8:00 - 17:00

Opening Hour: Mon - Fri

Affordable rates, strong auto insurance policy options, and reliable customer service.

Ask any driver, and they’ll agree — when it comes to their car insurance provider, quality matters. However, for drivers looking to choose between Geico and Progressive, the second and third largest private passenger auto insurers in the United States, the decision may not appear to be so simple.

Determining whether Geico or Progressive has the upper hand in your book will require a point-by-point comparison — one we’re providing in this in-depth guide.

Whether it’s cheap rates, discounts, online options, solutions for poor credit, or financial ratings, we’re leaving no stone unturned. Making the best decision for your car insurance needs is as easy as sticking with us.

You can also begin exploring rates by entering your ZIP code into our free car insurance comparison tool.

Table of Contents

| Geico | Progressive |

|---|---|

| Founded in 1936 | Founded in 1937 |

| Headquarters in Chevy Chase, Maryland | Headquarters in Mayfield Village, Ohio |

| Available in all 50 states | Available in all 50 states |

| $33,075,434,000 in Direct Premiums Written | $27,058,768,000 in Direct Premiums Written |

| 13.41% Market Share (#2 in the Market) | 10.97% Market Share (#3 in the Market) |

Between Geico and Progressive, drivers are faced with two extremely successful, highly profitable, and culturally iconic (think Geico’s “gecko” or Progressive’s “Flo”) providers.

First, there’s Geico. Originally founded in 1936 as the Government Employees Insurance Company, the insurer was initially geared toward federal employees and certain members of the military. Fast forward to present times, and the insurer has grown tremendously, claiming to have issued its 17 millionth policy in early 2019.

And then, there’s Progressive. Founded in 1937 as the Progressive Mutual Insurance Company, the provider boasts several firsts, including being the first car insurance company to have a website that allowed customers to purchase policies online. Today, Progressive says it has more than 20 million policies in place and continues to expand in its offerings.

What Geico and Progressive have in common are aggressive marketing and advertising campaigns. Both are among the biggest advertisers in the space, with budgets in the billions. In other words, they’re after customers. So, which car insurance provider is a driver to choose?

That’s where we come in.

In our comparison of both providers, we’re turning to data purchased through Quadrant Information Services. These figures represent the actual cost of car insurance coverage bought by drivers throughout the United States, factoring everyone from high-risk drivers to those buying basic coverages, those with poor credit, and beyond.

It’s simple — where you live can have a tremendous impact on what you pay in premiums. When looking at rates from state to state, several factors come into play. According to the Insurance Information Institute (III), this can include a state’s rate-setting policies, weather trends, or the frequency of insurance fraud or lawsuits.

In comparing Geico and Progressive at the state level, we’re examining a total of 48 locations:

Here’s a breakdown of average rates by state:

| State | Geico | Progressive |

|---|---|---|

| Alabama | $2,866.60 | $4,450.52 |

| Alaska | $2,879.96 | $3,062.85 |

| Arizona | $2,264.71 | $3,577.50 |

| Arkansas | $3,484.63 | $5,312.09 |

| California | $2,885.65 | $2,849.67 |

| Colorado | $3,091.69 | $4,231.92 |

| Connecticut | $3,073.66 | $4,920.35 |

| Delaware | $3,727.29 | $4,181.83 |

| District of Columbia | $3,692.81 | $4,970.26 |

| Florida | $3,783.63 | $5,583.30 |

| Georgia | $2,977.20 | $4,499.22 |

| Hawaii | $3,358.86 | $2,177.93 |

| Idaho | $2,770.68 | Data Not Available |

| Illinois | $2,779.16 | $3,536.65 |

| Indiana | $2,261.07 | $3,898.00 |

| Iowa | $2,296.16 | $2,395.50 |

| Kansas | $3,220.65 | $4,144.38 |

| Kentucky | $4,633.59 | $5,547.63 |

| Louisiana | $6,154.60 | $7,471.10 |

| Maine | $2,823.05 | $3,643.59 |

| Maryland | $3,832.63 | $4,094.86 |

| Massachusetts | $1,510.17 | $3,835.11 |

| Michigan | $6,430.11 | $5,364.55 |

| Minnesota | $3,498.54 | Data Not Available |

| Mississippi | $4,087.21 | $4,308.85 |

| Missouri | $2,885.33 | $3,419.14 |

| Montana | $3,602.35 | $4,330.76 |

| Nebraska | $3,837.49 | $3,758.01 |

| Nevada | $3,662.09 | $4,062.57 |

| New Hampshire | $1,615.02 | $2,694.45 |

| New Jersey | $2,754.94 | $3,972.72 |

| New Mexico | $4,458.30 | $3,119.18 |

| New York | $2,428.24 | $3,771.15 |

| North Carolina | $2,936.69 | $2,382.61 |

| North Dakota | $2,668.24 | $3,623.06 |

| Ohio | $1,867.19 | $3,436.96 |

| Oklahoma | $3,437.34 | $4,832.35 |

| Oregon | $3,220.12 | $3,629.13 |

| Pennsylvania | $2,605.22 | $4,451.00 |

| Rhode Island | $5,602.63 | $5,231.09 |

| South Carolina | $3,178.01 | $4,573.08 |

| South Dakota | $2,940.29 | $3,752.81 |

| Tennessee | $3,283.42 | $3,656.91 |

| Texas | $3,263.28 | $4,664.69 |

| Utah | $2,965.57 | $3,830.10 |

| Vermont | $2,195.71 | $5,217.14 |

| Virginia | $2,061.53 | $2,498.58 |

| Washington | $2,568.65 | $3,209.52 |

| West Virginia | $2,120.80 | Data Not Available |

| Wisconsin | $3,926.20 | $3,128.91 |

| Wyoming | $3,496.56 | $4,401.17 |

In reviewing these figures, here’s what we quickly discovered — when it comes to the lowest overall rates, Geico takes a clear lead over Progressive.

In fact, our analysis revealed:

Geico’s highest average rates are in:

Geico’s lowest average rates are in:

When it comes to Progressive’s state-by-state numbers, we see that Progressive’s highest average rates are in:

Conversely, Progressive’s lowest average rates are in:

Car accidents, speeding tickets, and driving under the influence. They’re all serious infractions that can wreak havoc on your car insurance rates, causing them to increase overnight. Why? Because at the end of the day, car insurance is largely a matter of risk.

As drivers continue to rack up tickets and violations, insurers will consider them to be higher risks and charge them higher rates.

What’s worse, is that as long as these infractions remain on your driving record, these rate hikes can stick with you for years.

Of course, the big question is this — who among Geico and Progressive has the lowest rates for drivers with speeding tickets, accidents, or DUIs?

We found that when it comes to car accidents and speeding tickets, Geico has the lowest average rates, but when it comes to DUIs, Progressive’s rates are lower.

First, let’s talk about speeding tickets. When comparing the average rates between Geico and Progressive, the difference is significant:

| Geico One Speeding Ticket | Progressive One Speeding Ticket |

|---|---|

| $2,645.43 | $4,002.28 |

We can clearly see that drivers who are insured with Progressive and have one speeding ticket are paying, on average, $1,356.85 or 33.9 percent more in rates than those with Geico.

Keep in mind that the surcharge insurers decide to tack on to your annual car insurance premium can vary depending on the nature of your ticket. For instance, someone ticketed for going 10 miles over the speed limit may face a lower increase than a driver ticketed for going 25 miles over the speed limit.

Having a car accident on your record – particularly, if you were found at fault – can also have a tremendous bearing on your bottom line. In terms of annual car insurance rates, we can once more see a significant difference between Geico and Progressive:

| Geico One Car Accident | Progressive One Car Accident |

|---|---|

| $3,192.77 | $4,777.04 |

Drivers with one car accident and who are insured with Progressive are paying $1,584.27 or 33.2 percent more in rates than their counterparts with Geico.

Without a doubt, the impact of having a DUI conviction on your driving record is severe.

A DUI will not only remain on your record for several years, but it will also cause your car insurance rates to skyrocket.

If your insurer is willing to keep you as a customer, you can be certain that your annual car insurance rates will go up exponentially, as you are now considered a high-risk driver.

In this instance, it’s Progressive that has the lower figures:

| Geico One DUI/DWI | Progressive One DUI/DWI |

|---|---|

| $4,875.87 | $3,969.65 |

In the end, Progressive customers with one DUI are paying $906.22 or 22.8 percent less than those insured with Geico.

Male or female, older or younger. Experts say what often determines whether certain drivers pay more is a matter of data.

In terms of gender, the Insurance Institute for Highway Safety (IIHS) reports male drivers as more likely to die in car crashes, as well as engage in riskier driving habits.

And in terms of age, the Centers for Disease Control and Prevention (CDC) reports that car crashes are the leading cause of death among teenagers.

These startling statistics are among the reasons why male drivers and younger drivers tend to pay higher-than-normal rates. But between Geico and Progressive, who has the best rates among these driver groups? Here’s a side-by-side comparison:

| Driver Demographic | GEICO | Progressive |

|---|---|---|

| Single 17-year old female | $5,653.55 | $8,689.95 |

| Single 17-year old male | $6,278.96 | $9,625.49 |

| Single 25-year old female | $2,378.89 | $2,697.73 |

| Single 25-year old male | $2,262.87 | $2,758.66 |

| Married 35-year old female | $2,302.89 | $2,296.90 |

| Married 35-year old male | $2,312.38 | $2,175.27 |

| Married 60-year old female | $2,247.06 | $1,991.49 |

| Married 60-year old male | $2,283.45 | $2,048.63 |

Based on these numbers, we see that:

Whether you like it or not, the state of your credit matters and can have a lasting impact on your major purchases. That includes buying a home, qualifying for a loan, and even purchasing car insurance.

As providers set rates, they will often look to what is called your credit-based score, or insurance score. Although this is not the same as your credit score, it’s largely based on your credit history. According to Credit Karma, this factors in variables such as:

Drivers with better scores will usually have better rates. With that in mind, here’s a look at what Geico and Progressive charge customers with good, fair, and poor credit:

| Credit Score | Geico | Progressive |

|---|---|---|

| Good | $2,434.82 | $3,628.85 |

| Fair | $2,986.79 | $3,956.31 |

| Poor | $4,259.50 | $4,737.64 |

We can see that Progressive customers are paying higher rates across the board, whether they have good, fair, or poor credit. In fact, the difference between the two companies is the largest among drivers with good credit, at $1,194.03.

However, where the rates between Geico and Progressive are closest are for those with poor credit. Even though Progressive has a higher average rate, the difference between the two is under $500.

For many drivers, more miles tend to translate into higher rates. The rationale? The more you drive, the more likely you are to get into an accident.

When we compared what Geico and Progressive customers are paying according to their average annual mileage, we discovered that once more, Geico has the advantage:

| Average Commute | Geico | Progressive |

|---|---|---|

| 10-mile commute/ 6,000 annual mileage | $3,162.64 | $4,030.02 |

| 25-mile commute/ 12,000 annual mileage | $3,267.37 | $4,041.01 |

But what should be noted among both insurers is this — the difference between what customers are paying with 10-mile or 25-mile commutes is minimal, particularly among Progressive customers. For Progressive drivers, the difference between the two is only $10.99.

The make, model, and cost of your car are all factors that insurers will consider when calculating your rates. But according to the III, it doesn’t stop there. Insurers will also consider:

We compared Geico and Progressive’s rates among three different cars over two different years:

| Make and Model | Geico | Progressive |

|---|---|---|

| 2015 Ford F-150 | $3,092.11 | $3,914.05 |

| 2015 Honda Civic Sedan | $3,092.58 | $4,429.56 |

| 2015 Toyota RAV4: XLE | $3,090.89 | $3,647.22 |

| 2018 Ford F-150 | $3,338.40 | $3,962.58 |

| 2018 Honda Civic Sedan | $3,338.87 | $4,528.90 |

| 2018 Toyota RAV4: XLE | $3,337.18 | $3,730.78 |

When looking at these specific vehicles, Progressive has the highest overall rates. However, the difference in premiums varies depending on the make and model.

For instance, insuring a 2018 Toyota RAV4 is similarly priced across both providers — $3,337.18 with Geico, and $3,730.78 with Progressive.

On the other hand, Honda Civic sedans proved to be the priciest for Progressive and yields the biggest difference in rates when compared to Geico — a $1,336.98 difference for the 2015 model and a $1,190.03 difference for the 2018 model.

No surprise here: As drivers opt to have higher levels of coverage, their rates will go up. This is clearly reflected among drivers insured with both Geico and Progressive:

| Coverage Level | Geico | Progressive |

|---|---|---|

| High | $3,429.14 | $4,350.96 |

| Medium | $3,213.97 | $4,018.46 |

| Low | $3,001.91 | $3,737.13 |

Once more, Geico proves to be the lowest among the pair, no matter what coverage level their customers pursue. The biggest difference in rates can be seen among those who have higher levels of coverage. In fact, Progressive customers are paying an average rate of $4,350.96 for high coverage — that’s $921.82 more than what their counterparts with Geico are paying.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

There’s no question about it — the true quality of any car insurance provider goes far beyond the price of its policies.

Whether that provider is financially stable and meeting the needs of its customers is just as important as scoring a good deal.

Fortunately, several prominent groups and organizations exist for this very purpose — to aid consumers in discerning whether insurers like Geico and Progressive are trustworthy and financially secure. From the likes of the Better Business Bureau to A.M. Best, we’re revealing how Geico and Progressive stack up.

Whether a provider has good credit or can meet its ongoing financial obligations are among the questions organizations such as A.M. Best, Standard & Poor’s, and Moody’s seek to answer. But before we dig deeper into each company’s insights, here’s an overview:

| Financial Strength Rating Issuer | Geico | Progressive |

|---|---|---|

| A.M. Best | A++ | A+ |

| Standard & Poor's (S&P) | AA+ | AA |

| Moody's Investors Service | Aa1 | Aa |

For well over a century, A.M. Best has existed to help consumers and industry insiders alike better understand the financial strength and creditworthiness of more than 3,500 insurers worldwide. Through its Financial Strength Ratings (FSR) system, A.M. Best seeks to measure an insurance provider’s “ability to meet its ongoing insurance policy and contract obligations.”

A.M. Best’s ratings range from an A++ at its highest, to a D as its lowest. As for Geico and Progressive:

https://www.youtube.com/watch?v=P5nClTxqZ1w

In the same way that banks and other lending institutions look to your credit score to determine your risk, companies such as Standard & Poor’s do the same for businesses. In fact, S&P is widely known as one of the top three credit rating agencies in the world.

In using a letter-grade system, S&P rates businesses according to their strengths and weaknesses, from AAA to D.

Like S&P, Moody’s Investors Service is also counted among the world’s top three credit rating agencies. Moody’s ratings range from an Aaa to a C.

And then, there’s the question of how Geico and Progressive interact with their customers. For instance:

They’re all questions we’re answering below as we break down each company’s customer service ratings. But first, here’s an overview:

| Customer Service Rating Issuer | Geico | Progressive |

|---|---|---|

| Better Business Bureau | A+ | A- |

| Consumer Reports Reader Score (out 100) | 89 | 87 |

| J.D. Power Auto Claims Satisfaction (out of 1,000 points) | 879 | 856 |

| NAIC Complaint Index (National Index = 1.00) | 0.74 | 0.88 |

Through J.D. Power’s Auto Claims Satisfaction Study, researchers analyze how customers feel their insurer measured up throughout the claims process — from their initial communication to the repair process and closure of the claim. J.D. Power’s most recent study involved responses from over 11,000 customers who recently settled claims with their providers.

We not only examined how each insurer performed in the study’s Overall Customer Satisfaction Index, but we also made note of each insurer’s Power Circle Ranking.

To go from customer satisfaction to complaints, we turn to the National Association of Insurance Commissioners (NAIC). The association annually gathers closed, confirmed consumer complaint data from state insurance departments. The NAIC reports:

The second-highest number of insurance-related complaints stem from auto insurance, with more than 30,000 complaints filed nationally in 2018.

For each insurer, the NAIC has calculated a Company Complaint Index. This figure is determined by dividing the company’s share of complaints in the U.S market by its share of premiums.

Here’s what you need to know — the National Complaint Index is always 1.00. This means that if a company has a complaint index of 2.00, it has twice the number of expected complaints in the market. Our research into both insurers revealed that:

Through Consumer Reports ratings, customers are given a chance to provide feedback in eight areas tied to the claims process. Here’s a side-by-side comparison of how Geico and Progressive fared:

| Consumer Reports Claims Handling | Geico | Progressive |

|---|---|---|

| Agent courtesy | Excellent | Very good |

| Being kept informed of claim status | Very good | Very good |

| Damage amount | Very good | Very good |

| Ease of reaching an agent | Excellent | Very good |

| Freedom to select repair shop | Very good | Very good |

| Promptness of response | Excellent | Very good |

| Reader Score | 89 | 87 |

| Simplicity of the process | Very good | Very good |

| Timely payment | Excellent | Excellent |

We can see that:

Both Geico and Progressive earned Very Good marks in each of the remaining categories.

For the Better Business Bureau, the question is simple — how are businesses really interacting with their customers? To answer that question, the BBB uses a letter-grade rating system based on several factors, ranging from the company’s complaint history to known licensing and government actions.

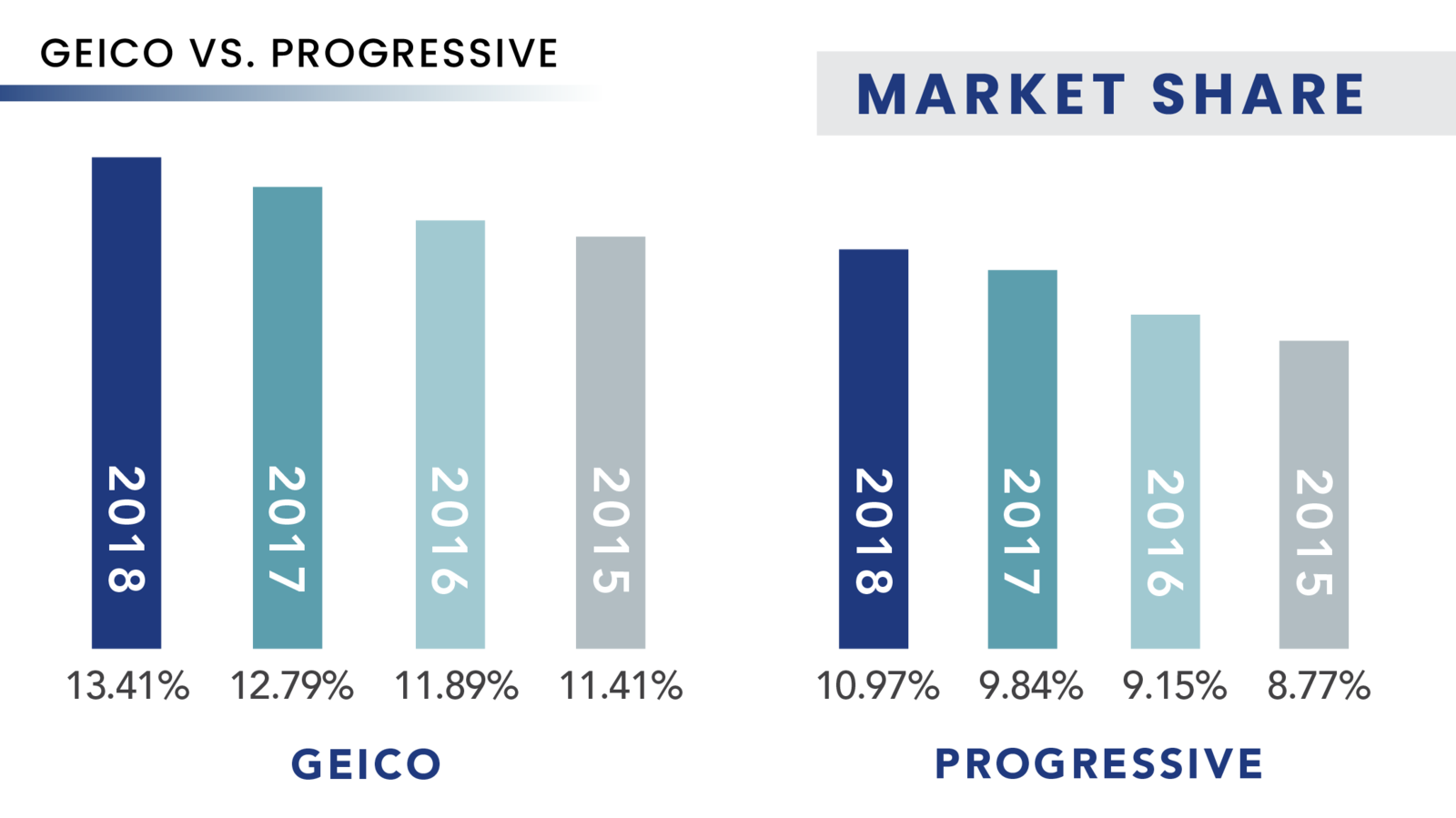

A strong indicator of a company’s influence can be seen in its market share.

A market share can be defined as a company’s portion of sales within the market that it’s part of.

Market share is always given as a percentage out of 100. The higher the market share, the more influence the company has within the market. We compared Geico and Progressive’s market share over four years:

| Company | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|

| Geico | 13.41 % | 12.79 % | 11.89 % | 11.41 % |

| Progressive | 10.97 % | 9.84 % | 9.15 % | 8.77 % |

It’s clear — in spite of both companies showing signs of steady growth, Geico has consistently maintained a higher market share than Progressive.

As of 2018:

The insurer with the highest market share? That designation goes to State Farm, at 17.02 percent.

We get it. In the face of the worst-case scenario, you want to be sure that you’re covered. Whether a car insurance company offers the coverages you’re looking for will make all the difference in the world.

For some, it’ll be a matter of simply carrying basic coverages. For others, the distinguishing factor will be in the extras. It’s why we’re breaking down Geico and Progressive’s coverage options below.

When it comes to basic car insurance coverages, you can count on both Geico and Progressive to have what you need:

| Geico Basic Coverage | Progressive Basic Coverage |

|---|---|

| Liability (BI and PD) Collision Comprehensive Property Damage Liability Medical Payments Personal Injury Protection (PIP) Uninsured Motorist/Underinsured Motorist | Liability (BI and PD) Collision Comprehensive Property Damage Liability Medical Payments Personal Injury Protection (PIP) Uninsured Motorist/Underinsured Motorist |

What about additional coverages? Here’s a side-by-side breakdown of what each insurer has to offer:

| Geico Additional Coverages | Progressive Additional Coverages |

|---|---|

| Emergency Road Service Rental Reimbursement Mechanical Breakdown Insurance Rideshare Accident Forgiveness Umbrella Insurance | Roadside Assistance Gap Insurance Rental Reimbursement Custom Parts and Equipment Rideshare Accident Forgiveness Umbrella Insurance Deductible Savings Bank |

When it comes to additional coverages, here’s where Geico and Progressive have common features:

Here are the additional coverages that Progressive offers, but Geico does not:

Here’s what Geico offers, but Progressive does not:

Drivers, beware — not all of these additional coverages are available in every state. And where they are available, the terms and conditions may vary. Customers will need to speak with an agent or representative to learn more.

Drivers looking to take advantage of a usage-based insurance (UBI) program have options with both insurers. However, what drivers need to keep in mind is that these programs are vastly different.

What is usage-based insurance? Drivers allowing their insurers to track their mileage and driving behaviors in hopes of earning a safe-driver discount. With Progressive, drivers have access to what is commonly known as a pioneer in the UBI market — Snapshot.

Progressive advertises average savings of $26 for enrolling in Snapshot and $145 for drivers who demonstrate safe driving behaviors. To participate, drivers must agree to have their behaviors monitored by a mobile app or plug-in device for about six months.

As a word of caution, Snapshot participants who don’t demonstrate safe-driving behaviors can face a rate hike.

https://www.youtube.com/watch?v=ISmVGMta-7I

Geico’s DriveEasy is relatively new, and among the newest players in the UBI space. As of now, Geico’s website promises savings of up to 20 percent to those who enroll but does not elaborate on any additional savings.

DriveEasy is powered by a mobile app, with a focus on developing safer driving habits. Right now, DriveEasy is only available in Connecticut and Pennsylvania, but the insurer promises to continue its expansion into other locations.

There’s no question about it — car insurance discounts are a surefire way to get more bang for your buck. At the end of the day, your best bargains will rely entirely on which insurer can most closely meet you where you are.

Below, we’ve listed some of the most common car insurance discounts, noting whether Geico or Progressive (or both) offer them:

| Discount | Geico | Progressive |

|---|---|---|

| Adaptive Cruise Control | x | |

| Adaptive Headlights | x | |

| Anti-lock Brakes | x | x |

| Anti-Theft | x | x |

| Claim Free | x | x |

| Continuous Coverage | x | x |

| Daytime Running Lights | x | x |

| Defensive Driver | x | x |

| Distant Student | x | x |

| Driver's Ed | x | x |

| Driving Device/App | x | x |

| Early Signing | x | x |

| Electronic Stability Control | x | |

| Emergency Deployment | x | |

| Engaged Couple | ||

| Family Legacy | x | x |

| Family Plan | ||

| Farm Vehicle | x | |

| Federal Employee | x | |

| Forward Collision Warning | x | |

| Full Payment | x | x |

| Further Education | x | |

| Garaging/Storing | ||

| Good Credit | x | |

| Good Student | x | x |

| Green Vehicle | ||

| Homeowner | x | x |

| Lane Departure Warning | x | |

| Life Insurance | ||

| Low Mileage | x | x |

| Loyalty | x | x |

| Married | x | |

| Membership/Group | x | |

| Military | x | |

| Military Garaging | ||

| Multiple Drivers | ||

| Multiple Policies | x | x |

| Multiple Vehicles | x | x |

| New Address | ||

| New Customer/New Plan | ||

| New Graduate | ||

| Newer Vehicle | x | x |

| Newly Licensed | ||

| Newlyweds | ||

| Non-Smoker/Non-Drinker | ||

| Occasional Operator | ||

| Occupation | x | |

| On Time Payments | ||

| Online Shopper | x | |

| Paperless Documents | x | |

| Paperless/Auto Billing | x | |

| Passive Restraint | x | x |

| Recent Retirees | ||

| Renter | ||

| Roadside Assistance | ||

| Safe Driver | x | x |

| Seat Belt Use | x | |

| Senior Driver | ||

| Stable Residence | x | |

| Students & Alumni | x | |

| Switching Provider | x | |

| Utility Vehicle | x | |

| Vehicle Recovery | x | x |

| VIN Etching | x | |

| Volunteer | ||

| Young Driver | x |

Progressive has Geico narrowly beat on the number of discounts offered — a total of 36, versus Geico’s 32. Just a few notable discounts offered between both insurers include:

Some discounts specific to Geico include:

Some discounts specific to Progressive include:

Discount availability and amounts will vary from state to state. Be sure to consult with an agent to learn more.

To be able to check coverages, pay premiums, and view policy documents online is a luxury most car insurance customers have come to expect.

The good news? Geico and Progressive are both up to speed on the latest online and mobile offerings.

The key for any prospective customer will be in understanding what each provider has to offer — whether that’s on the web, or through an app.

As for Geico’s website, customers are promised 24/7 access to the following:

Customers must create an online account to view their personal policy information.

When it comes to Geico’s mobile app, customers are promised the same amount of accessibility, but on the go. This includes viewing your policy cards, making payments, accessing emergency roadside assistance, and more. The app also features Geico Mobile’s Vehicle Care, which partners with CARFAX® in providing alerts for upcoming car services.

Geico’s app is available in both the App Store and Google Play. And when it comes to customer feedback, the news is good for Geico. In both the App Store and Google Play, Geico Mobile has an overall 4.8/5-star rating.

Progressive also provides its customers with 24/7 online access to the following:

Progressive customers must also create an online account to view their personal policy information.

The Progressive mobile app gives drivers 24/7 access to their policies, ID cards, billing and payments, emergency roadside assistance, the claims center, Snapshot, and more.

Progressive’s app is also available in the App Store and in Google Play. As for its ratings? Customers have given it 3.4/5 stars in the App Store, and 4.3/5 stars in Google Play.

From rates to ratings and from discounts to online access, we’ve compared Geico and Progressive point-by-point. Now the question remains — which provider is best?

| Geico Car Insurance Best for... | Progressive Car Insurance Best for... |

|---|---|

| Cheaper Rates | Discounts |

| Financial Strength Ratings | Additional Coverages |

| Customer Service Ratings | Usage-Based Insurance |

Here’s our final analysis for Geico:

Another notable advantage for Geico? A higher market share. Although both companies continue to show signs of continued growth, Geico maintains an edge as the insurer with the second-highest market share in the auto insurance industry.

As for Progressive, we’ve reached the following conclusions:

In terms of online access, we consider Geico and Progressive to be fairly equal. However, we give Geico’s app a slight edge due to higher overall ratings in both the App Store and Google Play.

Now is the time to begin shopping rates, and comparing your options. You can start now by entering your ZIP code into our free car insurance comparison tool.

Auto Insurance Company Reviews / Cheap Auto Insurance