | 1 | 5.83 | 0 | 5.64 |

| Glades County | 1 | 0 | 1 | 7.62 | 0 | 7.27 |

| Gulf County | 0 | 0 | 0 | 0 | 0 | 0 |

| Hamilton County | 2 | 1 | 4 | 14.01 | 6.98 | 28.2 |

| Hardee County | 0 | 0 | 0 | 0 | 0 | 0 |

| Hendry County | 0 | 3 | 2 | 0 | 7.57 | 4.96 |

| Hernando County | 5 | 1 | 0 | 2.81 | 0.55 | 0 |

| Highlands County | 3 | 0 | 2 | 3 | 0 | 1.94 |

| Hillsborough County | 30 | 27 | 22 | 2.22 | 1.95 | 1.56 |

| Holmes County | 4 | 0 | 0 | 20.74 | 0 | 0 |

| Indian River County | 2 | 3 | 0 | 1.35 | 1.98 | 0 |

| Jackson County | 3 | 4 | 2 | 6.17 | 8.28 | 4.14 |

| Jefferson County | 3 | 0 | 1 | 21.28 | 0 | 7.07 |

| Lafayette County | 1 | 0 | 0 | 11.55 | 0 | 0 |

| Lake County | 6 | 3 | 2 | 1.84 | 0.89 | 0.58 |

| Lee County | 18 | 12 | 21 | 2.57 | 1.66 | 2.84 |

| Leon County | 7 | 3 | 3 | 2.45 | 1.05 | 1.03 |

| Levy County | 7 | 2 | 1 | 17.67 | 5.02 | 2.48 |

| Liberty County | 0 | 1 | 0 | 0 | 12.02 | 0 |

| Madison County | 0 | 0 | 0 | 0 | 0 | 0 |

| Manatee County | 1 | 5 | 1 | 0.28 | 1.33 | 0.26 |

| Marion County | 9 | 7 | 10 | 2.63 | 2.01 | 2.82 |

| Martin County | 2 | 8 | 2 | 1.28 | 5.05 | 1.25 |

| Miami-Dade County | 29 | 30 | 23 | 1.07 | 1.1 | 0.84 |

| Monroe County | 0 | 1 | 1 | 0 | 1.29 | 1.3 |

| Nassau County | 0 | 1 | 0 | 0 | 1.25 | 0 |

| Okaloosa County | 1 | 3 | 2 | 0.51 | 1.5 | 0.99 |

| Okeechobee County | 0 | 0 | 3 | 0 | 0 | 7.21 |

| Orange County | 10 | 10 | 19 | 0.77 | 0.76 | 1.41 |

| Osceola County | 1 | 0 | 0 | 0.31 | 0 | 0 |

| Palm Beach County | 37 | 31 | 18 | 2.59 | 2.13 | 1.22 |

| Pasco County | 7 | 6 | 4 | 1.41 | 1.18 | 0.76 |

| Pinellas County | 14 | 13 | 16 | 1.47 | 1.35 | 1.65 |

| Polk County | 18 | 11 | 13 | 2.77 | 1.65 | 1.89 |

| Putnam County | 2 | 0 | 1 | 2.78 | 0 | 1.36 |

| Santa Rosa County | 1 | 0 | 2 | 0.6 | 0 | 1.15 |

| Sarasota County | 6 | 11 | 4 | 1.48 | 2.66 | 0.95 |

| Seminole County | 3 | 5 | 5 | 0.67 | 1.1 | 1.08 |

| St. Johns County | 2 | 1 | 4 | 0.88 | 0.43 | 1.64 |

| St. Lucie County | 3 | 3 | 4 | 1.01 | 0.98 | 1.28 |

| Sumter County | 2 | 0 | 0 | 1.71 | 0 | 0 |

| Suwannee County | 2 | 2 | 3 | 4.58 | 4.56 | 6.79 |

| Taylor County | 0 | 1 | 1 | 0 | 4.52 | 4.58 |

| Union County | 0 | 0 | 0 | 0 | 0 | 0 |

| Volusia County | 8 | 12 | 9 | 1.55 | 2.27 | 1.67 |

| Wakulla County | 0 | 0 | 1 | 0 | 0 | 3.11 |

| Walton County | 1 | 2 | 3 | 1.59 | 3.06 | 4.39 |

| Washington County | 0 | 0 | 1 | 0 | 0 | 4.07 |

| County Name | Alcohol Fatalities 2015 | Alcohol Fatalities 2016 | Alcohol Fatalities 2017 | Fatalities Per 100K Population 2015 | Fatalities Per 100K Population 2016 | Fatalities Per 100K Population 2017 |

|---|---|---|---|---|---|---|

| Alachua County | 5 | 6 | 8 | 1.93 | 2.27 | 3.00 |

| Baker County | 0 | 1 | 1 | 0.00 | 3.58 | 3.54 |

| Bay County | 2 | 7 | 5 | 1.10 | 3.83 | 2.72 |

| Bradford County | 0 | 1 | 0 | 0.00 | 3.74 | 0.00 |

| Brevard County | 8 | 9 | 15 | 1.41 | 1.56 | 2.55 |

| Broward County | 30 | 28 | 22 | 1.59 | 1.46 | 1.14 |

| Calhoun County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Charlotte County | 3 | 5 | 2 | 1.74 | 2.81 | 1.10 |

| Citrus County | 2 | 2 | 2 | 1.42 | 1.40 | 1.37 |

| Clay County | 1 | 3 | 2 | 0.49 | 1.45 | 0.94 |

| Collier County | 1 | 1 | 2 | 0.28 | 0.27 | 0.54 |

| Columbia County | 2 | 2 | 3 | 2.93 | 2.89 | 4.31 |

| Desoto County | 6 | 3 | 0 | 16.91 | 8.35 | 0.00 |

| Dixie County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Duval County | 4 | 9 | 11 | 0.44 | 0.97 | 1.17 |

| Escambia County | 2 | 3 | 8 | 0.65 | 0.96 | 2.55 |

| Flagler County | 1 | 1 | 2 | 0.95 | 0.93 | 1.81 |

| Franklin County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Gadsden County | 1 | 6 | 4 | 2.17 | 13.00 | 8.68 |

| Gilchrist County | 1 | 0 | 1 | 5.83 | 0.00 | 5.64 |

| Glades County | 1 | 0 | 1 | 7.62 | 0.00 | 7.27 |

| Gulf County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Hamilton County | 2 | 1 | 4 | 14.01 | 6.98 | 28.20 |

| Hardee County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Hendry County | 0 | 3 | 2 | 0.00 | 7.57 | 4.96 |

| Hernando County | 5 | 1 | 0 | 2.81 | 0.55 | 0.00 |

| Highlands County | 3 | 0 | 2 | 3.00 | 0.00 | 1.94 |

| Hillsborough County | 30 | 27 | 22 | 2.22 | 1.95 | 1.56 |

| Holmes County | 4 | 0 | 0 | 20.74 | 0.00 | 0.00 |

| Indian River County | 2 | 3 | 0 | 1.35 | 1.98 | 0.00 |

| Jackson County | 3 | 4 | 2 | 6.17 | 8.28 | 4.14 |

| Jefferson County | 3 | 0 | 1 | 21.28 | 0.00 | 7.07 |

| Lafayette County | 1 | 0 | 0 | 11.55 | 0.00 | 0.00 |

| Lake County | 6 | 3 | 2 | 1.84 | 0.89 | 0.58 |

| Lee County | 18 | 12 | 21 | 2.57 | 1.66 | 2.84 |

| Leon County | 7 | 3 | 3 | 2.45 | 1.05 | 1.03 |

| Levy County | 7 | 2 | 1 | 17.67 | 5.02 | 2.48 |

| Liberty County | 0 | 1 | 0 | 0.00 | 12.02 | 0.00 |

| Madison County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Manatee County | 1 | 5 | 1 | 0.28 | 1.33 | 0.26 |

| Marion County | 9 | 7 | 10 | 2.63 | 2.01 | 2.82 |

| Martin County | 2 | 8 | 2 | 1.28 | 5.05 | 1.25 |

| Miami-Dade County | 29 | 30 | 23 | 1.07 | 1.10 | 0.84 |

| Monroe County | 0 | 1 | 1 | 0.00 | 1.29 | 1.30 |

| Nassau County | 0 | 1 | 0 | 0.00 | 1.25 | 0.00 |

| Okaloosa County | 1 | 3 | 2 | 0.51 | 1.50 | 0.99 |

| Okeechobee County | 0 | 0 | 3 | 0.00 | 0.00 | 7.21 |

| Orange County | 10 | 10 | 19 | 0.77 | 0.76 | 1.41 |

| Osceola County | 1 | 0 | 0 | 0.31 | 0.00 | 0.00 |

| Palm Beach County | 37 | 31 | 18 | 2.59 | 2.13 | 1.22 |

| Pasco County | 7 | 6 | 4 | 1.41 | 1.18 | 0.76 |

| Pinellas County | 14 | 13 | 16 | 1.47 | 1.35 | 1.65 |

| Polk County | 18 | 11 | 13 | 2.77 | 1.65 | 1.89 |

| Putnam County | 2 | 0 | 1 | 2.78 | 0.00 | 1.36 |

| Santa Rosa County | 1 | 0 | 2 | 0.60 | 0.00 | 1.15 |

| Sarasota County | 6 | 11 | 4 | 1.48 | 2.66 | 0.95 |

| Seminole County | 3 | 5 | 5 | 0.67 | 1.10 | 1.08 |

| St. Johns County | 2 | 1 | 4 | 0.88 | 0.43 | 1.64 |

| St. Lucie County | 3 | 3 | 4 | 1.01 | 0.98 | 1.28 |

| Sumter County | 2 | 0 | 0 | 1.71 | 0.00 | 0.00 |

| Suwannee County | 2 | 2 | 3 | 4.58 | 4.56 | 6.79 |

| Taylor County | 0 | 1 | 1 | 0.00 | 4.52 | 4.58 |

| Union County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Volusia County | 8 | 12 | 9 | 1.55 | 2.27 | 1.67 |

| Wakulla County | 0 | 0 | 1 | 0.00 | 0.00 | 3.11 |

| Walton County | 1 | 2 | 3 | 1.59 | 3.06 | 4.39 |

| Washington County | 0 | 0 | 1 | 0.00 | 0.00 | 4.07 |

Here are the facts about teen (18 years old and under) DUIs in Florida in 2016:

Below are the facts concerning underage (under 21 years old) drinking-related fatalities:

If you’re injured in a car accident and need medical attention, the response time of Emergency Medical Services (EMS) could make the difference between life and death. Below are the average response times for rural areas of Florida between 2015-2017:

| Time (in minutes) | 2015 | Percent | 2016 | Percent | 2017 | Percent |

|---|---|---|---|---|---|---|

| 0 to 10 | 8 | 72.70% | 6 | 54.50% | 0 | 0% |

| 11 to 20 | 1 | 9.10% | 3 | 27.30% | 0 | 0% |

| 31 to 40 | 1 | 9.10% | 1 | 9.10% | 0 | 0% |

| 41 to 50 | 0 | 0% | 1 | 9.10% | 0 | 0% |

| 61 to 120 | 1 | 9.10% | 0 | 0% | 0 | 0% |

| Total | 11 | 100% | 11 | 100% | 0 | 0% |

And here are the EMS response times in urban areas over the same three-year period:

| Time (in minutes) | 2015 | Percent | 2016 | Percent | 2017 | Percent |

|---|---|---|---|---|---|---|

| 0 to 10 | 23 | 100% | 25 | 96.20% | 0 | 0% |

| 11 to 20 | 0 | 0% | 1 | 3.80% | 0 | 0% |

| 31 to 40 | 0 | 0% | 0 | 0% | 1 | 100% |

| Total | 23 | 100% | 26 | 100% | 1 | 100% |

Check out these facts about car ownership, commute time, commuter transportation, and traffic congestion in Florida.

Like most of the United States, the average household in Florida has two cars. Unlike the rest of the country, the second largest group is one-car households, followed by those that own three cars. Generally, in the U.S., those last two statistics are reversed.

The average commute time is 25.8 minutes, which is a little longer than the national average of 25.3 minutes. Just over two percent of Florida have a super-commute of 90+ minutes.

Commute times can in fact affect your rates, as can other factors.

In 2016, the top three transportation methods and situations were as follows:

Miami ranks 14th for most traffic congestion — out of all cities in the world! It ranks fifth out of 297 US cities and a fifth out of 319 North American cities. If you’re considering moving to Miami, you may want to keep these traffic stats in mind.

Below is a chart showing how much time commuters spend in traffic in Florida’s five most congested cities, including Miami.

| City | Hours Spent in Traffic | Peak (Time in Traffic) | Daytime (Time in Traffic) | Overall (Time in Traffic) |

|---|---|---|---|---|

| Miami | 64 | 13% | 7% | 9% |

| Orlando | 34 | 11% | 6% | 7% |

| Tampa | 28 | 13% | 5% | 7% |

| Clearwater | 21 | 9% | 5% | 6% |

| Jacksonville | 21 | 9% | 4% | 6% |

Now that you’re loaded with all the facts about driving in Florida, you should be confident in knowing the rules of the road, insurance requirements, and more.

Don’t forget: If you want to drive as a Florida resident, you need insurance! Enter your ZIP code below to get a free quote comparison. You might be surprised by how much you could save by switching insurance providers.

Auto Insurance Company Reviews / Auto Insurance Laws