8:00 - 17:00

Opening Hour: Mon - Fri

| City Stats | Details |

|---|---|

| Population | 122,366 |

| Population Density | 2,298 people/square mile |

| Average Annual Cost of Insurance | $3,662.27 |

| Cheapest Car Insurance Company | Geico |

| Road Conditions | Poor share: 15% Mediocre share: 25% Fair share: 21% Good share: 39% Vehicle Operating Costs: $382 |

Shopping for car insurance can be time-consuming. Wouldn’t life be easier if you could shorten the process?

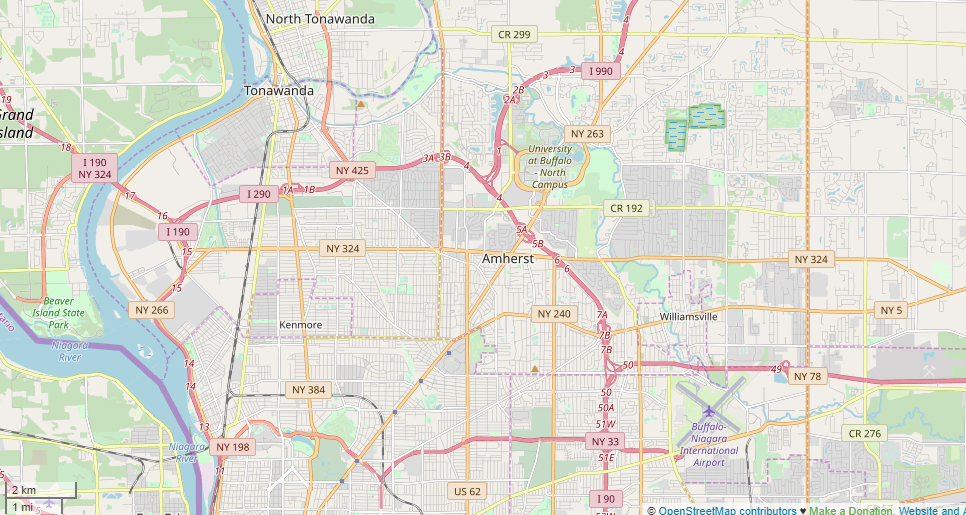

To save you time and money, this is your complete guide to car insurance options in Amherst, the most populated town in upstate New York. We’ll cover the factors that determine your auto insurance rates there, including age and gender and your driving record.

You’ll also find out more about living in Amherst and the greater Buffalo metropolitan area, from the state of the economy to crime rates and traffic congestion.

Are you ready to learn more? If you want to start researching rates, enter your zip code in the tool above.

Table of Contents

Cost is a major factor for some people when they shop for car insurance. And, with the average cost of annual premiums ranging from $3,662.27 to $4,289.88 for Amherst residents, the expense can cause headaches for some.

Which city you live in will have a major affect on car insurance. That’s why it’s essential to compare Amherst, NY against other top US metro areas’ auto insurance rates.

Not to worry. This complete guide to car insurance in Amherst has you covered. We’ll go over the parts of a car insurance policy, the factors that affect rates, providers, local laws, and other helpful information you need.

So, if you’re ready to get started, let’s get rolling. We partnered with Quadrant to give you the data in the sections below.

Your age and gender affect your car insurance premiums. Auto insurance costs more for young drivers than older ones who have driven for years. In Erie County, according to Data USA, the median age is 40 years. If you’re around that age or older, your premiums will cost less over time. Let’s see how much rates change at different ages:

| 17 | 25 | 35 | 60 | Cheapest Rate | Cheapest Age |

|---|---|---|---|---|---|

| $7,200.11 | $2,639.73 | $2,384.72 | $2,214.56 | $2,214.56 | 60 |

These states no longer use gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, and North Carolina, Pennsylvania. But age is still a big factor because young drivers are considered high-risk drivers in Amherst. New York does use gender, so check out the average monthly auto insurance rates by age and gender in Amherst, NY.

60-year-old drivers pay less for car insurance on average than their younger counterparts. The chart below clearly shows the cost differences between genders.

| Male | Female | Cheaper |

|---|---|---|

| $3,609.78 | $3,366.20 | Female |

Women often pay less for their car insurance than men because they’re considered less of a risk to insure; generally, they have fewer car accidents. Let’s look deeper at the differences between gender and age and marital status:

| Demographic | Rate (Cheapest) |

|---|---|

| Average | $3,609.78 |

| Married 35-year-old female | $2,410.91 |

| Married 35-year-old male | $2,358.53 |

| Married 60-year-old female | $2,202.88 |

| Married 60-year-old male | $2,226.25 |

| Single 17-year-old female | $6,293.75 |

| Single 17-year-old male | $8,106.48 |

| Single 25-year-old female | $2,557.26 |

| Single 25-year-old male | $2,722.19 |

Single 17-year-old drivers, if they’re not on a parent’s insurance plan, will pay the highest rates, while married 60-year-old females will pay the lowest premiums.

Regardless of these factors, you still have options. Take a look at them to get the best coverage at the right rates for you.

Amherst, New York auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Besides age, gender, and marital status, where you live in the town can also affect your rates. Our data shows an average rate for East Amherst residents.

| City | Zip | Average Annual Rate |

|---|---|---|

| East Amherst | 14051 | $3,662.27 |

Find more info about the monthly Amherst, NY car insurance rates by ZIP Code below:

This rate is roughly $600.00 lower than the average annual rate for premiums in Amherst, $4,289.88.

Nearly 900 car insurers operate in New York State, so you have plenty of options when choosing the right car insurance company. Below, we’ll go over the factors that can help you decide which company is the best for you. We’ll look at car insurance rates by company, commute, coverage level, credit history, and driving record.

Below are prices by company for different ages and genders.

| Group | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male | Average |

|---|---|---|---|---|---|---|---|---|---|

| Allstate | $2,758.29 | $2,566.64 | $2,595.70 | $2,622.07 | $8,007.17 | $8,564.87 | $2,672.36 | $2,663.18 | $4,056.29 |

| GEICO | $1,495.56 | $1,441.52 | $1,457.47 | $1,436.07 | $3,202.57 | $4,733.10 | $1,344.90 | $1,385.17 | $2,062.05 |

| Liberty Mutual | $4,016.07 | $4,016.07 | $3,739.49 | $3,739.49 | $7,814.32 | $12,684.71 | $4,016.07 | $4,267.21 | $5,536.68 |

| Nationwide | $2,390.46 | $2,390.46 | $2,255.22 | $2,255.22 | $4,275.82 | $6,380.28 | $2,390.46 | $3,054.38 | $3,174.04 |

| Progressive | $1,824.94 | $1,676.40 | $1,445.71 | $1,475.02 | $6,488.00 | $7,175.89 | $2,354.03 | $2,261.53 | $3,087.69 |

| State Farm | $2,631.10 | $2,631.10 | $2,305.84 | $2,305.84 | $7,875.87 | $10,125.20 | $2,900.95 | $3,052.40 | $4,228.54 |

| Travelers | $2,514.75 | $2,518.27 | $2,322.84 | $2,473.11 | $6,039.59 | $7,272.44 | $2,660.37 | $2,752.79 | $3,569.27 |

| USAA | $1,656.09 | $1,627.76 | $1,500.74 | $1,503.17 | $6,646.63 | $7,915.34 | $2,118.91 | $2,340.89 | $3,163.69 |

The cheapest Amherst, NY auto insurance company can be discovered below. You then might be asking, “How do those rates compare against the average New York auto insurance company rates?” We cover that as well.

Overall, Geico and USAA have the lowest rates among the companies listed.

Your regular commute also factors into your car insurance rates. How far do you drive to work?

The average New Yorker drives 11,421 miles yearly, so a little bit of driving here and there really adds up.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. | Average |

|---|---|---|---|

| Allstate | $4,000.91 | $4,111.66 | $4,056.29 |

| GEICO | $2,001.09 | $2,123.00 | $2,062.05 |

| Liberty Mutual | $5,381.57 | $5,691.78 | $5,536.68 |

| Nationwide | $3,174.04 | $3,174.04 | $3,174.04 |

| Progressive | $3,087.69 | $3,087.69 | $3,087.69 |

| State Farm | $4,076.82 | $4,380.25 | $4,228.54 |

| Travelers | $3,569.27 | $3,569.27 | $3,569.27 |

| USAA | $3,131.97 | $3,195.41 | $3,163.69 |

As shown, not all insurers factor distance into the cost of their premiums. Of those listed, Nationwide, Travelers, and Progressive didn’t change their rates for ten versus 25-mile commutes.

The amount of coverage you buy, whether you get basic liability, collision, or comprehensive insurance for full coverage auto insurance, makes a difference in your rates.

| Group | High | Low | Medium | Average |

|---|---|---|---|---|

| Allstate | $9,666.43 | $7,334.68 | $8,379.06 | $8,460.06 |

| GEICO | $4,049.19 | $3,473.17 | $3,706.95 | $3,743.10 |

| Liberty Mutual | $13,296.72 | $11,975.93 | $12,584.89 | $12,619.18 |

| Nationwide | $7,953.69 | $6,693.37 | $7,185.35 | $7,277.47 |

| Progressive | $6,538.66 | $5,636.33 | $5,995.63 | $6,056.87 |

| State Farm | $7,304.00 | $6,473.21 | $6,957.54 | $6,911.58 |

| Travelers | $9,076.69 | $7,668.66 | $8,153.39 | $8,299.58 |

| USAA | $6,753.12 | $6,267.22 | $6,447.19 | $6,489.18 |

Your coverage level will play a significant role in your Amherst, NY auto insurance rates. Find the cheapest Amherst, NY auto insurance rates by coverage level below:

With some insurers, such as USAA and Geico, the price difference between the lowest and highest coverage amounts to less than $1,000.

Depending on the insurers, some auto insurance companies check credit as well and this may add to your overall car insurance rates. These are average rates for poor, fair, and good scores.

| Group | Fair | Good | Poor | Average |

|---|---|---|---|---|

| Allstate | $3,395.17 | $2,913.46 | $5,860.23 | $4,056.29 |

| GEICO | $1,898.32 | $1,703.74 | $2,584.08 | $2,062.05 |

| Liberty Mutual | $5,067.35 | $3,797.47 | $7,745.21 | $5,536.68 |

| Nationwide | $3,174.04 | $3,174.04 | $3,174.04 | $3,174.04 |

| Progressive | $2,521.31 | $1,848.69 | $4,893.07 | $3,087.69 |

| State Farm | $3,744.37 | $2,972.61 | $5,968.64 | $4,228.54 |

| Travelers | $3,089.32 | $2,669.41 | $4,949.08 | $3,569.27 |

| USAA | $2,450.48 | $2,164.20 | $4,876.39 | $3,163.69 |

Your credit score will play a major role in your Amherst, NY auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, Massachusetts, and North Carolina. Find the cheapest Amherst, New York auto insurance rates by credit score below.

Nationwide was the only insurer that didn’t use credit score to calculate its rates. Among those who do, Liberty Mutual customers with poor credit can pay as much as $4,000 more than those with good credit.

Last, but not least, major and minor driving offenses on your record can also become a big factor in your premiums.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation | Average |

|---|---|---|---|---|---|

| Allstate | $3,440.86 | $3,440.86 | $5,011.66 | $4,331.77 | $3,964.46 |

| GEICO | $1,603.39 | $1,748.45 | $3,292.95 | $1,603.39 | $2,214.93 |

| Liberty Mutual | $4,428.83 | $4,428.83 | $8,860.22 | $4,428.83 | $5,905.96 |

| Nationwide | $2,420.94 | $2,420.94 | $5,377.89 | $2,476.37 | $3,406.59 |

| Progressive | $2,999.69 | $2,999.69 | $3,332.32 | $3,019.07 | $3,110.57 |

| State Farm | $4,021.86 | $4,021.86 | $4,435.22 | $4,435.22 | $4,159.65 |

| Travelers | $3,029.91 | $3,821.07 | $3,874.47 | $3,551.62 | $3,575.15 |

| USAA | $2,814.67 | $2,860.23 | $4,119.63 | $2,860.23 | $3,264.84 |

Your driving record will affect your Amherst auto insurance rates. For example, a Amherst, New York DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Amherst, New York auto insurance rates by driving record.

Several insurers listed didn’t change their rates for one accident, including Allstate and Liberty Mutual. Among those who do, USAA showed the smallest increase, $46, from a clean record.

Here we’ll look further at more car insurance rate factors, including the town’s economy, residents’ earnings, education levels, and jobs.

Factors affecting auto insurance rates in Amherst, NY may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Amherst, New York auto insurance.

The Brookings Institution’s Metro Monitor reveals that the Buffalo-Cheektowaga-Niagara Falls area ranks 20th of 100 for economic growth, which means it was among the slowest-growing.

Prosperity

Prosperity captures changes in the average wealth and income an economy produces. When worker productivity contributes to a metropolitan area’s growth, through innovation or training, for example, the value of those workers’ labor rises.

This is how the area grew from 2007 to 2017:

Despite the overall outlook, the Buffalo metropolitan area showed a nearly two percent rise in productivity, the standard of living, and average annual wages.

Growth

Growth indicators measure the change in the size of an urban area’s economy and its level of entrepreneurial activity. Growth and entrepreneurship create new opportunities for individuals and can help a metro economy become more efficient. These figures measure growth in gross metropolitan product, the number of jobs, and the amount of jobs at young firms.

Here’s how the Buffalo area grew from 2007 to 2017:

Regardless of an average gross metropolitan product rate, job growth was stagnant, and the number of jobs at newer firms ranked 93rd, almost at the bottom compared to the U.S. average.

Let’s explore how your earnings compare to how much you pay for car insurance annually. According to DataUSA, Erie County’s average annual income was just below $55,000, which means it’s among the top five highest-earning counties in New York State.

Let’s see how much residents earn versus how much they pay for annual car insurance premiums.

| Annual Car Insurance Premium | Annual Income | % of Income |

|---|---|---|

| $3,662.27 | $55,604.00 | 6.59% |

East Amherst residents earn slightly more than the county average. Almost seven percent of their annual income — after taxes — goes to car insurance. Are you curious to see how much you pay? Try our free calculator below.

CalculatorPro

Homeownership is often a sign of prosperity and shows that a driver may be more reliable and able to pay car insurance premiums. So, if you own a home, you may pay less than if you rent. Homeowners can also bundle their car and home insurance to save even more.

In 2017, the rate of owner-occupied homes was 64.2 percent, which was among the lowest of New York’s counties. This was a slight decline from 64.8 percent in 2016. Still, this rate was higher than the national average of 63.9 percent.

The median property value in Erie County was $153,300 in 2017, which was 70 percent less than the national average ($217,600). From 2016 to 2017, the median property value increased nearly five percent, from $146,400 to $153,300.

In 2016, Erie County universities awarded 20,369 degrees. Between the genders, 31,582 students were male and 39,728 were female.

The largest universities in Erie County by the number of degrees awarded are University at Buffalo (8,919 and 43.8 percent), SUNY Buffalo State (2,607 and 12.8 percent), and Erie Community College (2,322 and 11.4 percent). The image below from Data USA shows the most popular majors.

As shown, the most popular majors were General Business Administration & Management (1,736 and 8.52 percent), General Psychology (795 and 3.9 percent), and Registered Nursing (769 and 3.78 percent).

White-collar jobs, such as office and administrative support and sales and related were the most common occupations in Erie County. State University of New York (SUNY) Erie Community College offers degrees and certificates in Business Administration, Computer Science, and other growing popular majors, including those listed above.

Data wasn’t available at the county level, so this is Data USA’s chart for New York State. Whites and Asians held most of the occupations, including management, teaching, secretaries, and administrative assistants. Asians in management positions earned the highest salaries, at nearly $130,000 yearly.

The table below shows how much of the top races and ethnicities’ earnings statewide went to car insurance premiums.

| ANNUAL CAR INSURANCE | ANNUAL INCOME | % OF INCOME | NOTES |

|---|---|---|---|

| $3662.27 | $67,169 | 5.45% | White |

| $3662.27 | $62,618 | 5.85% | Native Hawaiian or Other Pacific Islander |

| $3662.27 | $62,444 | 5.86% | Asian |

Five to six percent of Whites, Asians, and native Hawaiians or other Pacific Islanders’ income in New York goes to car insurance.

The earnings for elementary and middle school teachers and secretaries and administrative assistants of both genders were almost even. Though the wage gap between males and females continues to close, men continue to earn more than women in New York.

In 2017, full-time male employees in New York made 1.29 times more than female employees.

The average annual salary for males was $78,550, while females made $60,672. This resulted in an $18,000 difference between the sexes, as the battle for earnings equality rages on.

According to Data USA, these are the poverty rates by age and gender in Erie County. Fifteen percent of Erie County residents live in poverty (134,000 out of 898,000 people), more than the national average of 13 percent. Most of them are females ages 25 to 34, followed by males and females, age 18 to 24.

These are Data USA’s poverty rates by race and ethnicity. Whites and Blacks top the list in Erie County, followed by Hispanics.

As shown in the Data USA chart below, from 2016 to 2017, Erie County employment grew at a rate of four percent, from 443,000 employees to 459,000 employees.

The most common job groups, according to the population, are office and administrative support occupations (63,340 people), sales & related occupations (48,406 people), and management occupations (44,434 people).

Driving in large metropolitan areas such as Buffalo can be frustrating, especially at peak commute times in the morning and evening.

To help make your routes a little easier, we gathered everything from information about the major highways in the area, including toll roads and road conditions.

Read on to find out more.

How many major highways are in Amherst? How many miles of roadway are there? And just how much does it cost to drive on area toll roads? We’ll answer all those questions and more below.

New York State has 31 active highways that span 1,730.34 miles. Eight state highways, one interstate highway, and a U.S. Highway criss-cross the city of Buffalo.

Below are the routes:

The New York State Thruway, except for the Garden State Parkway Connector and the Cross-Westchester Expressway have toll booths. The New York–Ripley mainline employs both an all-electronic, open road tolling system and a closed, ticket-based toll system.

I-90 and the Thruway continue into Erie County and the Buffalo area. It meets NY 78 at exit 49 near Depew before passing through the Williamsville toll barrier, the northwestern end of the major closed ticket system.

Tolls on the New York State Thruway are calculated according to the height of the vehicle, total number of axles, and distance traveled.

The Authority’s Toll & Distance Calculator estimates tolls, distance, and travel time for entry and exit points anywhere on the Thruway system for all vehicle classifications. Patrons are required to enter the height and number of axels on the vehicle.

Also, the Authority offers an On-Line Toll Ticket which can be used to determine passenger vehicle (class 2L) tolls. The Authority also provides information on other vehicle classifications. E-ZPass customers receive a 5 percent discount off the cash toll rate. Anyone, regardless of residency, can apply for a New York customer service center-issued E-ZPass tag to qualify for discounts.

E-ZPass rates apply only to customer tags New York E-ZPass Customer Service Center (CSC) issues. Non-New York CSC customers will pay cash or Toll by Mail rates.

The Thruway’s $88 annual permit discount plan is available for commuters’ using the Thruway’s ticket system. Commuter discount plans for the New York and Buffalo Regions fixed toll barriers and bridges (New Rochelle, Yonkers, Governor Mario M. Cuomo Bridge, Harriman, and both Grand Island Bridges) are also available.

To enroll in one of the various commuter plans, customers must first have an established E-ZPass account.

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Amherst might not seem like a “hotbed” of attractions. Still, you’ll find plenty of things to do there, including paying a visit to the Amherst Museum, seeing a performance at the MusicalFare theater, or the family-friendly Buffalo ComedySportz improv show.

TripAdvisor also maintains a list of top attractions in Amherst. Among them are Amherst State Park and the Buffalo Niagara Heritage Village.

The following video explores some of the most notable attractions in the Buffalo metropolitan area, such as the American side of Niagara Falls:

Below are pavement conditions and vehicle operating costs in the Buffalo-Niagara Falls area from TRIP, a national transportation research group:

| Poor Share | Mediocre Share | Fair Share | Good Share | Vehicle Operating Costs (VOC) |

|---|---|---|---|---|

| 15% | 25% | 21% | 39% | $382 |

Many of the roads are in good condition, however, a number of them need some work. Local officials are aware of it.

This news report covers a new app from the Erie County Public Works that will help residents report potholes throughout the county and track their maintenance:

The City of Buffalo recently considered installing red-light cameras to keep citizens safe.

Regarding speeding cameras, the state approved a pilot program earlier in 2019 for school zone speeding cameras in Buffalo. The news report below goes into more detail about the program:

Car ownership comes with a lot of responsibility. We’ll outline some of the problems you may face with vehicle ownership below, including how many cars residents own in Erie County, traffic congestion, busy highways, and road safety.

According to YourMechanic, the most popular vehicles in Buffalo are American made. The city ranks sixth out of 81 on their American Car Index — 61 percent of vehicle owners there prefer cars made in the U.S. The most popular make and model is the Chevrolet Malibu.

According to U.S. News and World Report states that the car is “a solid vehicle, but it lands near the bottom of the competitive midsize car segment because so many cars in the class are simply better.” They believe the Malibu rides smoothly, gets good gas mileage, and provides plenty of interior space.

Like the national average, most Erie County residents own two cars, followed by one, and then three cars.

The table below reveals how many Buffalo households on average own and don’t own cars.

| 2015 Households Without Vehicles | 2016 Households Without Vehicles | 2015 Vehicles Per Household | 2016 Vehicles Per Household |

|---|---|---|---|

| 30.00% | 28.20% | 1.03 | 1.08 |

From 2015 to 2016, the number of households that don’t own cars declined by two percent, and the overall number of cars owned increased slightly.

According to Speedtrap.org users, Interstate 290 and New Road in Amherst are among the biggest speed traps in town.

Federal Bureau of Investigation (FBI) statistics show that in 2017, 41 vehicle thefts occurred in Amherst compared to 833 in Buffalo.

The map linked here reveals the safest neighborhoods in the Buffalo area, according to Neighborhood Scout. Greiner Road / Shimerville Road tops the list.

Other safe neighborhoods include:

Neighborhood Scout gives the area a Crime Index of “5” to show that it’s safer than five percent of U.S. cities.

Your chances of becoming a victim of violent crime in Buffalo are one in 98. The average number of violent crimes and property crimes that occur there yearly appear below.

| STATS | VIOLENT | PROPERTY | TOTAL |

|---|---|---|---|

| Number of Crimes | 2,643 | 10,284 | 12,927 |

| Crime Rate (per 1,000 residents) | 10.22 | 39.77 | 49.99 |

Most of the crimes are property crimes, which can include vehicle theft; the crime rate in Buffalo for that type of crime is more than triple that of violent crimes.

Here is a breakdown of the violent crimes that happen there on average yearly.

| MURDER | RAPE | ROBBERY | ASSAULT | |

|---|---|---|---|---|

| Report Total | 40 | 157 | 858 | 1,588 |

| Rate per 1,000 | 0.15 | 0.61 | 3.32 | 6.14 |

Buffalo is a dangerous area for robberies and assaults.

This section features information about traffic congestion in the Buffalo metropolitan area, the busiest highways, and the safety of its streets and roads.

According to Inrix’s Traffic Scorecard, Buffalo ranks 151st worldwide for the most congested traffic.

In 2018, the average driver there spent 72 hours in traffic jams, which amounted to over $1,000 yearly in transportation-related costs, such as gas. At peak commute times in the morning and evening, commuters averaged speeds of 24 miles per hour. During off-peak hours, the speed rose to 30 mph. Free-flowing traffic fared better, at 38 mph.

Erie County residents averaged 20.8 minutes on the road during their commutes, which was lower than the U.S average of 25.5 minutes. Only 1 percent of Erie County drivers undergo “super commutes” of 90 minutes or longer.

Now, let’s see which form of transportation is the most popular during those commutes. Erie County commuters choose to drive alone — like the average American. Fewer than 10 percent of commuters carpool.

Among the busiest highways in the Buffalo area are U.S. Route 62 Business and the Queen Elizabeth Way.

U.S. Route 62 Business (US 62 Business) in Niagara Falls that flows from Pine Avenue to the downtown, between New York State Route 104 (NY 104) at its western end and U.S. 62 to the east. It runs mainly east–west but appears on signs as a north–south route in-line with U.S. 62 signage.

Queen Elizabeth Way (QEW) goes from the Canadian province of Ontario to the Niagara Peninsula and Buffalo, New York. It starts at the Peace Bridge in Fort Erie and flows 86 miles around the western end of Lake Ontario to Highway 427.

This Travel Channel video spotlights what it’s like to travel Queen Elizabeth Way from Hamilton, Ontario to Buffalo, New York:

Busy highways affect traffic safety. Sadly, among the most dangerous hazards are accidents.

Below are Erie County Highway Traffic Safety Administration (NHTSA) crash statistics. First, let’s look at the total fatal crashes in 2017.

| Erie County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatal Crashes | 57 | 47 | 44 | 50 | 43 |

These numbers have decreased since 2013. Next, let’s see some sobering statistics about alcohol-impaired fatalities.

| FATALITIES CRASHES IN ERIE COUNTY INVOLVING AN ALCOHOL-IMPAIRED DRIVER (BAC = .08+) | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities | 14 | 13 | 13 | 12 | 16 |

As shown, the number of alcohol-related crashes rose slightly since 2013, but pretty much have stayed steady. Now, let’s look at single-vehicle crash statistics.

| Erie County Single Vehicle Crashes | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities | 784 | 674 | 709 | 660 | 602 |

Fortunately, in recent years, the above numbers have declined. Let’s see the crashes that involved speeding.

| Erie County Crashes Involving Speeding | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities | 19 | 12 | 12 | 17 | 11 |

These numbers, too, have decreased in recent years. Now, let’s explore crashes that involved a roadway departure.

| Erie County Fatalities Involving a Roadway Departure | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities | 580 | 509 | 513 | 471 | 450 |

Again, the number of accidents has declined recently. Here are the crashes that involved an intersection:

| Erie County Crashes Involving an Intersection (or Intersection Related) | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities | 467 | 377 | 419 | 385 | 373 |

These deaths have also dropped from 2013 to 2017. Below are fatal crashes by person type.

| Erie County Fatal Crashes by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 423 | 375 | 368 | 330 | 339 |

| Pedestrian | 336 | 264 | 311 | 307 | 242 |

| Bicyclist and Other Cyclist | 40 | 46 | 36 | 39 | 46 |

The good news is, these numbers continue to lower. Next, let’s see the fatalities by state/road function class. Below is data for New York State.

| INTERSTATE (RURAL) | INTERSTATE (URBAN) | FREEWAY AND EXPRESSWAY | OTHER PRINCIPAL ARTERIAL | MINOR ARTERIAL | COLLECTOR ARTERIAL | LOCAL | UNKNOWN | TOTAL FATAL CRASHES |

|---|---|---|---|---|---|---|---|---|

| 2 | 1 | 0 | 11 | 5 | 1 | 22 | 0 | 42 |

An arterial road is a high-capacity urban road. Depending on the amount of traffic, the arterial road may be classified as a highway or a minor arterial road. A collector road gathers traffic from local roads and takes drivers to arterial roads.

Next are the results for crashes in Buffalo.

| INTERSTATE (RURAL) | INTERSTATE (URBAN) | FREEWAY AND EXPRESSWAY | OTHER PRINCIPAL ARTERIAL | MINOR ARTERIAL | COLLECTOR ARTERIAL | LOCAL | UNKNOWN | TOTAL FATAL CRASHES |

|---|---|---|---|---|---|---|---|---|

| 45 | 22 | 27 | 267 | 102 | 63 | 407 | 0 | 933 |

Most of Erie County’s fatal crashes occur on major and minor arterial roads. Be extra cautious when driving through these areas.

Another driving hazard is railroad crashes. The below data from the U.S. Department of Transportation (DOT) reveals Erie County fatalities and injuries from railway accidents.

| HIGHWAY USER SPEED | CALENDAR YEAR | COUNTY | HIGHWAY | HIGHWAY USER TYPE | RAIL EQUIPMENT TYPE | NON-SUICIDE FATALITY | NON-SUICIDE INJURY |

|---|---|---|---|---|---|---|---|

| 0 | 2013 | ERIE | BUFFALO YARD CROSSIN | Truck-trailer | Yard/Switch | 0 | 0 |

| 0 | 2013 | ERIE | OHIO ST YD | Automobile | Yard/Switch | 0 | 1 |

| 4 | 2014 | ERIE | PRIVATE | Truck-trailer | Light Loco(s) | 0 | 0 |

| 4 | 2015 | ERIE | PRIVATE RD | Truck-trailer | Yard/Switch | 0 | 3 |

Fortunately, few train/vehicle accidents occur in the area.

Insurance companies keep track of driving statistics, and Allstate is no exception. Below are some figures regarding insurance claims drivers file in the Buffalo area.

| 2018 BEST DRIVERS REPORT RANKING | AVERAGE YEARS BETWEEN CLAIMS | RELATIVE CLAIM LIKELIHOOD (COMPARED TO NATIONAL AVERAGE) | 2018 DRIVEWISE® HARD-BRAKING EVENTS PER 1 1,000 MILES |

|---|---|---|---|

| 144 | 7.4 | 0.358 | 25 |

Allstate ranked the area as the 144th safest to drive in 2018. The average amount of time between claims, seven years, indicates that many drivers don’t often experience major accidents. In the vicinity, the likelihood of a claim being made compared to the national average is 36 percent. Hard-braking incidents in the area average 25 per 1,000 miles.

Beyond regular taxi rides, below are the ridesharing services available in the Buffalo area.

A program from Esurance, Estar helps drivers find the best repair shops in their areas. According to Estar, these are the top seven repair shops in the Buffalo area:

GERBER – BUFFALO/DELAWARE AVE

2643 DELAWARE AVE.

BUFFALO, NY 14216

email: [email protected]

P: (716) 876-0700

F: (716) 876-5636

AUTO STARS COLLISION & MECHANICAL REPAIR

225 AMHERST ST.

BUFFALO, NY 14207

email: [email protected]

P: (716) 877-2892

F: (716) 877-3881

CARSTAR COLLISION OF AMHERST

2915 NIAGARA FALLS BLVD.

AMHERST, NY 14228

email: [email protected]

P: (716) 639-0777

CARSTAR EASTERN HILLS LLC

6705 TRANSIT RD

WILLIAMSVILLE, NY 14221

email: [email protected]

P: (716) 631-9565

CARSTAR BABBSCO COLLISION

8624 NIAGARA FALLS BLVD.

NIAGARA FALLS, NY 14304

email: [email protected]

P: (716) 297-9451

F: (716) 297-5401

CARSTAR WEST SENECA

120 ORCHARD PARK RD

WEST SENECA, NY 14224

email: [email protected]

P: (716) 824-3200

CARSTAR VENTURA’S

5665 LAKE AVE

ORCHARD PARK, NY 14127

email: [email protected]

P: (716) 827-5826

U.S. Climate Data shows that Erie County temperatures are cool most of the year and the area receives a fair amount of rain and snow.

| BUFFALO, NEW YORK WEATHER | DETAILS |

|---|---|

| Annual high temperature: | 56.3°F |

| Annual low temperature: | 40.2°F |

| Average temperature: | 48.25°F |

| Average annual precipitation - rainfall: | 40.47 inch |

| Days per year with precipitation - rainfall: | - |

| Annual hours of sunshine: | - |

| Av. annual snowfall: | 94 inch |

City-Data.com reveals that the average number of annual natural disasters in Erie County (20) surpasses the US average (13). In an average year, ten natural disasters there are declared emergencies (including presidential declarations). Below is a breakdown of the average number of natural disasters declared yearly.

Some incidents may have been assigned to more than one category.

Overall, the area receives few major storms yearly. Some lead to dangerous conditions, such as flooding, hurricanes, blizzards, and ice storms.

Because of the unpredictable nature of weather, it makes sense to buy comprehensive car insurance for protection from high winds, water, and other hazards that can damage your vehicle.

Can you live in the Buffalo area without a car? Perhaps — if you’re patient. According to a news report, four of the county’s largest employment centers are located outside of a city. Long public transportation commutes there and the cost involved can make life harder for the poor and people of color.

The Niagara Frontier Transportation Authority (NFTA) handles Buffalo’s public transportation system, operating the Metro Bus and Metro Rail. Many routes serve Buffalo every 15 to 60 minutes weekdays, with fewer stops to suburban locations.

Bus stops are available on most street corners along routes and many other locations.

Metro Rail is a 6.1-mile light rail rapid transit system in Buffalo. It runs along Main Street from First Niagara Center of the southern edge of the downtown to the University of Buffalo’s south campus, with 14 stops in between.

The train runs above ground on a transit mall downtown and then tunnels under Main Street as it heads north to the campus near the city line. Metro Rail rides are free at aboveground stations, but there is a $2 fare if you continue riding past the Fountain Plaza station into the subway.

Bus and rail fares start at $2 per trip. Children age 5-11, seniors 65 and older, and those on Medicare and Medicare pay $1. Drivers require exact change. If you ride more than a few times a day, you can buy a day pass from a bus driver, at fare machines at stations for $5, or via the Token Transit app.

No transfers are available between Metro vehicles. NFTA updates the route schedules regularly to accommodate riders.

Amtrak also offers rail service in the area. Stations near Amherst:

Renting a bike or a scooter are other potentially cost-effective transportation options. Below are some companies that offer bike rentals in Buffalo.

In major cities, a good parking spot can be hard to find. These are your options in the Buffalo metro area.

The Buffalo City Council recently changed local street-level parking rates from one dollar to two dollars per hour from 7 a.m. to 10 p.m. The WBLK website lists more information about the changes and the streets it affects. Drivers can pay at meters or through the Buffalo Roam mobile app.

You can find reserved parking in Buffalo via the Parkmobile app. Parking.com operates four garages in the city, and their website will help you find the closest location. There are also several public parking garages available.

ChargeHub lists 186 of the most popular electric car charging stations within ten miles of Amherst. Seventy of them are free. More than 90 percent of them are Level 2, however, eight percent are Level 3 charging stations. The main charging network in operation is ChargePoint.

The news report below ponders the issue of parking in Downtown Buffalo:

Pollutants from vehicle exhaust have been linked to health issues and even climate change. This pollution not only goes directly into the earth’s atmosphere, but it also reacts with other pollutants which make the situation worse. Children and people with chronic illnesses can be most sensitive to the effects.

Below are Environmental Protection Agency (EPA) air quality statistics for the Buffalo metro area.

| Buffalo-Cheektowaga-Niagara Falls Area Air Quality Index | 2016 | 2017 | 2018 |

|---|---|---|---|

| Days With AQI | 366 | 365 | 187 |

| Good Days | 281 | 279 | 161 |

| Moderate Days | 79 | 85 | 26 |

| Days Unhealthy for Sensitive Groups | 65 | 1 | - |

| Unhealthy Days | - | - | - |

| Very Unhealthy Days | - | - | - |

Fortunately, the numbers of “good” and “moderate” days have decreased recently, with few days “unhealthy for sensitive groups.”

The New York Department of Motor Vehicles requires all gas-powered cars to undergo annual emissions testing. Most 1996 or newer cars and most 1997 or newer diesel-powered vehicles with a gross vehicle weight rating (GVWR) less than 8,501 pounds will need an On-Board Diagnostics Generation II (OBDII) emissions inspection.

Vehicles with a model year of 1995 and older, including those up to 25 model years old and that weigh 18,000 lbs. or less qualify for “low enhanced” emissions testing. Vehicles that meet heavy safety inspection standards, as the NY DMV defines, are exempt.

Each emissions inspection for gasoline-powered vehicles confirms the presence and connection of the vehicle’s required emissions control devices. This includes confirming that the gas cap is there, in good condition, and fits properly.

Finding the right car insurance can be a hassle — you need to educate yourself on the coverage you need and get quotes from several providers. If you’re an active member of the military or a veteran, you may also wonder if insurers will offer you a discount for your service.

We’ve simplified the process through organizing everything you need and putting it in one place. In this section, we’ll learn when local members of the military served and the discounts insurers offer them.

So, let’s get ready to learn more.

Most of the veterans served in Vietnam, followed by those from the conflict in Korea, and our most recent Gulf War. The number of Vietnam veterans there is almost four times higher than veterans from other conflicts.

No military bases are located within an hour away from Erie County.

If you are or were in the U.S. military, most car insurance companies will want to give back by serving you. Many of them offer military discounts.

Below is a list of known providers who give military discounts. We excluded those who offer military discounts only to certain states.

| Insurance Company | Percentage Saved with Discount |

|---|---|

| Farmers | 5% |

| Geico | 15% |

| Liberty Mutual (must be active duty) | 4% |

| MetLife | 15% |

| USAA | 60% off when deployed 15% for garaging on base |

*USAA gives a 15 percent military garage discount for garaging cars on a military base.

USAA is car insurance available only to U.S. military personnel and their families.

Compared to other insurers, USAA generally offers lower and more affordable rates. Below, you will see how USAA’s and other insurers’ rates compare to the average annual premium in New York, $4,289.88.

| GROUP | ANNUAL PREMIUM | COMPARED TO STATE AVERAGE (+/-) | COMPARED TO STATE AVERAGE (%) |

|---|---|---|---|

| Allstate | 4740.97 | 451.08 | 0.1051 |

| Liberty Mutual | 6540.73 | 2250.85 | 0.5247 |

| Progressive | 3771.15 | -518.73 | -0.1209 |

| Nationwide | 4012.93 | -276.95 | -0.0646 |

| Geico | 2428.24 | -1861.64 | -0.434 |

| State Farm | 4484.58 | 194.7 | 0.0454 |

| Travelers | 4578.79 | 288.91 | 0.0673 |

| USA | 3761.69 | -528.2 | -0.1231 |

Geico and USAA offer the best rates for members of the military.

Every city or town, like every state, has specific laws governing day-to-day life there. With several on the books, it can be hard to remember which ones you need to know most to stay out of trouble.

In this section, we’ve gathered information about hands-free cell phone laws, food truck, tiny home, and parking regulations.

Read on find out more about these laws.

The town of Amherst and the city of Buffalo don’t have specific hands-free cellphone laws.

According to AAA, in New York “no person shall operate a motor vehicle while using a mobile telephone to engage in a call while the vehicle is in motion unless that person is using a hands-free device. Text messaging while driving is prohibited for all drivers.”

These laws are primary enforcement, which means a police offer can pull you over for using your cell phone.

Food truck operators in Erie County must follow local laws. Below are some of the most crucial requirements they must meet.

The Erie County, New York Department of Health conducts regular inspections of local food facilities, including temporary food stands and establishments. Food truck operators must meet their guidelines to comply with the law.

Amherst town law defines food trucks as “self-contained mobile food units” in which ready-to-eat food is prepared, cooked, wrapped, packaged, processed, or portioned for service, sale, or distribution. Owners or their employees are “mobile food vendors.” These are some essential regulations to note:

Owners or operators must pay certain fees to the town clerk when they apply for a permit, per the below schedule.

| TYPE OF PERMIT | FEE |

|---|---|

| Peddler’s or solicitor’s permit | $50 |

| Transient business permit | $50 |

| Mobile Food Vehicle Vendor permit | $400 for the first vehicle |

| $200 for each additional vehicle | |

| $200 for permit renewals according to regulations. |

As defined in the town zoning laws, food truck vendors can operate only from 9:00 a.m. to 8:00 p.m. if they’re in the front yard of a residential property. If they’re not in the front yard, they can operate from 9:00 a.m. to 11:00 p.m. On commercial property or in a right-of-way next to non-residential property, they may operate from 7:00 a.m. to 11:00 p.m.

WNY Food Trucks features more information about food trucks and vendors in Western New York.

Tiny homes appeal to people who want to simplify their lives. Before you abandon standard housing, you should be aware that tiny homes have specific regulations.

A tiny home is usually considered a mobile home and must follow the same laws. If you are on a plot of land, you will need access to a septic tank, water, and other utilities before you can be approved to live on the land legally.

Amherst has enacted laws regulating house trailers and trailer camps.

Don’t let the laws discourage you from owning a tiny home. Once you become familiar with the requirements, you’ll be ready to own a tiny house.

The Town of Amherst doesn’t have specific laws regarding reserved parking or parking in the wrong direction. It does have some off-street parking, vehicle and traffic, and handicapped parking laws.

You might have some lingering questions about Amherst and car insurance options there. If you want to know more, we’ll answer some questions below.

They’re here to help clear up any confusion you have, whether you’re moving to the city or simply need to know more about it.

So, read on below for answers to the major questions people ask about the Amherst area.

It is, according to Money magazine. It named Amherst — Erie County’s largest suburb — as the best place to live in New York.

Traveling along U.S. route 62 from Buffalo to Amherst by car, it’s nine miles or about 15 minutes away.

The town of Amherst has a population of 122,366, making it the 13th biggest city or town in New York.

New York is a no-fault insurance state. That means that if another driver causes an accident that harms you, you must file a claim with your own insurance company to pay your medical bills and damages.

As such, the state requires drivers to have minimum liability insurance to pay for accident claims. Per New York law, your insurance coverage must meet these requirements:

NOLO states that New York’s no-fault car insurance system applies to personal injuries from car accidents, not vehicle damage. You can, however, file a claim for vehicle damage (or a total loss) against the driver responsible, without limitations.

One way to avoid filing a potential lawsuit is to buy more coverage than the minimum required to pay for all of your injuries or vehicle damage. Otherwise, you may have to pay or file a case for compensation.

The average annual rate for premiums in Amherst is $4,289.88. In East Amherst, it’s $3,662.27, which is slightly $600 less. Depending on your needs and situation, you may pay more or less than these averages.

If you’re ready to see how much you may pay for car insurance in Amherst, try our FREE calculator below for rates.

[/su_spoiler]

Auto Insurance Company Reviews / Cheap Auto Insurance