8:00 - 17:00

Opening Hour: Mon - Fri

| Summary | State Farm Stats | Allstate Stats |

|---|---|---|

| Year Founded | 1922 | 1931 |

| Current Executives | Michael L. Tipsord Chairman, President, and CEO | Tom Wilson, CEO Steven E. Shebik, CEO |

| Numbers of Employees | 58,000 | 42,900 |

| Total Revenue and Total Assets | Total Revenue: $81.7 billion Total Assets: $159.9 billion | Total Revenue: $38.5 billion Total Assets: $112.4 billion |

| Headquarters Address | State Farm Insurance One State Farm Plaza Bloomington, IL 61710 | 2755 Sanders Road, Northbrook, IL 60062 |

| Phone Number | 800-STATE-FARM (800-782-8332) | (847) 402-5000 |

| Company Website | https://www.statefarm.com | https://www.allstate.com |

| Premiums Written | $65,868,839 | $33,251,176 |

| Loss Ratio | 0.62 | 0.59 |

| Best For | Property and Casualty Insurance Life and Health Annuities Mutual Funds Banking Products | Discounts |

As you get closer to choosing a car insurance provider, you may be searching for reassurance before you contact them. If you’re leaning toward State Farm or Allstate, you’ll need to know some general information before you make your final decision.

Both companies earn millions of dollars each year from new policies and pay out millions in filed claims. They essentially have the same services, so what’s so different about them? Do both companies have affordable premiums and discounts? Are State Farm and Allstate available in all 50 states?

Find those answers and more in this comparison of State Farm and Allstate. If you want to go right into the quote process, enter your ZIP code in the free auto insurance comparison box above.

For more information on State Farm and Allstate, continue through this review.

Table of Contents

Car insurance premiums can make all the difference in decision-making. Many potential customers are searching for a car insurance premium that’s cost-efficient to their overall cost of living.

As you’ve seen with most of our guides, we report the annual premiums (or rates) of different companies. For this review, we’ll talk strictly about State Farm and Allstate.

In this section, we’ll cover State Farm and Allstate’s market share, loss ratio, and direct premiums written. We’ll also include the factors that determine car insurance premiums and the average annual premiums based on those factors, such as commute mileage, credit history, driving recording, and demographics.

Car insurance premiums vary depending on the state in which you live. As we mentioned before, State Farm and Allstate are available in all 50 U.S. states.

Therefore, we’ve provided the average annual premiums of each state, and we’ll compare the average annual premiums from both companies to each state average.

| State | Average by State | State Farm Annual Premiums | Allstate Annual Premiums |

|---|---|---|---|

| Alaska | $3,422 | $2,228 | $3,145 |

| Alabama | $3,567 | $4,798 | $3,312 |

| Arkansas | $4,125 | $2,789 | $5,150 |

| Arizona | $3,771 | $4,756 | $4,904 |

| California | $3,689 | $4,202 | $4,533 |

| Colorado | $3,876 | $3,271 | $5,537 |

| Connecticut | $4,619 | $2,976 | $5,832 |

| District of Columbia | $4,439 | $4,074 | $6,469 |

| Delaware | $5,986 | $4,467 | $6,316 |

| Florida | $4,680 | $3,398 | $7,440 |

| Georgia | $4,967 | $3,385 | $4,211 |

| Hawaii | $2,556 | $1,040 | $2,173 |

| Iowa | $2,981 | $2,225 | $2,966 |

| Idaho | $2,979 | $1,868 | $4,089 |

| Illinois | $3,305 | $2,345 | $5,204 |

| Indiana | $3,415 | $2,409 | $3,979 |

| Kansas | $3,280 | $2,720 | $4,010 |

| Kentucky | $5,195 | $3,354 | $7,144 |

| Louisiana | $5,711 | $4,579 | $5,999 |

| Maine | $2,953 | $2,199 | $3,676 |

| Maryland | $4,583 | $3,961 | $5,233 |

| Massachusetts | $2,679 | $1,362 | $2,709 |

| Michigan | $10,499 | $12,566 | $22,903 |

| Minnesota | $4,403 | $2,067 | $4,532 |

| Missouri | $3,329 | $2,693 | $4,096 |

| Mississippi | $3,665 | $2,980 | $4,942 |

| Montana | $3,221 | $2,418 | $4,672 |

| North Carolina | $3,393 | $3,079 | $7,190 |

| North Dakota | $4,166 | $2,561 | $4,669 |

| Nebraska | $3,284 | $2,439 | $3,199 |

| New Hampshire | $3,152 | $2,185 | $2,725 |

| New Jersey | $5,515 | $7,527 | $5,714 |

| New Mexico | $3,464 | $2,341 | $4,201 |

| Nevada | $4,862 | $5,796 | $5,372 |

| New York | $4,290 | $4,485 | $4,741 |

| Ohio | $2,710 | $2,508 | $3,197 |

| Oklahoma | $4,142 | $2,817 | $3,719 |

| Oregon | $3,468 | $2,731 | $4,766 |

| Pennsylvania | $4,035 | $2,744 | $3,984 |

| Rhode Island | $5,003 | $2,407 | $4,959 |

| South Carolina | $3,781 | $3,071 | $3,903 |

| South Dakota | $3,982 | $2,306 | $4,724 |

| Tennessee | $3,661 | $2,639 | $4,829 |

| Texas | $4,043 | $2,880 | $5,485 |

| Utah | $3,612 | $4,646 | $3,566 |

| Virginia | $2,358 | $2,269 | $3,387 |

| Vermont | $3,234 | $4,383 | $3,190 |

| Washington | $3,059 | $2,500 | $3,541 |

| West Virginia | $2,595 | $2,126 | $3,821 |

| Wisconsin | $3,606 | $2,388 | $4,854 |

| Wyoming | $3,200 | $2,304 | $4,374 |

| Median | $3,661 | $2,731 | $4,533 |

Based on the state average, the three cheapest car insurance premiums are in Virginia, Hawaii, and West Virginia. However, the cheapest State Farm premiums are in Hawaii, Massachusetts, and Idaho. Allstate’s top three cheapest states are Hawaii, Massachusetts, and New Hampshire.

Michigan is the most expensive state for car insurance with average annual premiums over $10,000. Overall, State Farm’s average annual premiums are cheaper than the state averages and Allstate’s averages.

Let’s talk about what market share, loss ratio, and direct premiums written means. All three are factors in how car insurance authorities can determine the financial strength of a company.

Market share is the percent of a particular industry, such as car insurance. The loss ratio is the calculation of money earned versus money paid out in filed claims.

In other words, the loss ratio for car insurance companies refers to the amount of money earned from premiums and money paid out from filed claims.

For example, a car insurance company with a loss ratio of 67.23 spends $67.23 for every $100 they earn from premiums. Loss ratios that are too high show a car insurance company that’s spending more on claims than premiums being earned.

Loss ratios that are too low show a company’s lack of paying out filed claims to policyholders.

Direct premiums written is the total dollar amount of premiums written at a company before policyholders renew their policies. Therefore, the direct premiums written increase when there are new policies written for a company.

With this information in mind, what are the projections for State Farm and Allstate? The information provided below shows the market share, loss, and direct premiums written from State Farm and Allstate in a four-year trend.

| Year | Company | Market Share | Loss Ratio | Direct Premium Written |

|---|---|---|---|---|

| 2015 | State Farm | 18.68 | 66.1 | $35,588,209,000 |

| 2016 | State Farm | 18.26 | 77.02 | $39,194,660,000 |

| 2017 | State Farm | 18.07 | 68.79 | $41,817,416,000 |

| 2018 | State Farm | 17.01 | 63 | $41,963,578,000 |

State Farm earned over $35 billion in direct premiums written in 2015 and progressively earned more within the four-year trend. However, State Farm’s market share decreased gradually.

The largest decrease in market share was in 2018. State Farm managed to keep a steady loss ratio, taking caution not to spend more than they earn.

What about Allstate’s projections? Let’s take a look at Allstate’s market share, loss ratio, and direct premiums written.

| Year | Company | Market Share | Loss Ratio | Direct Premium Written |

|---|---|---|---|---|

| 2015 | Allstate | 9.97 | 65.02 | $19,000,663,000 |

| 2016 | Allstate | 9.7 | 64.75 | $20,813,858,000 |

| 2017 | Allstate | 9.26 | 59.51 | $21,430,405,000 |

| 2018 | Allstate | 9.19 | 56 | $22,663,214,000 |

Allstate’s market share is nearly half of State Farm’s market share. Despite its market share, Allstate’s direct premiums written have increased from $19 billion to $22.6 billion over a four-year trend.

This number is from the total amount of direct premiums written. Allstate has a decrease in loss ratio, which means they paid out less in filed claims over a four-year trend.

Whenever a potential customer is getting a quote from a car insurance provider, there will be a few questions the provider will want the future policyholder to answer.

One of those questions during the process is the customer’s age, gender, and marital status. These demographics will determine the cost of the policy they want to enroll in.

Why are age, gender, and marital status important to car insurance companies?

Car insurance providers correlate gender with risk due to statistics that show male drivers as frequent risk-takers when operating a motor vehicle. Therefore, car insurance premiums are more expensive for male drivers than female drivers.

As of August 2019, car insurance premiums based on gender have been banned in California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan.

What are State Farm and Allstate’s average annual premiums based on age, gender, and marital status? This summarized data will show the cost of car insurance based on age, gender, and marital status from State Farm and Allstate.

| Demographics | Base Average Annual Premiums | State Farm Annual Premiums based on Demographics | Allstate Annual Premiums based on Demographics |

|---|---|---|---|

| Single 17-year-old female | $7,559 | $5,954 | $9,282 |

| Single 17-year-old male | $9,028 | $7,324 | $10,643 |

| Single 25-year-old female | $2,703 | $2,336 | $3,425 |

| Single 25-year-old male | $2,889 | $2,555 | $3,571 |

| Married 35-year-old female | $2,449 | $2,082 | $3,156 |

| Married 35-year-old male | $2,446 | $2,082 | $3,123 |

| Married 60-year-old female | $2,243 | $1,874 | $2,913 |

| Married 60-year-old male | $2,308 | $1,874 | $2,991 |

State Farm continues to be the cheapest car insurance company when comparing average annual premiums. Policies for teen drivers are at least $3,000 less for State Farm policyholders, while Allstate teen policies are much more expensive.

The cheapest car insurance premiums available based on age, gender, and marital status are married drivers who are 60 years and older.

Discounts can make a big difference in average annual premiums, so a potential customer will have to ask an agent how they are eligible for each discount. Premiums based on the demographics, however, fall in State Farm’s favor.

Car insurance companies will want to know your credit history and your car insurance history. Credit history, of course, is your credit score, which car insurance companies will check for whenever you’re in a closer stage of obtaining a policy with a car insurance company.

Car insurance providers and credit experts agree there’s a correlation between credit history and risk. Therefore, potential customers and policyholders may end up paying more for car insurance premiums per year based on their credit history.

Car insurance providers will also want to know your credit history as a policyholder for other car insurance companies. Both of these factors determine the financial ability to pay a company’s premium.

How much are State Farm and Allstate’s annual premiums based on credit history? Here is the data summary of the cost of insurance based on credit history.

| Company | Poor | Fair | Good |

|---|---|---|---|

| State Farm | $4,951 | $2,853 | $2,174 |

| Allstate | $6,491 | $4,581 | $3,860 |

Car insurance premiums are the most expensive if a policyholder has poor credit. Remember, poor credit is associated with high risk while fair and good credit is associated with lower risk.

Although State Farm and Allstate premiums have decreasing premiums for better credit scores and credit history, State Farm is the cheaper of the two companies.

Another question car insurance providers ask is how many miles you’re estimated to drive. They’ll ask what the vehicle you’re insuring is used for.

If it’s a vehicle that you use to commute to work, school, or general commuting, then car insurance companies may increase the premiums.

Some car insurance companies may issue the same car insurance premium regardless of the miles you’re estimated to drive during the policy year.

Do State Farm and Allstate issue car insurance premiums based on commute mileage? If so, do they increase premiums based on commute mileage? Here’s another table that describes the car insurance premiums from State Farm and Allstate.

| Company | 10 miles commute. 6,000 annual mileage. | 25 miles commute. 12,000 annual mileage. |

|---|---|---|

| State Farm | $3,176 | $3,344 |

| Allstate | $4,842 | $4,934 |

Both State Farm and Allstate increase their premiums based on whether commute mileage is higher or lower for the duration of the policy.

Allstate’s premiums based on commute mileage are more expensive than State Farm’s premiums. State Farm policyholders who are estimated to drive fewer than 7,500 miles will receive up to a 30 percent discount.

Coverage level depends on the liability coverage rules offered by a car insurance company. Every U.S. state has a coverage level that’s composed of coverage limits, often referred to as coverage rules.

Coverage limits are the maximum amount of money car insurance companies will cover in case a policyholder is in an accident, and coverage rules is an abbreviated view of coverage limits.

For example, let’s say a state whose minimum liability coverage is $15,000 for bodily injury of one person per accident, $30,000 for bodily injury of multiple people per accident, and $25,000 for property damage per accident.

These coverages are minimum coverage limits according to the law of that particular state. To abbreviate the limits, car insurance will list them as coverage rules. For the sake of the example, the coverage rule would be 15/30/25.

If a policyholder doesn’t think the state’s minimum coverage requirements are enough, they can ask the insurance company for a higher coverage limit, which would change the coverage rule and increase the total of the annual premium.

An example of higher coverage rules is 50/100/50 (often associated with medium coverage) and 100/300/100 (often associated with high coverage).

Consult a car insurance agent about the medium and high coverage rules in your state. Coverage limits and rules are particularly important for states with low coverage limits and medium and high coverage levels may be recommended for adequate car insurance coverage.

So how much are policyholders expected to spend on premiums based on coverage level? Let’s take a look at average annual premiums from State Farm and Allstate.

| Company | Low | Medium | High |

|---|---|---|---|

| State Farm | $3,055 | $3,270 | $3,455 |

| Allstate | $4,628 | $4,897 | $5,139 |

See how the premiums increase as the coverage level gets higher? Higher coverage limits require more money for premiums. Allstate continues to be the more expensive car insurance provider of the two companies.

One of the main factors of car insurance is one’s driving record. Car insurance companies will give policyholders a discount if they have a clean driving record. However, a driving record with accidents or DUI convictions could increase car insurance premiums. Sometimes they can double.

Car insurance companies want to prepare for the risk, so their car insurance premiums are justified due to a policyholder’s driving record.

Too many accidents, DUI convictions, or traffic violations can place a policyholder in the high-risk pool. Some car insurance companies will issue higher premiums for accidents than DUI convictions, while some car insurance companies won’t increase premiums for traffic violations such as speeding tickets.

Motorists in the high-risk pool will have limited options to acquire car insurance and will need the help of their state department of motor vehicles to get insurance.

How do car insurance premiums look for State Farm and Allstate regarding driving records? Let’s examine the number of annual premiums.

| Company | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| State Farm | $2,821 | $3,186 | $3,396 | $3,637 |

| Allstate | $3,820 | $4,484 | $4,988 | $6,261 |

State Farm’s annual premiums do increase but not over $1,000. However, Allstate premiums can increase over $2,000, depending on the driving record offense.

Speeding violations have the cheapest increase, but multiple violations can greatly increase your car insurance premiums. Accidents and DUI convictions are the costliest, especially for Allstate policyholders.

Multiple accidents, convictions, and violations could terminate your car insurance policy.

Some coverages are required for a motorist to have. Our guides often refer to them as core coverages. However, some coverages are required that some drivers may not be aware of, and some coverages are part of policies.

This section will explore car insurance core coverages. In addition to required car insurance coverage, we’ll examine other coverages offered at State Farm and Allstate.

Liability coverage is required for all motorists in the United States. Each state has its requirements for drivers regarding how much car insurance they must have in case they get in an accident.

Liability coverage pays any medical costs or property damage costs for a no-fault driver. However, the at-fault driver’s policy must have coverage limits that will cover the total cost of damages and injuries.

Collision coverage is another core coverage that pays for property damage whether it be a vehicle or other personal property regardless of who is at fault.

Comprehensive coverage pays for accidental damage that doesn’t involve a collision such as vehicle theft, vandalism, fire, colliding with an animal, storm damage, or any other damage outside the driver’s control.

Loan and leasing companies will insist that their customers enroll in full coverage. Full coverage is a combination of liability, collision, and comprehensive coverage. It’s much more expensive, but it will cover all bases of coverage. Having full coverage can also protect the total cost of damage just in case a new model vehicle is at a total loss.

State Farm and Allstate have all three of these core coverages. The premiums listed above represent the total annual cost of car insurance. Therefore, when you get your policy, it’s likely that these three coverages will be part of it.

The answer is yes. In some U.S. states, additional liability is required and is part of the liability requirements for insurance.

Uninsured motorist coverage and underinsured motorist coverage are required in most states. Uninsured motorist coverage pays for bodily injury in the event of an accident where the injured party is a victim of a hit-and-run, the at-fault driver has no liability insurance, or an insurance company denies coverage of bodily injury costs.

However, underinsured motorist coverage protects a policyholder when an at-fault driver has a coverage limit that won’t cover the total cost of bodily injury or property damage.

In addition to uninsured and underinsured motorist coverage, State Farm and Allstate have other coverages like personal injury protection (PIP) insurance and medical payments (MedPay) are considered additional liability insurance coverages.

To better understand the differences and similarities of PIP and MedPay, watch this short video that explains how PIP and MedPay work in car insurance.

State Farm and Allstate both offer emergency roadside assistance and rideshare driver coverage. Emergency roadside assistance coverage will add more cost to your annual premiums, but it’s helpful in case you run out of gas, blow a tire, or if you need a boost for your car battery.

Also, if your car won’t start, emergency roadside assistance can have the vehicle towed to your home or an auto repair shop.

Since more drivers are using their vehicles to rideshare, car insurance companies such as State Farm and Allstate have created specialized insurance options for motorists who are part of a transportation network company (TNC).

Allstate’s rideshare coverage program is called Allstate Ride For Hire®. State Farm and Allstate alert rideshare drivers who work for a TNC that there may some gaps in TNC coverage and motorists may have to pay expensive deductibles.

With rideshare insurance coverage, car insurance companies like State Farm and Allstate lower the deductibles.

Unfortunately, rideshare coverage is not available in all 50 states. Talk to a car insurance agent about rideshare coverage to be sure. In addition to rideshare coverage, the motorist’s policy will also go into effect.

Here are a few other coverages that State Farm and Allstate share:

There are car insurance coverages that each company has that the other one doesn’t. For instance, State Farm’s rental reimbursement pays for car rental fees that you may pay for while your car is being repaired.

If you are at least 50 miles away from your home, State Farm will pay for travel expenses such as meals, lodging, and transportation if your vehicle is disabled. Collision and comprehensive coverage are required for this coverage to take effect.

State Farm doesn’t have sound system insurance like Allstate does. Sound system coverage pays for the cost of stolen or damaged audio or video equipment in the policyholder’s vehicle. This particularly useful in case the policyholder has an expensive deductible.

Innovation has made it easier to track the driving habits of motorists. Car insurance companies are willing to offer discounts to policyholders who practice safe driving habits on the road. Usage-based insurance is divided into two categories: pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD).

PAYD determines the premium cost and is based on a policyholder’s use of the car or the mileage they drive.

The fewer miles you drive, the cheaper the premium. PHYD, on the other hand, tracks how a policyholder drives, which includes patterns of risky driving, hard-braking events, and speeding. PHYD is often coupled with telemetrics to accurately measure a driver’s habits.

Telemetrics connect to smartphone apps to reflect the driving habits of the driver. This information is recorded for car insurance providers so they may determine your driving performance and see if you are eligible for discounts.

State Farm has a PHYD method to give policyholders discounts, but they don’t have PAYD. State Farm’s PHYD program is called Drive Safe and Save™. Policyholders can access this service by signing in to the Drive Safe and Save™ Mobile App using their State Farm online account information.

Allstate, however, has a PAYD and PHYD method of usage-based car insurance. Allstate’s PAYD insurance is called Milewise®. Allstate policyholders pay as low as $2.22 per day.

Policyholders who are enrolled in Milewise® use a device (telemetric) sent from Allstate to capture the number of miles driven. Once plugged into the vehicle, policyholders use the Allstate® Mobile App to monitor driving and spending.

Allstate’s PHYD program is called Drivewise®.

This program allows policyholders to earn discounts when they drive at safe speeds, limit late-night commutes, and limit hard-braking events. Allstate uses this information in their best drivers report, which you may have seen in our city insurance guides.

Determining which car insurance company is best for you will depend on your needs. If cost-efficient car insurance premiums are what you need, go with the company with cheaper premiums.

If you need something unique, go with a car insurance provider with more options. This comparison and contrast guide is here to give you the facts on what State Farm and Allstate provide regarding car insurance premiums, coverages, and customer reviews.

From what you’ve seen, State Farm is best for cheaper premiums per year. Although Allstate is more expensive, their complaint ratio is much less than State Farm’s.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

If you haven’t seen our car insurance guides or company review articles, we share the analysis of financial strength agencies and credit rating agencies to show the performance of a car insurance provider.

These agencies release reports annually to keep policyholders, potential customers, researchers, and other interested parties informed on the overall grade and performance of companies.

Let’s examine the performance of State Farm and Allstate from the perspectives of the top financial strength agencies and credit rating agencies, which are A.M. Best, Moody’s, and Standard & Poor’s Global (S&P).

| Agency | State Farm Ratings | Allstate Ratings |

|---|---|---|

| A.M. Best | A++ | A++ |

| Better Business Bureau | A+ | A+ |

| Moody's | Aa1 | Aa3 |

| S&P | AA | A |

| J.D. Power | 3 out of 5 | 3 out of 5 |

State Farm and Allstate have an A++ financial strength rating (FSR), which is the highest rating in the A.M. Best FSR results. Both companies rate as A+ or excellent with the Better Business Bureau (BBB).

According to Moody’s rating scale, State Farm and Allstate show high quality and are subject to very low credit risk. State Farm appears to be slightly better based on the ratings.

S&P Global says State Farm has a very strong capacity to meet financial commitments (AA rating). Allstate has a strong capacity to meet financial commitments (A rating) but is somewhat susceptible to adverse economic conditions and changes in circumstances.

In 2019, J.D. Power listed State Farm and Allstate as about average when rated under their Power Circle Ratings. All ratings are considered to be an excellent grade and stable rating from other agencies.

However, State Farm appears to have better grades and ratings. Although both companies have made their stake as one of the largest and most successful car insurance providers in the United States, State Farm has better overall ratings than Allstate.

Many potential customers look at a company’s review before they make their final decision. For this section, we’ll explore overall customer reviews of State Farm and Allstate and compare which company has better reviews.

Car insurance providers have created innovative ways to get information to their policyholders. How do customers feel about their insurance provider? Let’s examine the total reviews and ratings of mobile apps.

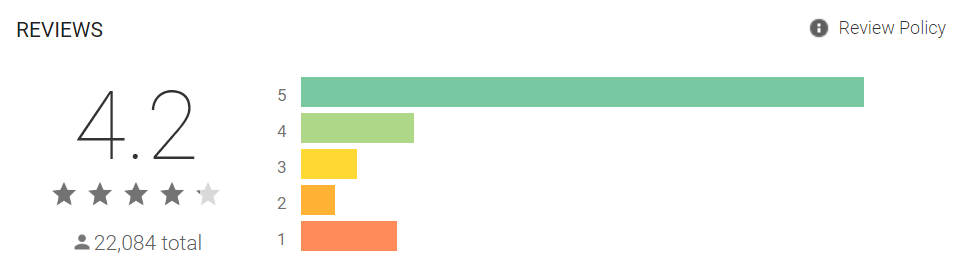

Over 22,000 people reviewed State Farm through the Google Play Store. The State Farm app is classified as a finance mobile app, which further indicates how policyholders can use the app.

This is a more detailed look at how customers rated State Farm’s mobile app. The majority of State Farm® Mobile App users gave State Farm a five-star rating.

Let’s see Allstate’s customer review in the Google Play Store.

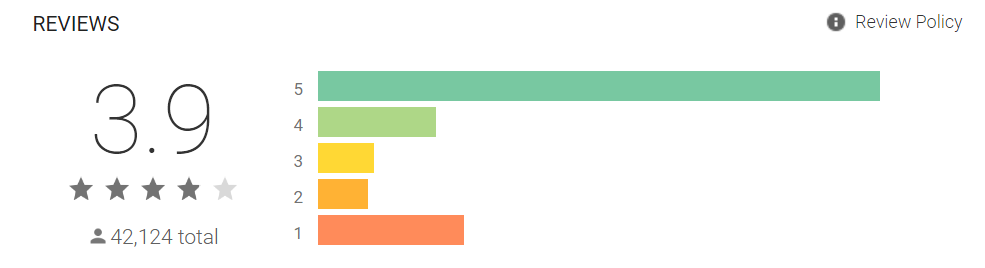

Google Play members gave the Allstate® Mobile App a four-star rating based on 42,124 reviews.

State Farm is rated at 4.2 stars while Allstate is rated 3.9 stars. However, more policyholders have reviewed Allstate’s mobile app service than State Farm’s mobile app service.

Ratings could be associated with usability, the ease of making a claim, and simple payment arrangements. Also, ratings are subject to change depending on the rating from the customer and the number of customers that respond.

Earlier, we showed a composite rating from J.D. Power. Did you know that J.D. Power reports customer satisfaction reviews of different regions of the country? We’ll use this section to report the latest results in a data table and summary.

Before we show you the figures, here’s an explanation of what some of the values mean.

The research placed in a report is called the Overall Customer Satisfaction Index Ranking. The rankings are measured on a 1,000 point scale and J.D. Power’s Power Circle Ratings, which are measured from:

We’ll focus on State Farm and Allstate’s overall customer satisfaction results from each region. Here are the rankings and ratings.

| Region | State Farm Overall Customer Satisfaction Ranking (Out Of 1,000) | State Farm J.D. Power Circle Rating | Allstate Overall Customer Satisfaction Ranking (Out Of 1,000) | Allstate J.D. Power Circle Rating |

|---|---|---|---|---|

| California | 824 | oooo | 808 | ooo |

| Central | 828 | ooo | 844 | oooo |

| Florida | 834 | ooo | 847 | ooooo |

| Mid-Atlantic | 834 | ooo | 816 | oo |

| New England | 844 | oooo | 830 | oooo |

| New York | 845 | oooo | 831 | ooo |

| North Central | 841 | oooo | 822 | ooo |

| Northwest | 820 | ooo | 816 | ooo |

| Southeast | 853 | oooo | 813 | oo |

| Southwest | 831 | ooooo | 826 | ooo |

| Texas | 835 | ooo | 836 | ooo |

State Farm’s overall customer satisfaction ranking doesn’t drop below 820, while Allstate’s ranking has dropped as low as 808. Also, State Farm’s Power Circle Ratings are all about average and above.

Overall, State Farm’s customer satisfaction and rating are slightly better than Allstate’s.

The National Association of Insurance Commissioners (NAIC) reports the ratio of complaints each year in a complaint index.

The NAIC Complaint Index shows policyholders and potential customers the complaints of car insurance companies made within a year and describes them in ratios. The lower the ratio, the happier policyholders are with a car insurance company.

In the introductory table, we listed State Farm’s complaint ratio as 0.62 and Allstate’s complaint ratio is 0.59. Although State Farm has a higher rating than Allstate, Allstate has a lower complaint ratio.

State Farm and Allstate are available in all 50 states. Each company has several discounts available to potential customers, new policyholders, and policyholders who have renewed their previous policies.

Here’s a list of discounts that are available for policyholders at State Farm and Allstate.

| Discount Summary | State Farm Discounts (% Saved) | Allstate Discounts (% Saved) |

|---|---|---|

| Anti-lock Brakes | 5 | 10 |

| Anti-Theft | 15 (discount with comprehensive coverage, higher discount with "engine cut off") | 10 |

| Claim Free | 15 (must have State Farm for at least three years) | 35 |

| Daytime Running Lights | - | 2 |

| Defensive Driver | 5 | 10 |

| Distant Student | - | 35 |

| Driver's Ed | 15 | 10 |

| Driving Device/App | 50 (Drive Safe & Save; 5% for each vehicle; Up to 50% off based on driving history after three months) | 20 (20% cash back) |

| Early Signing | - | 10 |

| Electronic Stability Control | - | 2 |

| Farm Vehicle | - | 10 |

| Full Payment | - | 10 |

| Good Student | 25 (savings last until the age of 25) | 20 |

| Green Vehicle | - | 10 |

| Homeowner | 3 | - |

| Low Mileage | 30 (must have proof of estimated commute mileage under 7,500) | - |

| Multiple Policies | 17 (includes Life, Renters, Home, Condo in combination with Auto insurance) | 10 |

| Multiple Vehicles | 20 | - |

| Newer Vehicle | 40 (40% off PIP and MedPay coverage for vehicle models of '94 or later) | 30 |

| On Time Payments | - | 5 |

| Paperless Documents | - | 10 |

| Paperless/Auto Billing | $2 ($2 off per month with automatic payment | 5 |

| Passive Restraint | 40 (40% off PIP or MedPay coverage for vehicle models '93 or newer) | 30 |

| Safe Driver | 15 (same qualifications as "Claim Free" discount; Only applies to new customers with who hasn't had an accident in three years, discount at 15%). | 45 |

| Senior Driver | - | 10 |

| Utility Vehicle | - | 15 |

| Vehicle Recovery | 5 | 10 |

Some State Farm discounts are up to 50 percent off. However, some conditions have to be met for you to receive the discount.

Allstate, on the other hand, doesn’t have many conditions needed to receive a discount, but clarify with an Allstate agent just in case something has changed as you pay month to month.

Customer feedback is a sign of whether customers are happy with their car insurance company. Reviews that are too positive may draw some concern. No company has 100 percent satisfactory reviews. It’s possible but unlikely.

Both State Farm and Allstate have good reviews, which is one of the reasons why they continue to earn profits and new premiums each year.

Average annual premiums between State Farm and Allstate show a major disparity. State Farm premiums are much cheaper than Allstate. Some premiums for Allstate were as high as $2,000 more than State Farm’s premiums.

As far as coverage is concerned, that’s a matter of which state you live in. Car insurance coverage varies by state, and it can be murky for policyholders who move from one state to another.

State Farm and Allstate offer the essential coverages, but they differ for travel expense insurance as it relates to motor vehicles, usage-based PAYD insurance, and sound-system insurance.

An advantage Allstate has over State Farm is accident forgiveness. Allstate gives policyholders accident forgiveness when they enroll in a policy, but State Farm requires a policyholder to be with State Farm for nine years to be eligible for accident forgiveness.

As we conclude the company review, was there something we missed in the guide? Would you like to see a closer look at what you would pay for car insurance? Use the free auto insurance comparison tool below by entering your ZIP code in the dialog box.

Auto Insurance Company Reviews / Cheap Auto Insurance