8:00 - 17:00

Opening Hour: Mon - Fri

| Oregon Statistics Summary | Details |

|---|---|

| Road Miles 2015 | Total in State: 73,544 Vehicle Miles Driven: 35,999 Million |

| Vehicles Registered | 3,479,174 |

| State Population | 4,190,713 |

| Most Popular Vehicle | Outback |

| Percentage of Motorists Uninsured | 12.7% State Rank: 21st |

| Driving Deaths | Speeding (2008-2017) Total: 1,158 Drunk Driving (2008-2017) Total: 1,150 |

| Average Premiums 2015 (Annual) | Liability: $584.13 Collision: $226.83 Comprehensive: $93.87 Combined Premium: $904.83 |

| Cheapest Provider | State Farm Mutual Auto |

Oregon is a magical state. It’s home to ecological diversity like you’ve never seen and offers its residents and tourists alike access to the great expanse of the Pacific Ocean. When you’re driving through Oregon, you have the chance not only to head down to the beach but to explore lush forests, expansive mountain ranges, and bustling, expansive cities.

Navigating Oregon’s roadways, naturally, can be an entrancing but also stressful experience. Finding the best auto insurance as an Oregon resident can also pit you up against all sorts of challenges, be they natural or based in the auto insurance industry. When purchasing auto insurance in Oregon, you have to consider any potential weather hazards while also parsing through dozens of insurance offers from equally numerous providers.

Never fear, though! It’s easier than you may think to find the right kind of auto insurance coverage for your car and lifestyle. In order to take a bit of the stress out of your auto insurance quest, we’ve compiled this comprehensive guide to auto insurance providers in Oregon that’ll keep you legal and safe on the Beaver State’s roadways.

In this guide, we’ll address Oregon’s required coverage and available provider rates as well as the state-specific laws that you’ll have to abide by as an Oregon resident. You can even take advantage of our FREE online tool in order to start comparing rates in your area!

Are you ready to see what the Beaver State has to offer? Let’s get started.

Table of Contents

When you’re shopping for auto insurance, it can be difficult to know what level of coverage is best for you. What’s the difference between minimal and comprehensive coverage? Should you base your purchase off of a provider’s anticipated rates?

The kind of coverage you choose should fit with your driving style and budget. In this section, we’ll explore how living in Oregon impacts the coverage available to you and what, precisely, you’ll be paying for when you purchase coverage as a resident of the Beaver State.

From core coverage to potential coverage add-ons – we’ve got it all here!

In Oregon, state minimum liability coverage operates on a 25/50/20 ratio. We’ve broken down what those ratios mean below:

In addition to the aforementioned minimum liability coverage, the state of Oregon requires that its drivers have the following:

Not all states require you to have these additional points of coverage, but Oregon wants its drivers to remain safe while on the road and to avoid having to dive into personal savings in order to care for anyone or anything injured in an accident.

That said, that amount of coverage sounds like a lot of money, doesn’t it? In actuality, the state minimum auto insurance coverage in Oregon is in place to ensure that while you’re recovering from an accident or helping someone else replace damaged property, you don’t run out of funds. Money goes fast when you’ve been in an accident, and while minimum coverage is useful, it’s always worthwhile to explore more expansive options.

No matter what state you live in, you’re required to carry some form of financial responsibility or proof of insurance on your person while you drive in order to prove to law enforcement that you have your state’s required minimum liability coverage.

Forms of financial responsibility in Oregon can include:

If you happen to get pulled over in the state of Oregon, you need to be able to show a law enforcement representative proof of insurance. Without one of these forms of financial responsibility, you may face fines or the suspension of your license and registration.

If you happen to be driving without auto insurance in Oregon, you may have to file an SR-22 form in order to verify to law enforcement and the state that you do, in fact, have state minimum liability coverage. An SR-22 serves as another form of financial responsibility and can protect you from unnecessary fines or suspensions.

You may also have to file an SR-22 if you:

If you’ve had to file an SR-22, you’ll need to carry it with you in your car or on your person while driving for three years after you’ve received it in order to protect yourself from immediate license suspension.

With all of that cheery information out of the way, let’s get down to brass tacks. Your auto insurance premium in Oregon will be some percentage of your disposable income per capita.

What precisely is the disposable income per capita, though? Effectively, the term applies to the money that you’re able to spend after you’ve paid your taxes for the year.

For example, let’s say you made $80,000 over the course of a year, pre-taxes. After March comes and goes, you’ll have roughly $65,000 to use on every other expense in your life. As such, that $65,000 serves as your disposable income.

The state average of residents’ disposable income serves as a state’s annual per capita disposable income.

In Oregon, the annual per capital disposable income comes to $36,445.

This means that on average, Oregon residents will have $36,445 a year to commit to utilities, rent, groceries, and other forms of insurance. On a monthly basis, that number comes to $3,037.08.

How does your auto insurance premium factor into this number? Well, the average premium for annual full coverage in Oregon comes in at about $894.10. This means that over the course of a year, you’ll pay roughly $900 for your auto insurance coverage.

On a month by month basis, Oregon residents should expect to pay an average of $74.51 a month in order to secure full auto insurance coverage.

That said, Oregon’s state average for auto insurance rates is lower than the national average. Across the United States, the average annual rate for auto insurance is $981. That means that, as an Oregon resident, you’re getting a deal on your insurance!

CalculatorPro

According to the National Association of Insurance Commissioners, core coverage in the state of Oregon rated as follows in 2015.

| Coverage Type | Annual Costs (2015) |

|---|---|

| Liability | $584.13 |

| Collision | $226.83 |

| Comprehensive | $93.87 |

| Combined | $904.83 |

These variant forms of coverage may cost your wallet a little more in the long run. However, if you get into an accident that elicits costs that exceed the amount of minimum coverage you have, you’ll likely find that more extensive coverage will keep you from having to dig into your savings.

Let’s take a look at how the average cost of auto insurance varies from state to state.

Want to learn a little more about the additional coverage available to you? Keep reading to find out more!

We’ve already touched on Uninsured/Underinsured coverage and PIP coverage as part of the state of Oregon’s minimum insurance requirements.

As a refresher, though, note that PIP will cover your personal medical expenses as well as rehabilitation, funeral expenses, loss of earnings, and even childcare expenses that result from an accident regardless of fault. This coverage also extends to anyone in the vehicle with you.

UMBI coverage will protect you if you happen to get into an accident with someone who doesn’t have insurance while UIM will cover if you’re hit by someone who doesn’t have enough coverage to see to all of your expenses. UMBI and UIM coverages ensure that you won’t have to dig into your savings should the person at-fault in an accident be unable to see to your financial needs.

Both PIP and UMBI have their own loss ratios. What, though, is a loss ratio?

In short, a loss ratio tells you how much a particular provider is willing to pay out on an insurance claim.

Providers with rates above 100 percent are able to cover all of their clients’ expenses, but they risk going bankrupt in order to do so. Comparatively, providers with lower rates are less likely to entirely cover their clients, but they’re more financially stable.

Oregon, in particular, is home to providers with average UMBI loss ratios but higher than average PIP loss ratios. That said, national averages for loss ratios range between 94-112 percent. That range leaves Oregon a little above average but otherwise sitting pretty.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 124.89% | 116.36% | 115.50% |

| Uninsured/Underinsured Motorist Coverage | 64.68% | 72.79% | 76.53% |

If you want more options for insurance add-ons, then you’re in luck. There are a variety of ways you can secure additional coverage, so many so that you may end up feeling like a kid in a candy factory.

Don’t let the prospects overwhelm you. We’ve compiled a list of some of the more readily available add-ons that’ll fit into any budget. These forms of coverage will do double-duty to protect you in case of an accident.

Check any of the additional coverage options to learn more about these opportunities:

There are additional factors that can impact your auto insurance rate, including your gender. Though the myth of gender’s influence on a person’s ability to drive a car responsibility has been challenged multiple times, auto insurance providers seem determined to proceed with caution.

| Company | Married 35-year old female Annual Rate | Married 35-year old male Annual Rate | Married 60-year old female Annual Rate | Married 60-year old male Annual Rate | Single 17-year old female Annual Rate | Single 17-year old male Annual Rate | Single 25-year old female Annual Rate | Single 25-year old male Annual Rate |

|---|---|---|---|---|---|---|---|---|

| Blank | $1,914.64 | $1,904.00 | $1,723.47 | $1,794.06 | $5,037.55 | $6,279.58 | $2,206.08 | $2,312.57 |

| Allstate F&C | $3,116.60 | $2,896.79 | $2,841.32 | $2,868.61 | $9,332.73 | $10,401.52 | $3,262.94 | $3,277.55 |

| American Family Mutual | $2,304.32 | $2,304.32 | $2,054.19 | $2,054.19 | $5,697.93 | $8,930.71 | $2,304.32 | $2,413.79 |

| Farmers Ins Co Of OR | $2,069.68 | $2,024.02 | $1,829.43 | $1,945.91 | $8,559.72 | $8,752.78 | $2,317.92 | $2,376.37 |

| Geico Cas | $2,392.62 | $2,311.56 | $2,226.68 | $2,240.44 | $6,189.22 | $5,642.07 | $2,548.10 | $2,200.85 |

| Safeco Ins Co of OR | $2,776.95 | $2,928.21 | $2,411.66 | $2,679.41 | $8,850.63 | $9,545.05 | $2,670.62 | $2,692.84 |

| NICOA | $2,222.89 | $2,212.78 | $1,980.76 | $2,071.14 | $5,087.37 | $6,359.30 | $2,592.14 | $2,729.36 |

| Progressive Universal | $1,926.67 | $1,745.84 | $1,672.83 | $1,722.85 | $8,277.50 | $9,124.21 | $2,301.66 | $2,177.58 |

| State Farm Mutual Auto | $1,618.73 | $1,618.73 | $1,481.05 | $1,481.05 | $5,136.09 | $6,447.93 | $1,836.59 | $2,105.82 |

| Standard Fire Insurance Co | $1,887.50 | $1,902.25 | $1,699.83 | $1,768.58 | $5,296.68 | $6,424.93 | $1,969.94 | $2,002.27 |

| USAA CIC | $1,608.07 | $1,560.55 | $1,590.69 | $1,535.96 | $4,886.29 | $5,247.50 | $2,068.24 | $2,149.86 |

You’ll note that the primary difference in rates displayed here doesn’t fall along gender lines, necessarily, but rather along age lines.

Teenage boys, as you can see, have much higher insurance rates than their female counterparts. Teenagers are considered to be less experienced drivers than their adult counterparts and, as such, have to pay higher rates in order for auto insurance providers to effectively cover any accidents that the driving learning curve may bring about.

Comparatively, middle-aged married women and men have similar auto insurance rates.

The city and county you live in also impact your auto insurance rates.

Oregon’s bigger, urban areas, with their increased amount of traffic, see higher rates than their rural counterparts. Just so you can see the full range of available rates, we’ve compiled the following provider costs next to their applicable city and ZIP code.

| Most Expensive ZIP Codes in Oregon | City | Average Annual Rate by ZIP Code |

|---|---|---|

| 97236 | PORTLAND | $4,908.54 |

| 97233 | PORTLAND | $4,879.89 |

| 97266 | PORTLAND | $4,879.16 |

| 97230 | PORTLAND | $4,798.11 |

| 97216 | PORTLAND | $4,786.62 |

| 97220 | PORTLAND | $4,750.30 |

| 97218 | PORTLAND | $4,666.61 |

| 97206 | PORTLAND | $4,660.64 |

| 97211 | PORTLAND | $4,562.34 |

| 97215 | PORTLAND | $4,538.22 |

| 97030 | GRESHAM | $4,530.67 |

| 97080 | GRESHAM | $4,516.29 |

| 97213 | PORTLAND | $4,466.19 |

| 97203 | PORTLAND | $4,447.21 |

| 97024 | FAIRVIEW | $4,436.31 |

| 97086 | HAPPY VALLEY | $4,429.53 |

| 97217 | PORTLAND | $4,413.23 |

| 97212 | PORTLAND | $4,371.73 |

| 97202 | PORTLAND | $4,353.56 |

| 97060 | TROUTDALE | $4,342.93 |

| 97227 | PORTLAND | $4,322.28 |

| 97089 | DAMASCUS | $4,310.96 |

| 97010 | BRIDAL VEIL | $4,298.84 |

| 97055 | SANDY | $4,281.70 |

| 97009 | BORING | $4,251.54 |

The most expensive ZIP code can be found in Portland, while the cheapest ZIP code can be found in La Grande.

| Cheapest ZIP Codes in Oregon | City | Average Annual Rate by ZIP Codes |

|---|---|---|

| 97850 | LA GRANDE | $2,953.60 |

| 97883 | UNION | $2,977.42 |

| 97814 | BAKER CITY | $3,001.96 |

| 97914 | ONTARIO | $3,007.22 |

| 97918 | VALE | $3,009.25 |

| 97824 | COVE | $3,010.45 |

| 97801 | PENDLETON | $3,011.07 |

| 97859 | MEACHAM | $3,015.05 |

| 97913 | NYSSA | $3,016.37 |

| 97867 | NORTH POWDER | $3,018.90 |

| 97841 | IMBLER | $3,025.25 |

| 97820 | CANYON CITY | $3,025.33 |

| 97876 | SUMMERVILLE | $3,029.90 |

| 97819 | BRIDGEPORT | $3,030.22 |

| 97880 | UKIAH | $3,030.50 |

| 97870 | RICHLAND | $3,033.13 |

| 97833 | HAINES | $3,036.74 |

| 97877 | SUMPTER | $3,038.47 |

| 97905 | DURKEE | $3,040.56 |

| 97754 | PRINEVILLE | $3,041.45 |

| 97738 | HINES | $3,041.62 |

| 97818 | BOARDMAN | $3,043.38 |

| 97827 | ELGIN | $3,044.26 |

| 97479 | SUTHERLIN | $3,044.45 |

| 97834 | HALFWAY | $3,046.41 |

To give you a bigger picture of rates, the tables below show the most expensive and cheapest rates by cities. Take a look to see where your city lands.

| Most Expensive Cities in Oregon | Average Annual Rate by City |

|---|---|

| Maywood Park | $4,750.30 |

| Gresham | $4,726.70 |

| Fairview | $4,436.31 |

| Happy Valley | $4,429.53 |

| Troutdale | $4,342.93 |

| Portland | $4,315.24 |

| Damascus | $4,310.96 |

| Bridal Veil | $4,298.84 |

| Sandy | $4,281.70 |

| Boring | $4,251.54 |

| Clackamas | $4,220.48 |

| Eagle Creek | $4,214.68 |

| Estacada | $4,200.61 |

| Welches | $4,186.59 |

| Brightwood | $4,182.88 |

| Milwaukie | $4,174.20 |

| Molalla | $4,171.20 |

| Rhododendron | $4,162.53 |

| Mulino | $4,149.58 |

| Beavercreek | $4,119.60 |

| Marylhurst | $4,059.09 |

| Oak Grove | $4,058.14 |

| Beaverton | $4,023.12 |

| Gladstone | $4,014.25 |

| Aloha | $3,989.37 |

Even though Portland had the most expensive ZIP code, it is only the sixth most expensive city on the list.

| Cheapest Cities in Oregon | Average Annual Rate by City |

|---|---|

| La Grande | $2,953.60 |

| Union | $2,977.42 |

| Baker City | $3,001.96 |

| Ontario | $3,007.22 |

| Vale | $3,009.25 |

| Cove | $3,010.45 |

| Mission | $3,011.07 |

| Meacham | $3,015.05 |

| Nyssa | $3,016.37 |

| North Powder | $3,018.90 |

| Imbler | $3,025.25 |

| Canyon City | $3,025.33 |

| Summerville | $3,029.90 |

| Bridgeport | $3,030.22 |

| Dale | $3,030.50 |

| Richland | $3,033.13 |

| Haines | $3,036.74 |

| Granite | $3,038.46 |

| Durkee | $3,040.55 |

| Prineville | $3,041.45 |

| Hines | $3,041.62 |

| Boardman | $3,043.38 |

| Elgin | $3,044.26 |

| Sutherlin | $3,044.45 |

| Jamieson | $3,047.01 |

One of the best things about shopping for auto insurance is that no matter what you need, you have dozens upon dozens of auto insurance providers to choose from. However, the kind of diversity of options can get pretty overwhelming, especially when each company is trying to convince you that they have your best interests at heart.

That’s why we’re here to help you weed your way through your available policies. With this comprehensive guide in hand, you’ll be able to figure out exactly what kind of coverage you’re paying for and what kind your lifestyle demands.

First thing’s first, though: what kind of auto insurance providers are most active and effective in Oregon? Certainly choosing one of the ten largest companies is always a sound choice.

Let’s dive into the company ratings, customer complaints, and financial success of some of Oregon’s biggest auto insurance providers.

Assessing a provider’s financial health is one of the best ways to determine whether or not that provider is safe to shop with. What is financial health, though? According to the A.M. Best Rating, it’s the ability of a company to provide for those with its coverage and to retain an income.

If you take a look at the table below, you’ll get a good idea of which providers in Oregon can provide you with the most comprehensive coverage while remaining financially secure.

| Company Name | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | A | $620,489 | 59.83% | 21.28% |

| Progressive Group | A+ | $370,678 | 62.08% | 12.71% |

| Farmers Insurance Group | A | $275,252 | 54.10% | 9.44% |

| Liberty Mutual Group | A | $261,291 | 67.77% | 8.96% |

| Geico | A++ | $260,828 | 70.56% | 8.95% |

| Allstate Insurance Group | A+ | $237,418 | 54.12% | 8.14% |

| USAA Group | A++ | $164,064 | 77.08% | 5.63% |

| Country Insurance & Financial Service Group | A | $104,849 | 58.75% | 3.60% |

| American Family Insurance Group | A+ | $91,870 | 66.64% | 3.15% |

| Nationwide Corp Group | A+ | $68,651 | 71.56% | 2.35% |

For data that’s a little less financially driven, you can take a look at customer satisfaction with Oregon’s various providers. A 2018 J.D. Power study reveals customer’s satisfaction with individual providers’ care all throughout the Pacific Northwest, as you can see below.

| Companies | Ranking | J.D. Power Circle Rating™ |

|---|---|---|

| USAA | 896 | 5 |

| PEMCO Insurance | 842 | 5 |

| The Hartford | 832 | 4 |

| American Family | 826 | 4 |

| State Farm | 817 | 3 |

| Progressive | 808 | 3 |

| Liberty Mutual | 807 | 3 |

| Geico | 805 | 3 |

| Allstate | 798 | 2 |

| Safeco | 798 | 2 |

| Farmers | 785 | 2 |

| Nationwide | 782 | 2 |

| Northwest Region | 813 | 3 |

On the other hand, which companies in Oregon garner the most customer complaints?

| Rank | Company | 2013 Premiums | # Confirmed Complaints | Complaint Index |

|---|---|---|---|---|

| 1 | Mutual of Enumclaw | $24,577,981 | 0 | 0.00 |

| 2 | California Casualty | $12,364,357 | 0 | 0.00 |

| 3 | Oregon Automobile Insurance | $2,356,977 | 0 | 0.00 |

| 4 | Nationwide | $27,621,198 | 1 | 0.33 |

| 5 | Oregon Mutual Group | $226,313,718 | 1 | 0.33 |

| 6 | Country Financial Insurance | $76,467,503 | 3 | 0.35 |

| 7 | State Farm | $458,101,249 | 23 | 0.46 |

| 8 | Allstate | $145,845,584 | 11 | 0.69 |

| 9 | Farmers | $257,482,967 | 25 | 0.89 |

| 10 | Progressive | $233,583,428 | 23 | 0.90 |

| 11 | Geico | $105,245,810 | 12 | 1.05 |

| 12 | Safeco | $161,089,253 | 28 | 1.60 |

| 13 | American Family | $67,474,556 | 12 | 1.63 |

| 14 | USAA | $70,876,072 | 13 | 1.68 |

| 15 | Sublimity | $9,324,662 | 2 | 1.97 |

| 16 | Liberty Mutual | $41,884,111 | 11 | 2.41 |

| 17 | Unitrin | $13,016,683 | 4 | 2.82 |

Complaints don’t always determine whether or not a company can provide you with excellent coverage, but the numbers will tell you something about their customer service.

Different companies will also offer you different rates, which means there’s some benefit to doing your research prior to committing to a plan. Take a look at the range of rates available to you as an Oregon resident.

| Company | Annual Average | Compared to State Average | Percent Compared to State Average |

|---|---|---|---|

| Allstate F&C | $4,749.76 | $1,352.64 | 28.48% |

| American Family Mutual | $3,507.97 | $110.85 | 3.16% |

| Farmers Ins Co Of OR | $3,734.48 | $337.36 | 9.03% |

| Geico Cas | $3,218.94 | -$178.18 | -5.54% |

| Safeco Ins Co of OR | $4,319.42 | $922.30 | 21.35% |

| NICOA | $3,156.97 | -$240.15 | -7.61% |

| Progressive Universal | $3,618.64 | $221.52 | 6.12% |

| State Farm Mutual Auto | $2,715.75 | -$681.37 | -25.09% |

| Standard Fire Insurance Co | $2,869.00 | -$528.12 | -18.41% |

| USAA CIC | $2,580.90 | -$816.22 | -31.63% |

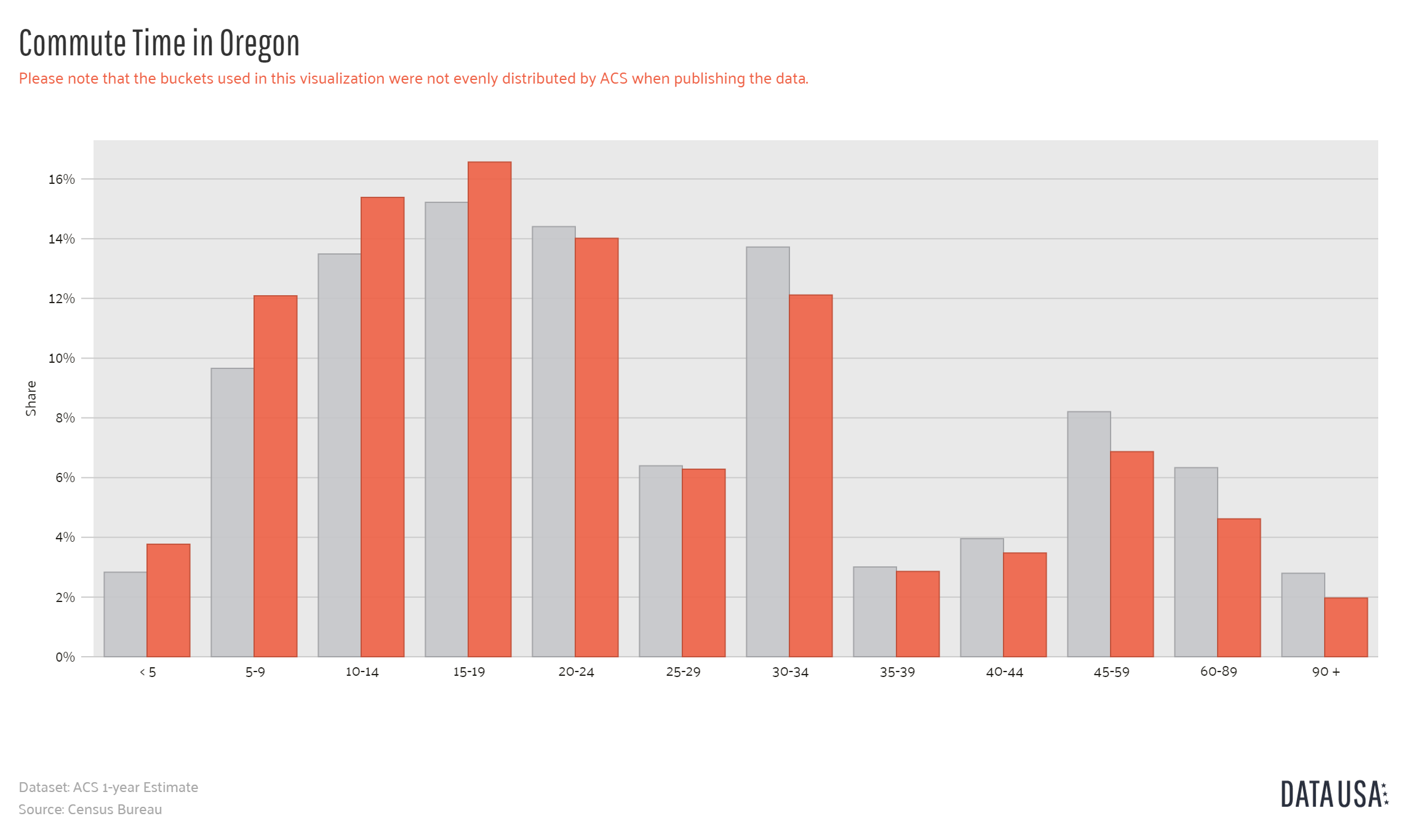

The distance you travel while driving to and from work does, in fact, contribute to your auto insurance rate. Drivers with more significant commutes tend to be charged more for their coverage due to the greater amount of time they spend on the road.

| Companies | 10-mile commute. 6,000 annual mileage. | 25-mile commute. 12,000 annual mileage. |

|---|---|---|

| USAA | $2,506.99 | $2,654.80 |

| State Farm | $2,645.69 | $2,785.80 |

| Travelers | $2,754.32 | $2,983.68 |

| Nationwide | $3,156.97 | $3,156.97 |

| Geico | $3,165.82 | $3,272.06 |

| American Family | $3,453.60 | $3,562.34 |

| Progressive | $3,618.64 | $3,618.64 |

| Farmers | $3,734.48 | $3,734.48 |

| Liberty Mutual | $4,319.42 | $4,319.42 |

| Allstate | $4,749.76 | $4,749.76 |

That said, there’s not always a difference in rate based on a person’s commute. If your commute is a little bit longer than average, though, you may want to factor it into your rate comparisons.

Commute times are among a handful of factors that contribute to rates increasing. Take a look at some of the others.

Likewise, the amount of coverage you want protecting your car while you drive will vary the rates that you’re offered by providers throughout Oregon. You may be tempted to take on a less expensive plan simply to save money, but remember: being underinsured can lead to greater expenses in the long run.

| Companies | Low | Medium | High |

|---|---|---|---|

| USAA | $2,468.39 | $2,583.40 | $2,690.90 |

| State Farm | $2,564.14 | $2,719.79 | $2,863.31 |

| Travelers | $2,690.23 | $2,853.40 | $3,063.38 |

| Geico | $2,956.17 | $3,234.73 | $3,465.92 |

| Nationwide | $3,008.89 | $3,241.68 | $3,220.33 |

| American Family | $3,490.82 | $3,709.39 | $3,323.69 |

| Progressive | $3,491.04 | $3,601.67 | $3,763.21 |

| Farmers | $3,499.81 | $3,685.73 | $4,017.90 |

| Liberty Mutual | $4,052.06 | $4,308.05 | $4,598.16 |

| Allstate | $4,569.25 | $4,739.52 | $4,940.50 |

We can also see how rates compare between the top ten companies in the region when putting up against the state average.

You won’t be too surprised to learn that your credit history will impact your insurance rate. Your credit history reflects your ability to pay back the money you owe, and auto insurance providers want to ensure that you’ll be able to stay on top of your rates for as long as you’re partnered with them.

| Companies | Good | Fair | Poor |

|---|---|---|---|

| USAA | $1,719.01 | $2,157.98 | $3,865.69 |

| State Farm | $1,935.03 | $2,419.05 | $3,793.17 |

| Travelers | $2,210.28 | $2,810.04 | $3,586.68 |

| Geico | $2,554.43 | $3,218.94 | $3,883.45 |

| Nationwide | $2,625.62 | $3,028.06 | $3,817.24 |

| American Family | $2,779.49 | $3,288.44 | $4,455.98 |

| Liberty Mutual | $2,886.97 | $3,737.43 | $6,333.87 |

| Progressive | $3,274.88 | $3,515.16 | $4,065.88 |

| Farmers | $3,351.28 | $3,535.79 | $4,316.37 |

| Allstate | $3,621.66 | $4,389.68 | $6,237.94 |

As you can see, drivers with lower credit scores are charged more for their coverage than those with fair or good scores.

The average credit score throughout the state of Oregon is 688. Compared to the national average of 675, Oregon is sitting pretty with an above average state credit!

Last but not least, your driving history will without a doubt impact the kind of rates and coverage that you’re offered by Oregon’s auto insurance providers. If you’re prone to traffic violations or car accidents, then your provider of choice will need you to be paying for a greater amount of coverage than a driver with a clean record.

| Companies | Clean record | With one speeding violation | With one accident | With one DUI |

|---|---|---|---|---|

| USAA | $1,874.54 | $2,194.01 | $2,616.67 | $3,638.37 |

| Geico | $2,120.41 | $2,928.42 | $3,378.95 | $4,447.98 |

| Travelers | $2,324.83 | $2,836.34 | $2,973.80 | $3,341.03 |

| State Farm | $2,408.68 | $2,654.33 | $3,145.65 | $2,654.33 |

| American Family | $2,440.25 | $3,127.99 | $3,743.66 | $4,719.97 |

| Nationwide | $2,676.81 | $3,027.83 | $2,866.59 | $4,056.64 |

| Progressive | $2,729.50 | $3,251.19 | $4,977.18 | $3,516.70 |

| Farmers | $3,149.22 | $3,763.01 | $4,057.67 | $3,968.02 |

| Liberty Mutual | $3,826.69 | $4,254.32 | $4,282.10 | $4,914.58 |

| Allstate | $3,828.80 | $4,670.30 | $5,162.22 | $5,337.70 |

As you can see, even a single speeding violation can significantly increase the auto insurance rate you have to pay.

When you move to Oregon, you’ll have the option to choose to purchase coverage from domestic insurers and foreign insurers. What’s the difference?

Domestic insurers are providers who are state-local. You won’t find branches for these insurers outside of the state of Oregon, and their policies comply solely with Oregon’s driving laws.

Foreign insurers are providers who operate on a national level and whose policies aren’t state-specific.

This difference shouldn’t necessarily impact your auto insurer provider search, but you will want to think about the ways that foreign insurer’s policies may or may not fall short of Oregon’s minimum liability coverage.

Driving laws vary from state to state. If you’re just moving to Oregon, it may be difficult for you to keep your previous state’s laws and Oregon’s driver laws straight in your mind. Keeping track of Oregon’s state laws, though, can prevent you from getting pulled over for violating a law you weren’t even aware of.

As part of this comprehensive guide to auto insurance and road operations in Oregon, we’ve compiled a list of the state’s driver-oriented laws. You can reference this guide at any time to make sure that you’ve got all of the most important driving laws under your belt.

Take a look through this section before you hit the road, and you’ll be among the safest drivers in the Beaver State.

We’ve already mentioned the minimum liability coverage that the state of Oregon requires all of its registered drivers to have. Ensuring that you have the basic amount of auto insurance that the state requires not only keeps you safe in case you get in an accident, but proof of that insurance will prevent you from having your license suspended by the state.

Just as a refresher, Oregon requires the following minimum liability coverage:

The last thing you want to end up doing is driving down an interstate and BAM! A rock hits and fractures your windshield. If that experience isn’t bad enough, a number of states would require you to go through hyper-specific procedures in order to replace your broken windshield.

Oregon is not one of these states.

While, on one hand, this means that auto insurance providers are not required to include full glass coverage in Oregon in their comprehensive plans, it also means that you won’t have to dig into your savings in order to afford newly-minted windshield glass.

Instead, insurers in Oregon can provide you with after-market windshields – so long as they’re of the same quality, fit, finish, and function as your original windshield – to save you money and time.

Now, if you do want coverage from a provider who’ll include windshield replacement in your plan, you can shop around through the state of Oregon to find the best provider for you.

Learn more here: Oregon Windshield Insurance

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Similarly, Oregon’s auto insurance providers are not required by law to provide every driver in the state with coverage. If you or someone you know has a poor history of driving, you may be considered a “high-risk driver.”

What precisely is a high-risk driver? It’s someone who’s driving history reflects a number of accidents, DUIs, tickets, or other traffic violations and who insurance companies may believe that they’ll need to provide significant coverage for.

The state of Oregon has a plan in place to see to it that high-risk drivers registered with the state receive the state’s minimum liability coverage. This plan is known as the Automobile Insurance Plan of Oregon, or OR AIP.

It’s worth noting that you have to apply to be covered by OR AIP. In order to be considered for coverage through the program, you have to meet the following requirements:

You may be rejected from the plan if you:

If you are accepted to the plan, your coverage will be allocated to one of the state’s many providers. That said, you’ll have the state minimum coverage, but you may be covered by a company you’re not particularly interested in. Without any other coverage options, though, you’ll have to work within the bounds of the plan the state allocates for you.

Unfortunately, low-income families do not have access to any government-sponsored insurance programs at this point in time. Low-income families without a poor driving history are also unable to apply for OR AIP.

That said, there are still things you can do in order to find affordable auto insurance coverage in the state of Oregon. Ask your preferred insurance provider if they have any discounts available that you could be awarded for a clean driving record, strong credit history, or any of the common themes below:

Auto insurance fraud is kind of a big deal. That said, it’s also a crime that’s extremely hard to commit unintentionally.

In order to commit insurance fraud, you’ll have had to:

The consequences of automobile fraud range from hefty fines to jail time. Don’t bother making a false claim because you think it’ll bring you some extra dough. The price isn’t worth the crime.

If you’ve been in an accident, there’s a limited amount of time in which you’re able to make a auto insurance claim regarding any injuries or property damage sustained. This time period is referred to as the statute of limitations.

In Oregon, you’ll have:

Note that while that may seem like a lot of time, overcoming the consequences of an accident can eat into your statute of limitations. As such, do what you can to file a claim for personal injuries or property damage as quickly as you can after a car accident in order to get all of the coverage that you deserve.

Oregon, specifically, has a law in place designed to ensure that no one in the state speeds up and runs a yellow light.

While this behavior may be acceptable in other states, Oregon has ORS 811.265 in place in order to limit the number of intersection fatalities that arise over the course of a year.

In Oregon, you are only able to drive through a yellow light if you were otherwise unable to stop your vehicle safely at the intersection in question.

We’ve already briefly touched on the driver requirements that’ll keep you legal on Oregon’s roadways. Just as a refresher, though, in order to maintain your vehicle license in Oregon, you have to have one of the following forms of financial responsibility – otherwise known as “proof of insurance” – on you at all times while you’re driving:

For some more specific Oregon requirements, keep on reading and arm yourself with the knowledge that’ll make you a safer driver.

If you get caught driving without insurance, you could be in some serious trouble. In Oregon, the first time you’re pulled over and found not to have one of the aforementioned forms of financial responsibility on your person, you’ll be facing fines and penalties alike.

A first-time offense for driving without insurance in Oregon results in:

If you are or have a teenager who’s raring to get on the road, you’re in luck. Oregon allows young drivers to apply for their learner’s permits at the age of 15!

That said, there are restrictions placed on learner’s permits that are designed to keep younger drivers safe on the road. These restrictions will be slowly peeled back over time as the young driver in question receives her full license or a restricted license.

| Teen Driving Requirements | Details |

|---|---|

| Minimum Age (Learner's Permit) | 15 years old |

| Minimum Age (Driver's License) | 16 years old |

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (100 hours without driver education) |

| Nighttime Restrictions | During Intermediate/Restricted License Stage: Midnight - 5 a.m. Restrictions Lifted: 12 months or age 18 (whichever comes first) |

| Passenger Restrictions | During Intermediate/Restricted License Stage: first 6 months–no passengers younger than 20; second 6 months–no more than 3 passengers younger than 20 Restrictions Lifted: 12 months or age 18 (whichever comes first) |

Unlike a number of other states, driver’s education is required in Oregon so long as the driver in question is younger than 18 years old.

However, if a young driver has 50 hours of supervised driving recorded, she’ll be able to take her driver’s test without having to go through driver’s education.

On the other end of the spectrum, drivers 50 years old or older also have restrictions placed on their ability to renew their licenses.

| Older Driver Requirements | Details |

|---|---|

| License Renewal Cycle | 8 years |

| Proof of Adequate Vision (required at renewal) | 50 and older, every renewal |

| Mail or Online Renewal Permitted | No |

Everyone in Oregon has to go to the DMV every eight years in order to get their license renewed. However, any driver over 50 years old also has to have a vision test upon the renewal of their license.

Unfortunately, you can’t avoid the line at the DMV by submitting a renewal application online or through the mail. No matter what your age, you’ll have to renew your license in person.

Have the mountains, ocean, and general beauty of Oregon won you over? Then you’re going to have to take a few steps to make sure that you properly register your car with your new home state.

Once you’ve settled in as a resident of the Beaver State, you’ll have 30 days to title and register your car with the state. All you’ll need to do is swing by your local DMV in order to get all of your information in order.

From there, you’ll need to make sure that your pre-existing insurance policy complies with Oregon’s state minimum liability coverage requirements. Just as a refresher, the ratio for insurance in Oregon is 25/50/20 with an additional 15/20/50 set aside for UMM and PIP. Let’s break those ratios down one more time:

Like we’ve mentioned, renewing your license in Oregon is a fairly straightforward process. While you’re not doing to be able to avoid the line at the DMV, you can avoid an eye exam so long as you’re under 50 years of age.

The state of Oregon requires you to renew your license in person at the DMV every eight years in order to drive legally on the road.

Want to stay safe and legal on Oregon’s roadways? We address move over laws, seat belt legislation, speed limits, and more so you can avoid unnecessary fines and drive with more confidence.

Oregon is an at-fault state. This means that when an accident occurs, one driver is determined to be at-fault.

This driver then must take on the financial responsibility of paying for the other driver’s medical and property damage in addition to any damage they themselves may have sustained.

This “at-fault” policy is what makes having the right kind of coverage so essential in Oregon. If you’re not protected, you may find yourself having to use our savings in order to pay for someone else’s medical bills. Of course, because Oregon requires PIP and UMBI, you’ll likely be a little safer than you would be otherwise.

All the same, it’s worth it to consider what kind of add-ons will make your auto insurance policy more comprehensive.

Seat belts and car seats are designed to keep all passengers in a car as safe as possible. As such, child safety seat laws in Oregon are exceptionally strict.

| Oregon Seat Belt Laws | Details |

|---|---|

| Effective Date | 12/07/1990 |

| Primary Enforcement | Yes ; Effective 12/07/1990 |

| Age/Seats Applicable | 16+ years in all seats |

| 1st Offense Max Fine | $115 |

| Oregon Car Seat Laws | Details |

|---|---|

| Must be in child safety seat | Younger than 2 years must be in a rear facing child restraint; 7 or younger: 40 pounds or less must be in a child restraint; more than 40 pounds but 4 feet and 9 inches or less must be in a booster seat |

| Adult belt permissible | Taller than 4 feet and 9 inches; 8 through 15 |

| Max Base Fines for 1st Offense | $75 |

| Preference for Rear Seat | Law states no preference for rear seats |

Because the seat belt and car seat policies listed above are subject to primary enforcement, an officer doesn’t need any other reason to pull your car over if she notices that you’re driving without a seat belt on.

These seat belt restrictions do not apply to the cargo area of trucks. However, these spaces have their own set of legalities.

The only people who can ride in the cargo area of a truck are:

Seem specific? It is on purpose. Once again, seat belt, car seat, and cargo area laws are in place to keep all of the passengers in a vehicle as safe as possible.

Keep Right laws in Oregon dictate that if you’re driving at a speed that’s slower than the posted speed limit, you need to stay in the right-hand lane of the road you’re on.

Move Over laws in Oregon require you to move out of the way of an oncoming vehicle with flashing lights that happens to be moving in the same direction you are. This ensures that emergency vehicles can make it to their destinations without delay.

Some examples of other vehicles you’ll want to move over for include the following:

Even though you may want to be, you’re no Speed Racer. Speeding, in fact, is the source of the majority of fines across the United States. If you’re looking to avoid unnecessary tickets, keep Oregon’s posted speed limits in mind.

| Oregon Speed Limits | Details |

|---|---|

| Rural Interstates | Cars: 65 mph; 70 MPH on specified segments of road Trucks: 55 mph; 65 MPH on specified segments of road |

| Urban Interstates | 55 MPH |

| Other Limited Access Roads | 65 MPH |

| Other Roads | 65 MPH |

You’ll note that these listed limits are the maximum speed for their road types. Rural interstates may see less traffic than urban interstates, but that doesn’t mean that your speedometer can start creeping upward.

These days, Lyft and Uber are more than just ridesharing services. They’re also job opportunities. If you use your car as part of a ridesharing or delivery position, you’ll need ridesharing insurance in addition to Oregon’s state minimum coverage.

State Farm and USAA are the only two providers in the state of Oregon who offer ridesharing coverage.

You can always check with your superior to see if you can make use of company insurance while working in the rideshare industry. If you can’t, you’ll want to do some additional shopping in order to find the best policy for you.

You can also make behavioral decisions that’ll keep you and your fellow drivers safer on Oregon’s roadways. These rules apply to things like drinking and driving and the use of hand-held devices while you’re behind the wheel.

It’s fun to go out drinking with friends, no question. What isn’t fun is attempting to drive home and having someone – maybe you, maybe another driver – getting injured in the process.

As of 2017, 137 of Oregon’s fatalities were attributed to alcohol-impaired driving. In order to combat this trend, the state has strict DUI policies in place.

| Formal Name for Offense | BAC Limit | High BAC Limit | Criminal Status | Look Back Period |

|---|---|---|---|---|

| Driving Under the Influence of Intoxicants | 0.08 | 0.15 | 1st-3rd class A misdemeanors, 4th+ class C felonies | 10 years |

As you can see, while an initial DUI offense will result in a misdemeanor, your fourth will result in a felony and can land you jail time. Take a look at our breakdown of the consequences of driving while intoxicated.

| Number of Offense | License Revocation | Jail Time | Fine | Other |

|---|---|---|---|---|

| 1st | 1 year | 2 days - 1 year OR 80 hours community service | min $1000 for BAC; min $2000 for HBAC; up $10000 if child in car | drug and alcohol program, participation in victim impact panel, IID for 1 year after license suspension |

| 2nd | 3 years | minimum 2 days, but up to 1 year | min $1500; HBAC min $2000; up to $10000 if child in car | IID for 2 years after suspenion, treatment program and victim impact panel |

| 3rd | mandatory lifetime, not elegible for hardship license, may apply for reinstatement after 10 years | 90 day minimum | $2000 min, additional $2000 for HBAC | - |

| 4th | Felony | - | - | - |

Drinking and driving is an expensive misdemeanor. Not only will you have to pay out to repay the state for your offense, but if you get caught drinking and driving for a third time, you risk losing your license for the rest of your life.

There are simple ways to avoid driving while intoxicated. Ridesharing programs like Lyft and Uber are ideal for getting you home safely, and electing a designated driver at the beginning of the night is a great way to make sure that no one intoxicated gets behind a steering wheel.

With innovations in today’s technology, it seems like there isn’t a single person alive who doesn’t have access to a smartphone. With this increased connectivity comes the urge to text or call someone while you’re on the road.

Don’t do this. Staying in touch with a friend or loved one may feel important, but you can’t focus on the road and send a message without compromising your focus.

In order to limit the number of hand-held related fatalities that Oregon sees over the course of a year, the state government has implemented an all-encompassing hand-held ban throughout the state.

| Hand-held ban | Young driver cell phone ban | Texting ban | Enforcement |

|---|---|---|---|

| All drivers | drivers younger than 18 | All drivers | Primary |

According to the IIHS, drivers in Oregon are not allowed to use any electronic devices in one or both hands while driving a vehicle on a public highway. This means that if you’re in the driver’s seat, you legally cannot touch your phone – not while you’re at stoplights, not while you’re stuck in traffic, nada.

It’s also worth noting that getting caught using a cellphone or other hand-held device if a first-string offense, meaning that you can receive a ticket for this and no other reason if an officer spots you.

With laws and legalities out of the way, you may feel as though you know everything there is to know about driving safely in Oregon. Not so! We’re here to help you explore the ways those laws and legalities translate into your everyday driving experience in the Beaver State.

Here we’ll address the fatality and vehicle facts that you need to know in order to be a more conscientious driver.

It’s not always sports cars that are the first to be stolen by car thieves. In Oregon, in fact, Honda Accords and Civics go significantly faster than their flashy cousins.

| Rank | Make/Model | Year of Vehicle | Year | Thefts |

|---|---|---|---|---|

| 1 | Honda Accord | 1994 | 1994 | 1,491 |

| 2 | Honda Civic | 1998 | 1998 | 1,276 |

| 3 | Subaru Legacy | 1998 | 1998 | 377 |

| 4 | Ford Pickup (Full Size) | 2004 | 2004 | 295 |

| 5 | Toyota Camry | 1990 | 1990 | 221 |

| 6 | Chevrolet Pickup (Full Size) | 1999 | 1999 | 217 |

| 7 | Acura Integra | 1994 | 1994 | 209 |

| 8 | Subaru Impreza | 1999 | 1999 | 171 |

| 9 | Honda CR-V | 1999 | 1999 | 158 |

| 10 | Jeep Cherokee/Grand Cherokee | 1994 | 1994 | 141 |

It’s not just the make and model that catches a person’s eye, though. The place where a person lives, works, and drives can impact the likelihood of their car getting stolen. The FBI has compiled a list of Oregon’s vehicle thefts by city, as you can see below.

| City | Population | Motor Vehicle Theft |

|---|---|---|

| Salem | 158,234 | 656 |

| Eugene | 158,499 | 608 |

| Gresham | 109,965 | 510 |

| Springfield | 60,024 | 270 |

| Grants Pass | 34,865 | 236 |

| Medford | 76,949 | 163 |

| Albany | 51,645 | 142 |

| Hillsboro | 96,313 | 126 |

| Bend | 79,926 | 87 |

| Beaverton | 93,551 | 83 |

Theft isn’t the only thing Oregon drivers have to worry about. Let’s touch on all of the major causes of traffic fatalities across the state so you can drive more carefully.

It won’t surprise you to learn that weather and light contribute to a significant number of traffic fatalities a year. We’ve touched on the ways that different conditions impact people’s ability to drive in the table below.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 180 | 42 | 61 | 12 | 3 | 298 |

| Rain | 17 | 14 | 24 | 1 | 0 | 56 |

| Snow/Sleet | 10 | 0 | 3 | 0 | 0 | 13 |

| Other | 4 | 2 | 5 | 1 | 0 | 12 |

| Unknown | 9 | 0 | 9 | 0 | 3 | 21 |

| TOTAL | 220 | 58 | 102 | 14 | 6 | 400 |

Oregon isn’t exactly the sunshine state, so when a sunny afternoon gives way to an Oregon downpour, make sure that you’re taking things a little bit slower than you normally would.

The type of road that you’re driving on will also contribute to the likelihood of your getting into an accident.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 300 | 292 | 216 | 217 | 229 | 199 | 237 | 282 | 309 | 284 |

| Urban | 116 | 85 | 101 | 114 | 108 | 114 | 120 | 163 | 189 | 153 |

| Unknown | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 |

Even though urban roads see more traffic than rural ones, rural roads in Oregon see more fatalities over the course of a year than those in the cities.

A person’s relationship to the cars on the road – be they passenger, occupant, or pedestrian – also impacts the likelihood that they’ll be involved in an accident. Even the car a person is driving can increase or decrease their likelihood of a fatality. Take a look at the data below.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car Occupants | 134 | 128 | 152 | 182 | 155 |

| Light Pickup Truck Occupants | 37 | 56 | 60 | 68 | 60 |

| Light Utility Truck Occupants | 33 | 43 | 56 | 68 | 47 |

| Large Truck Occupants | 5 | 7 | 8 | 9 | 10 |

| Other/Unknown Occupants | 3 | 8 | 5 | 7 | 5 |

| Van Occupants | 11 | 5 | 20 | 24 | 14 |

| Bus Occupants | 0 | 0 | 1 | 0 | 0 |

| Motorcyclists | 34 | 46 | 61 | 55 | 57 |

| Pedestrians | 48 | 57 | 69 | 71 | 69 |

| Bicyclists and Other Cyclists | 3 | 7 | 8 | 10 | 10 |

| Other/Unknown Non-occupants | 4 | 0 | 5 | 3 | 4 |

| State Total | 313 | 357 | 446 | 498 | 437 |

As you can see, passenger cars see the most accidents by far in Oregon.

Crashes aren’t all one and the same, though. Fatality commonality will vary based on the number of cars and types of vehicles that were involved in individual crashes.

| Crash Type and Fatality Totals | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Single Vehicle | 190 | 220 | 280 | 266 | 252 |

| Involving a Large Truck | 33 | 32 | 53 | 53 | 54 |

| Involving Speeding | 95 | 105 | 119 | 143 | 119 |

| Involving a Rollover | 67 | 90 | 109 | 95 | 92 |

| Involving a Roadway Departure | 187 | 228 | 278 | 309 | 280 |

| Involving an Intersection (or Intersection Related) | 69 | 71 | 90 | 87 | 66 |

| Total Fatalities (All Crashes) | 313 | 357 | 446 | 498 | 437 |

There are also a number of individual counties that are more likely to see a higher fatality rate than others. Our collected data shows that the following Oregon counties see the most fatalities over the course of a single year.

| Rank | County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Multnomah County | 52 | 28 | 41 | 55 | 58 |

| 2 | Marion County | 14 | 25 | 24 | 37 | 40 |

| 3 | Lane County | 33 | 45 | 57 | 45 | 32 |

| 4 | Clackamas County | 16 | 38 | 27 | 44 | 29 |

| 5 | Jackson County | 15 | 17 | 25 | 34 | 24 |

| 6 | Douglas County | 13 | 27 | 31 | 16 | 23 |

| 7 | Deschutes County | 7 | 13 | 13 | 24 | 21 |

| 8 | Washington County | 21 | 16 | 28 | 30 | 21 |

| 9 | Josephine County | 12 | 13 | 24 | 24 | 19 |

| 10 | Klamath County | 14 | 11 | 15 | 14 | 17 |

| Total | All Counties | 313 | 357 | 446 | 498 | 437 |

We’re not saying that a higher fatality rate in your county means that you need to move. Rather, the fatality rate of your area should impact your auto insurance considerations and encourage you to drive a little more cautiously.

As we briefly touched on before, speeding causes a significant number of driving fatalities both in Oregon and across the United States.

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Baker | 0 | 1 | 0 | 0 | 0 |

| Benton | 0 | 2 | 0 | 1 | 0 |

| Clackamas | 7 | 9 | 5 | 17 | 12 |

| Clatsop | 2 | 1 | 0 | 8 | 7 |

| Columbia | 3 | 1 | 2 | 3 | 0 |

| Coos | 2 | 3 | 0 | 3 | 6 |

| Crook | 0 | 1 | 2 | 1 | 3 |

| Curry | 2 | 1 | 0 | 1 | 0 |

| Deschutes | 2 | 7 | 8 | 5 | 5 |

| Douglas | 3 | 5 | 8 | 4 | 5 |

| Gilliam | 0 | 0 | 0 | 0 | 0 |

| Grant | 1 | 0 | 1 | 1 | 1 |

| Harney | 1 | 1 | 2 | 0 | 1 |

| Hood River | 2 | 0 | 0 | 1 | 0 |

| Jackson | 6 | 7 | 7 | 11 | 8 |

| Jefferson | 2 | 1 | 1 | 1 | 0 |

| Josephine | 4 | 6 | 9 | 8 | 5 |

| Klamath | 5 | 4 | 8 | 7 | 6 |

| Lake | 0 | 0 | 0 | 1 | 0 |

| Lane | 9 | 12 | 17 | 11 | 5 |

| Lincoln | 2 | 3 | 2 | 1 | 2 |

| Linn | 1 | 3 | 1 | 2 | 2 |

| Malheur | 3 | 3 | 1 | 2 | 3 |

| Marion | 5 | 3 | 7 | 13 | 12 |

| Morrow | 1 | 1 | 0 | 0 | 0 |

| Multnomah | 20 | 12 | 15 | 16 | 18 |

| Polk | 1 | 2 | 5 | 3 | 2 |

| Sherman | 0 | 0 | 0 | 0 | 0 |

| Tillamook | 2 | 1 | 3 | 0 | 1 |

| Umatilla | 4 | 5 | 3 | 1 | 1 |

| Union | 0 | 1 | 2 | 3 | 0 |

| Wallowa | 1 | 3 | 0 | 1 | 1 |

| Wasco | 0 | 2 | 2 | 5 | 6 |

| Washington | 3 | 2 | 5 | 9 | 5 |

| Wheeler | 0 | 0 | 1 | 0 | 0 |

| Yamhill | 1 | 2 | 2 | 3 | 2 |

As you can see, in 2017, 119 of Oregon’s fatalities involved a driver who was speeding.

We’ve already touched on the dangers of drunk driving, but what does the fatality rate of those drivers look like in Oregon?

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Baker | 1 | 1 | 3 | 1 | 0 |

| Benton | 0 | 1 | 0 | 4 | 5 |

| Clackamas | 8 | 9 | 11 | 18 | 11 |

| Clatsop | 0 | 0 | 1 | 2 | 6 |

| Columbia | 1 | 1 | 3 | 2 | 1 |

| Coos | 0 | 3 | 3 | 2 | 3 |

| Crook | 0 | 0 | 3 | 1 | 4 |

| Curry | 2 | 2 | 1 | 0 | 0 |

| Deschutes | 2 | 6 | 2 | 7 | 6 |

| Douglas | 5 | 6 | 5 | 3 | 6 |

| Gilliam | 0 | 0 | 0 | 0 | 0 |

| Grant | 1 | 0 | 1 | 1 | 1 |

| Harney | 1 | 3 | 2 | 0 | 0 |

| Hood River | 0 | 0 | 2 | 1 | 0 |

| Jackson | 5 | 8 | 9 | 12 | 9 |

| Jefferson | 3 | 2 | 4 | 1 | 2 |

| Josephine | 4 | 3 | 15 | 10 | 8 |

| Klamath | 5 | 4 | 7 | 6 | 5 |

| Lake | 1 | 0 | 0 | 2 | 0 |

| Lane | 10 | 12 | 20 | 13 | 6 |

| Lincoln | 1 | 2 | 3 | 3 | 2 |

| Linn | 4 | 4 | 6 | 5 | 3 |

| Malheur | 2 | 0 | 1 | 4 | 3 |

| Marion | 6 | 4 | 9 | 11 | 17 |

| Morrow | 1 | 2 | 2 | 0 | 1 |

| Multnomah | 22 | 8 | 18 | 15 | 16 |

| Polk | 2 | 1 | 8 | 3 | 5 |

| Sherman | 0 | 0 | 1 | 0 | 0 |

| Tillamook | 3 | 0 | 1 | 0 | 1 |

| Umatilla | 4 | 4 | 1 | 6 | 1 |

| Union | 0 | 1 | 2 | 1 | 0 |

| Wallowa | 1 | 4 | 0 | 1 | 0 |

| Wasco | 1 | 0 | 1 | 3 | 2 |

| Washington | 5 | 4 | 6 | 11 | 6 |

| Wheeler | 0 | 0 | 0 | 0 | 3 |

| Yamhill | 0 | 1 | 3 | 3 | 5 |

The numbers aren’t especially positive. You also have to consider the fact that these statistics include a number of teenage drivers who were caught in an accident after drinking.

In 2018, Oregon ranked 15th in a list of the most dangerous states for drunk driving. It ranks 16th among the most dangerous states for teenage drunk drivers.

This high ranking contributes to Oregon’s push back against drinking and driving. The state hopes that with stricter punishments for both DUIs and underage drinking, the state’s percentage of fatalities involving an intoxicated driver can be curbed.

The good news is that if you happen to get in an accident, Oregon’s Emergency Medical Services will quickly become your new best friends. The location of your accident will impact how quickly the EMS will be able to reach your location and get you to a hospital.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 4.92 min | 13.75 min | 42.89 min | 58.34 min | 269 |

| Urban | 1.19 min | 6.73 min | 29.02 min | 37.50 min | 179 |

While it takes the EMS a little longer to arrive in rural areas, you’ll note that the response times for both rural and urban areas in Oregon are under an hour. That’s great news! This means that the EMS will be able to get you or a loved one away from the site of an accident quickly and efficiently.

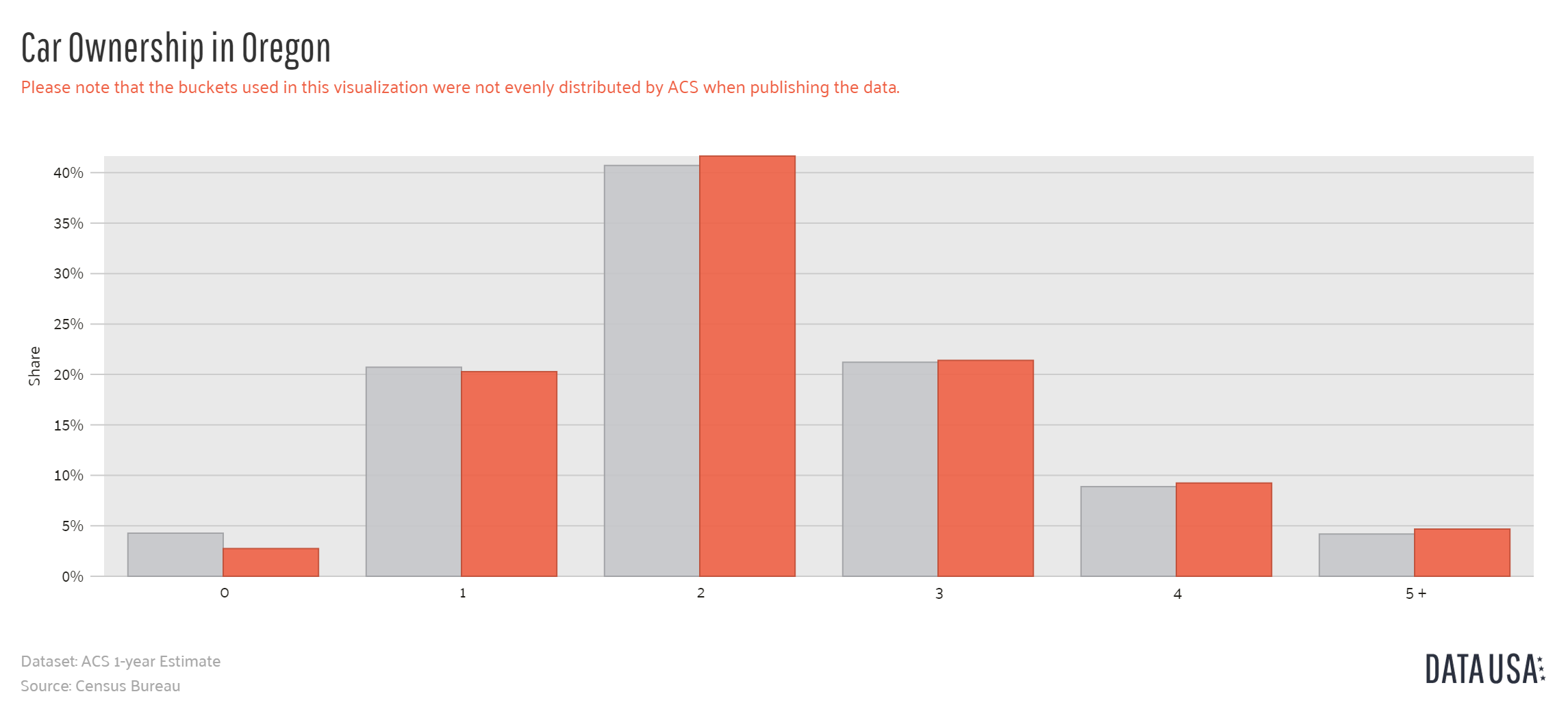

With all of the finer points of Oregon legality out of the way, we can take a final look at some of the traffic statistics the state has to offer. We’ll touch on the average number of cars Oregon residents own and how much time you might expect to spend commuting to work in the morning.

On average, Oregon residents keep two cars in their garages. This means that it’s easier for individual family members to travel, but it may also mean that your morning commute is a little more crowded.

That said, Oregon has an average commute time of 22.3 minutes. That’s not too bad, all things considered. Oregon actually comes in three minutes under the average national commute time of 25.3 minutes, so even though your early mornings may feel long, you’re spending less time in your car than you may think.

While you might be one of the Oregon residents who’s lucky enough to work from home, the vast majority of Oregon’s residents – 72.4 percent, in fact – commute to work every day in individual cars. If you’re the type of person who wants time to wake up in the morning or cool down after work, Oregon’s commute will be perfect for you.

Even with a commute time shorter than the national average, Oregon still threatens to cram your morning with a bit of undue traffic, especially in its more urban areas. Portland, in particular, made it onto the INRIX’s scorecard for global traffic.

| City Name | 2018 Impact Rank | Hours Lost in Congestion | Year Over Year Change | Cost of Congestion (per driver) | Inner City Travel Time (minutes) | Inner City Last Mile Speed (MPH) |

|---|---|---|---|---|---|---|

| Portland, OR | 70 | 116 | -9% | $1,625 | 5 | 13 |

Now, your commute time and traffic congestion will vary based on the time of day you’re driving through the city. Your speed, too, will see some flux based on whether you’re heading into work, heading out to lunch, or driving home.

Of all the states in the union, Portland ranks as the 7th most congested, according to SOURCE. Drive slow out there, then, and try not to get too frustrated when the traffic kicks in.

And with all that in mind, you’ve conquered Oregon’s auto insurance policies! Hopefully you’ll be able to use the data in this comprehensive guide to auto insurance in order to better choose the policies and rates that suit your lifestyle.

If you want to move ahead and compare rates in your area, you can use our FREE online tool to start contrasting rates in your area.

Cheap Auto Insurance / States